Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

The SOL coin is currently in a retracement phase which has plunged the coin price to the $184 support. The coin price is hovering above this level, trying to get enough support for continuing its rally. However, the price action still needs sufficient data for a bullish reversal, or this short-term fall is likely to continue.

Key technical points:

- The SOL coin daily RSI chart displayed a significant drop for a minor pullback.

- The intraday trading volume in the SOL coin is $1.47 Billion, indicating a 23.63% loss.

Source- SOL/USD chart by Tradingview

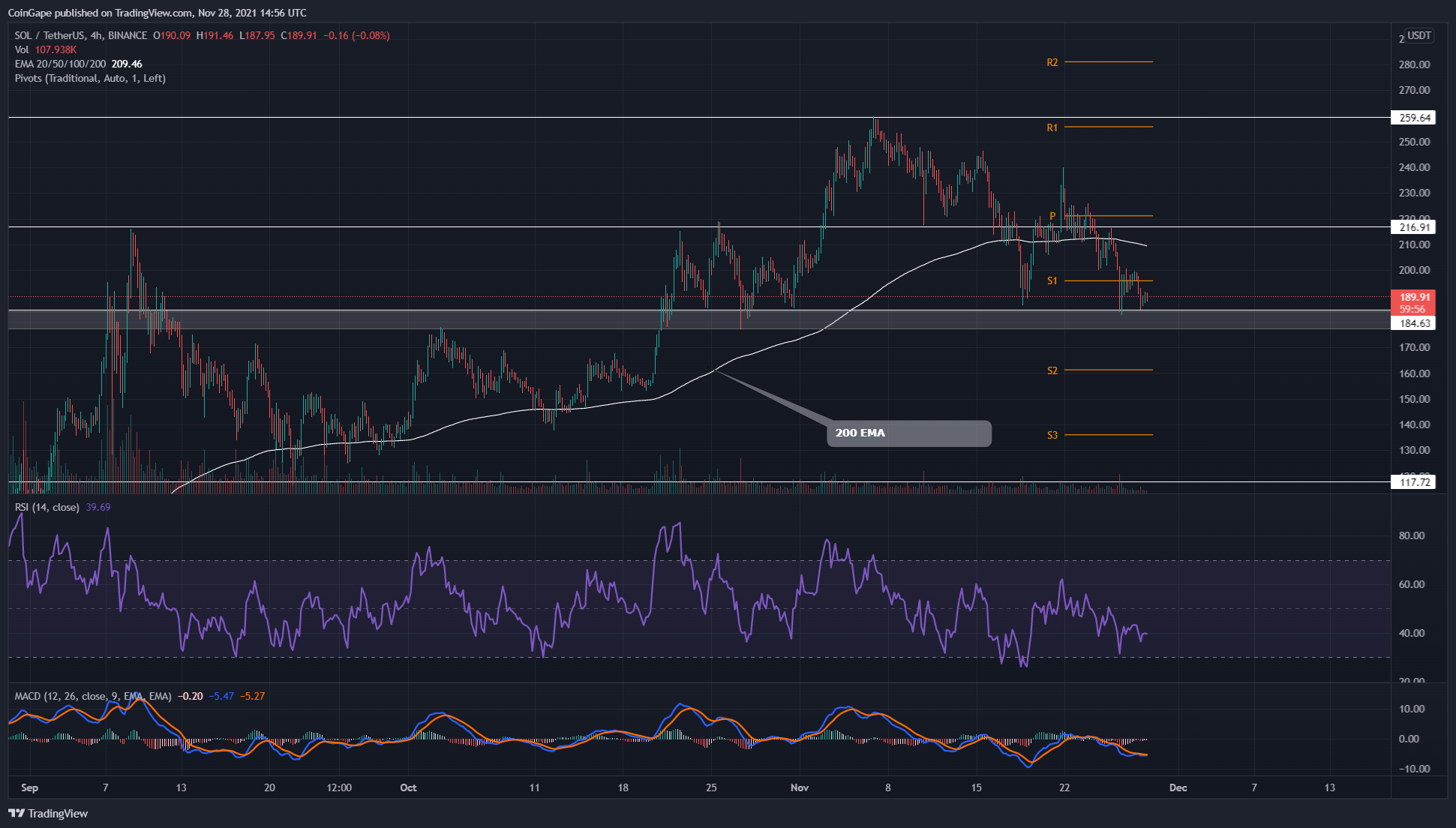

The SOL coin displayed a remarkable rally in its technical chart where the coin made a New All-Time High of $260 before initiating a minor correction phase. So far, the coin has dropped around 28% from the top and is currently trying it sustain above a strong support zone around $185. According to the crucial EMA’s(20, 50, 100, 200), the SOL coin is trading above the 100 and 200 EMA, maintaining this uptrend.

The Relative Strength Index(40) projects a bearish sentiment within the SOL coin. Moreover, the RSI line value has significantly dropped for this pullback, suggesting strong selling in this coin.

SOL/USD 4-hour Time Frame Chart

Source- SOL/USD chart by Tradingview

The SOL coin price is currently trading at the $189 mark, with an intraday loss of $1.51%. The RSI chart in this lower time frame chart displays a clear bullish divergence, suggesting the increasing bullish momentum at this support.

However, the price action has not yet indicated enough demand pressure at this support level, and therefore, the crypto traders could wait until the price breach the nearest resistance around the $217 mark, providing better confirmation for a bull rally.

The post Solana Price Analysis: SOL Price Retest The Support Zone Around $184; Will The Rally Continue, Or There’s More To This Correction Phase. appeared first on Coingape.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.