Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

Bitcoin attempted another leg up in the past 24 hours but was stopped at $52,000 and retraced to just over $50,000. Most altcoins have also stalled since yesterday’s increases, with a few exceptions such as Tezos, which has surged by nearly 30% in a day.

Bitcoin Failed at $52K

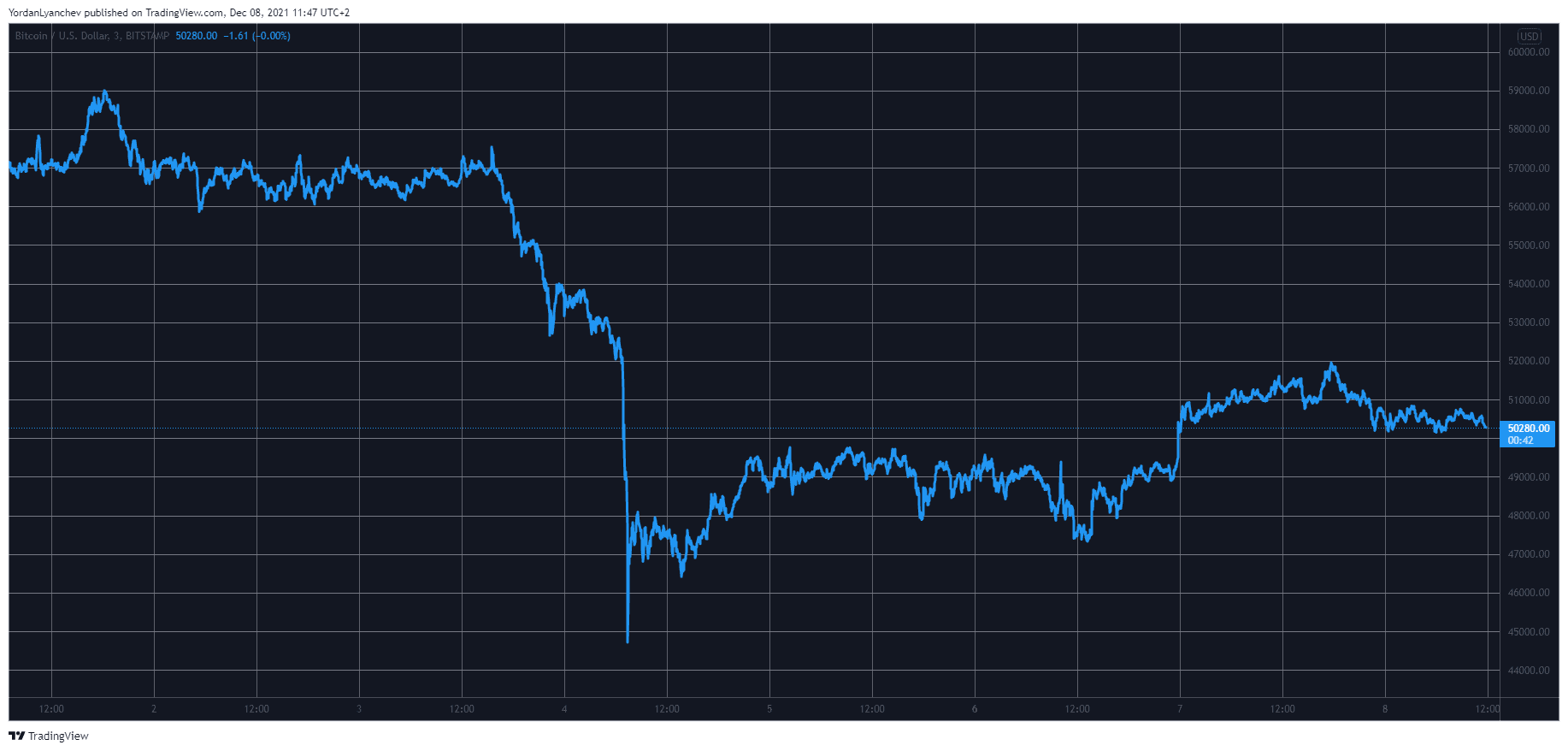

CryptoPotato reported on Saturday the massive crash that drove bitcoin from $58,000 to a two-month low of $42,000, resulting in over $2.5 billion in liquidations from 400,000 over-leveraged traders.

The asset started to recover on Sunday but was stopped in its tracks at nearly $50,000. However, it managed to breach that level yesterday.

Moreover, BTC kept climbing in the following hours and even touched $52,000. This is where the bears stepped up once more and pushed it south again. As a result, bitcoin now stands at just over $50,000, and its market capitalization is down to $950 billion.

BTCUSD. Source: TradingView

BTCUSD. Source: TradingView

Altcoins Stall: XTZ Explodes

Most alternative coins mimicked BTC’s performance lately, meaning that they dumped in value hard on Saturday and charted impressive gains yesterday.

Today, though, most have stalled or even retraced. Ethereum went from $4,600 to $3,500 in hours during the crash and exceeded $4,400 yesterday. After a minor 24-hour decline, though, ETH stands below that line. Binance Coin has lost a similar percentage and now stands at $585.

Solana has declined the most from the larger-cap alts. A 6.5% decrease has driven SOL to well below $200. Cardano (-5.5%), Avalanche (-5%), Terra (-03%), and Shiba Inu (-3%) are also in the red.

Ripple and Dogecoin are slightly in the red, while Polkadot has gained 1%. Chainlink is the most significant gainer from the larger-cap altcoins, with an 11.5% surge to $22.

Tezos stands out from the lower- and mid-cap alts. XTZ has surged by nearly 30% following a partnership with the gaming giant Ubisoft.

Overall, though, the cryptocurrency market capitalization is down by $50 billion in a day and is well beneath $2.4 trillion.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.