Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

While DeFi promises a world where people can transfer their money without the hassle and transaction fees of banks, anybody who has tried to convert some ETH to some BNB recently knows it’s not so simple.

Gas fees make cross-chain transactions very expensive, hindering the free flow of crypto assets.

So it’s not surprising that cross-chain bridges have grown at an unprecedented rate—a TVL increase of 89% MoM in October—as DeFi transaction volume booms in the bull market.

However, did you know that cross-chain bridges solve other problems besides (what are essentially) crypto transaction fees?

As multi-chain projects and interoperability become key components of the industry, DeFi investors need to understand how cross-chain bridges work.

DeFi TVL (since January 2021) Data source: Footprint Analytics

DeFi TVL (since January 2021) Data source: Footprint Analytics

DeFi TVL Ranking by BlockChain (since Jan 2021) Data source: Footprint Analytics

DeFi TVL Ranking by BlockChain (since Jan 2021) Data source: Footprint Analytics

This article will look into the nature of cross-chain bridges, specifically:

1. How does a cross-chain bridge work

2. Cross-chain bridges’ market performance

3. Problems addressed by cross-chain bridges

4. Selecting a cross-chain bridge

1. What is a cross-chain bridge?

A cross-chain bridge or a blockchain bridge enables the transfer of tokens assets, smart contract instructions or data between blockchains. Two chains may have different protocols, rules and governance models, but a cross-chain bridge connects these disparate blockchains together by interoperating securely.

A cross-chain bridge allows users to:

- Deploy digital asset transactions fast and easy

- Enjoy low operational difficulty

- Take advantage of lower transfer fees on non-scalable blockchains

- Implement dApps across multiple platforms

Here’s an example of how cross-chain assets are transferred with a bridge:

When a user needs to convert an asset such as an ERC20 A token on Ethereum into another asset such as BEP20 A token on the BSC chain via AnySwap, the ERC20 A will be locked on the source chain and then notify the bridge to generate the BEP20 A on the BSC chain before sending it to the user.

In this example, the entire operation of the cross-chain bridge takes about five to 20 minutes, with an approximate gas fee in the range of $10 to $20, depending on the pre-congestion conditions in Ether at the time.

2. How has Crosslink Bridge performed recently?

The market is currently dominated mostly by Layer 2 scale-out cross-chain bridges, which are mainly built on Ethereum for better interconnection and interoperability.

According to Footprint, the TVL of cross-chain bridges was $16.2 billion as of Oct. 26, an increase of over 72.25% in the last 30 days. The four largest cross-chain bridges namely, Avalanche Bridge, Polygon Bridge, Arbitrum Bridge and Fantom Anyswap Bridge, account for 95.61% of the entire cross-chain bridge, with its highest monthly increase of 401.23% last month.

Data from CoinTofu Cross-ChainBridge tool, reveal that these four cross-chain bridges also have excellent user experience ratings.

TVL & share distribution across- chain bridges (since Apr 2021) Data source: Footprint Analytics

TVL & share distribution across- chain bridges (since Apr 2021) Data source: Footprint Analytics

Ethereum Bridges TVL Ranking & Change Data source: Footprint Analytics

Ethereum Bridges TVL Ranking & Change Data source: Footprint Analytics

The above chart shows that Optimism has had the most active deposits from the beginning of September to today, followed by Avalanche. Current transfer fees are as low as $0.25 (according to L2 Fees) and their transfer fees are variable, but with relatively small changes.

Ethereum Bridge Daily Unique Depositors (since June 2021) Data source: Footprint Analytics

Ethereum Bridge Daily Unique Depositors (since June 2021) Data source: Footprint Analytics

