Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

Bitcoin keeps struggling with the $50,000 mark as the asset failed to breach it decisively and remains below it as of now. Most altcoins are also slightly in the red on a daily scale, except for Terra, which skyrocketed by more than 10%.

Bitcoin Stands Below $50K

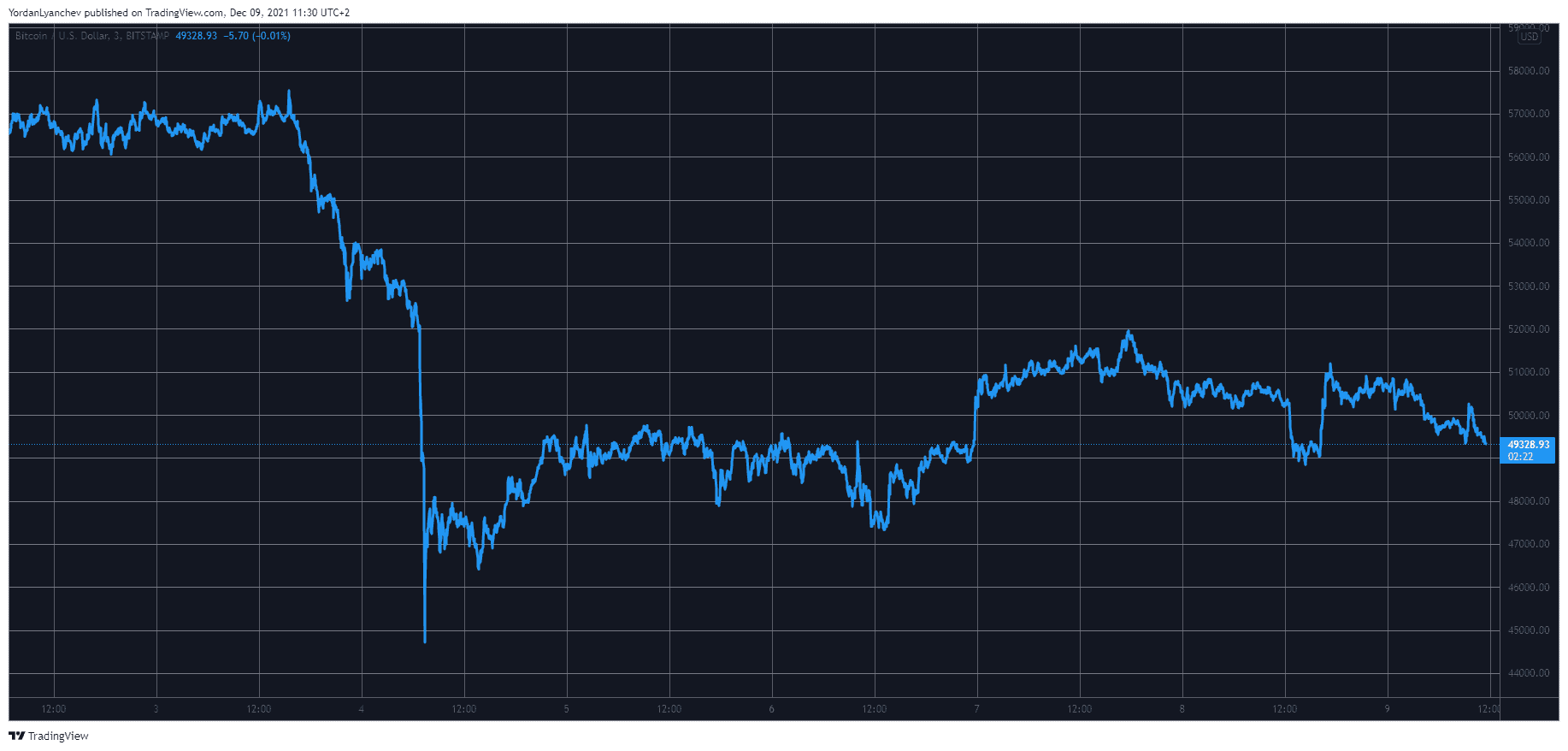

Ever since the massive price crash that transpired during the weekend, bitcoin has failed to produce any significant gains and to overcome the coveted $50,000 level decisively.

It seemed as the asset had done so two days ago when it traded well above that line and even tapped $52,000. However, the bears didn’t allow any further increases.

Just the opposite, they pushed the cryptocurrency south and drove it below $49,000 yesterday. In the following hours, BTC attempted another leg up which culminated in reaching $51,000.

Once again, though, bitcoin failed to maintain above it and, as of now, trades below $50,000. Its market capitalization has declined beneath $950 billion, and the dominance over the altcoins sits at 40%.

BTCUSD. Source: TradingView

BTCUSD. Source: TradingView

Terra Soars 10% as Alts Retrace

Similar to bitcoin, most altcoins have struggled in the past few days. Ethereum dumped from above $4,600 to $3,500 during the Saturday crash but quickly bounced off and reclaimed $4,000. On a daily scale, though, ETH is down by 1% and stands at just over $4,300.

Solana, Cardano, Polkadot, Dogecoin, Avalanche, and Shiba Inu are also slightly in the red since yesterday. In contrast, Binance Coin and Ripple have marked minor gains.

Terra, on the other hand, has surged by more than 10% in a day. As a result, LUNA now trades at $75 and is just inches away from registering yet another all-time high, which is now set at $78, according to CoinGecko. Moreover, the asset has now entered the top ten largest cryptocurrencies by market cap.

More gains come from WAX (29%), NEAR Protocol (17%), Celo (12%), Huobi Token (10%), and Gala (10%).

The cryptocurrency market capitalization has remained relatively still at just over $2.3 trillion.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.