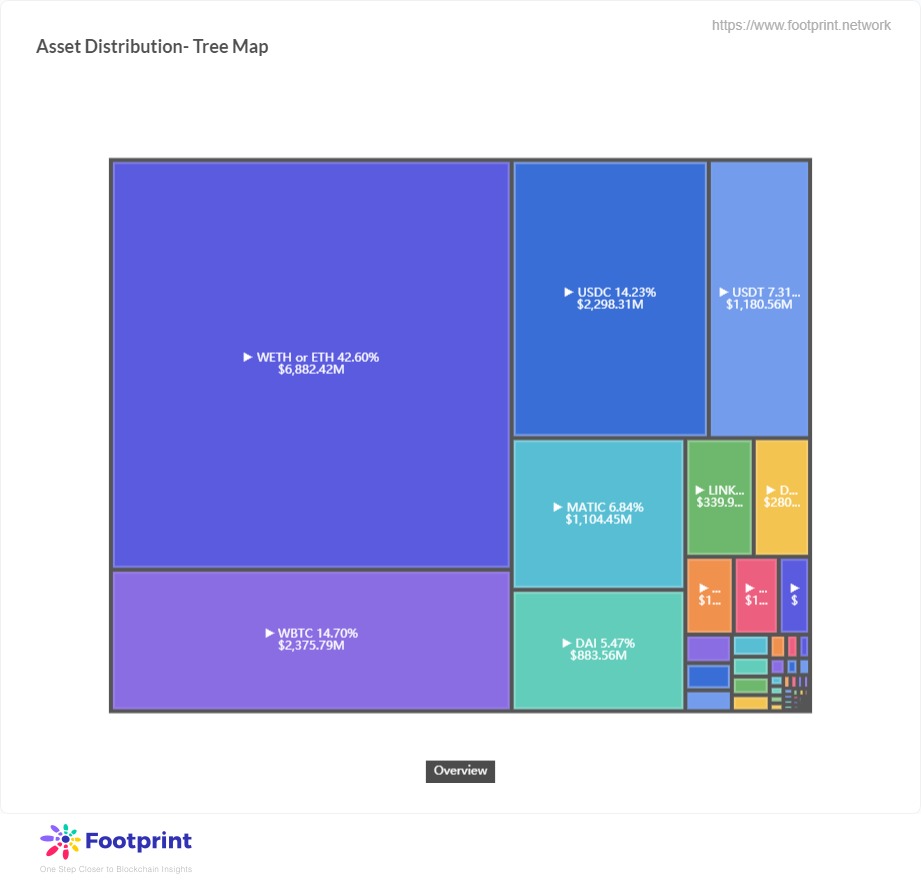

The main asset traded on cross-chain bridges is ETH (WETH), with total ETH lock-ups on the 15 cross-chain bridges valued at $6.882 billion as of Oct. 26. This represents approximately 42.6% of total lock-ups and the most used asset by investors, followed by WBTC and stablecoin USDC.

Asset Distribution- Tree Map Data source: Footprint Analytics

Asset Distribution- Tree Map Data source: Footprint Analytics

3. What problems do cross-chain bridges address?

Cross-chain bridges create growth across chains (reflected by Fantom and Avalanche prices—which hit gains of 12% and 18%, respectively, in the first week of November) that offer disparate asset interoperability, high level of security and better asset rendition.

Without a bridge, investors have to go through different exchanges and incur larger fees instead.

Cross-chain bridges also address the following:

- Lower gas costs with increased transaction speeds

- User assets can be freely interacted with for a high user experience

- Improved productivity and usefulness of existing crypto assets

- Higher security, better privacy

The use of cross-chain bridges is appropriate in the following scenarios:

- Token transfers between Ether and a Layer 2 network, with assets interoperable across chains, such as faster and easier deposit of funds, withdrawal of assets and exit times to reduce operational complexity

- High fees and use in times of Ether congestion

- Thin assets supported by single chains and more assets supported by cross-chain bridges

- Investors can use cross-chain bridges when investing in new chains to get to the head mine faster, but need to assess the full mechanics of the new chain and its security.

- Arbitrage trading across the DEX on Optimism, Arbitrum and Polygon, etc.

4. How to choose the right cross-chain bridge

Consider the following criteria when selecting a cross-chain bridge:

- A stable TVL exceeding USD$1 billion with sound cross-chain mechanism and a credible execution environment reflected by gradual changes instead of abrupt fluctuations. Verification method of cross-chain information and management method of cross-chain funds must also be taken into account.

- Reasonable transfer costs (from USD$1 to USD$5) across the chain and interaction speeds with an estimated arrival time of 10 to 30 minutes

- Security to ensure against hackers that take advantage of vulnerability

In addition, there are also a number of aggregation tools that offer a one-stop cross-chain bridge solution, of which CoinTofu has a better overall experience in terms of reaching the cross-chain page with one click and displaying the advantages of supported cross-chain bridges, estimated arrival times, transaction fees, and user experience ratings.

Conclusion

With the development of the DeFi industry, cross-chain bridges have become more popular than traditional exchanges. They enable interoperability and mutual integration of blockchain applications to support project owners, various blockchains and investors and address the problem of capital flow and lower transaction costs to users.

Author bio:

Maxine Smith, a crypto writer from Singapore, and DeFi data analyst with a focus on market trends and regulations

The above content above is for reference only and does not constitute investment advice. If you spot any errors, feedback is welcome.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.