Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

Plus: ETH’s deflationary alternative

Based on IntoTheBlock’s weekly newsletter. If you enjoy it, and would like to receive it every Friday make sure to sign up here!

This week we dive into the latest action in crypto markets. Firstly, we assess Bitcoin’s proposition as an inflation hedge given the 30-year high recorded in consumer prices in the U.S.

We also go into on-chain data for Ethereum, which in contrast recorded a reduction in its supply as more Ether gets burned than issued.

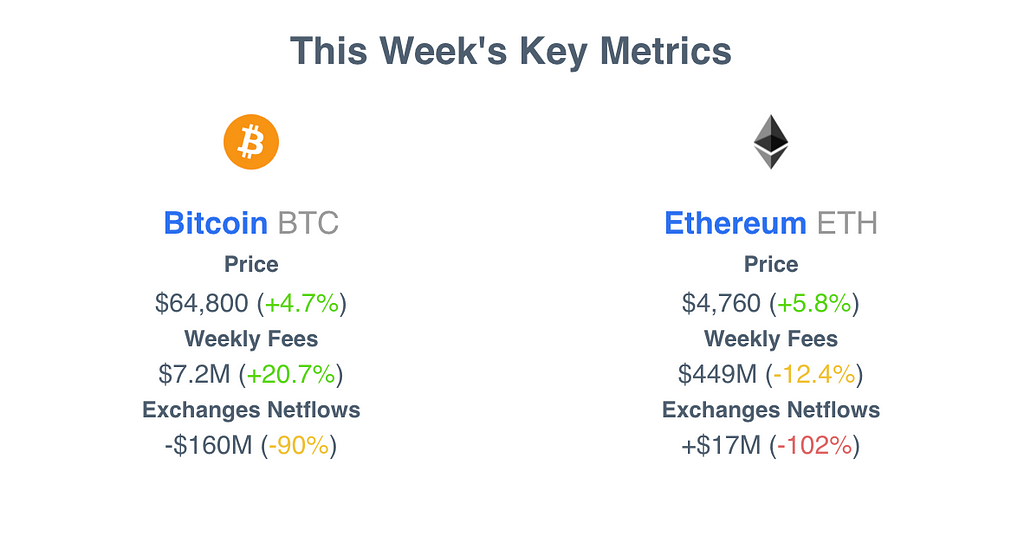

Weekly Fees — Sum of total fees spent to use a particular blockchain in a week. This tracks the willingness to spend and demand to use Bitcoin or Ether.

- Bitcoin saw an increase in network revenues, reaching a 6-week high

- Ethereum’s total fees decreased slightly below last week’s $500M+, recording its third highest week to date

Exchanges Netflows — The net amount of inflows minus outflows of a specific crypto-asset going in/out of centralized exchanges over the past seven days. Crypto going into exchanges may signal selling pressure, while withdrawals potentially point to accumulation.

- Bitcoin had relatively small outflows from centralized exchanges

- More Ether was deposited into centralized exchanges than withdrawn this week

Bitcoin as an Inflation Hedge

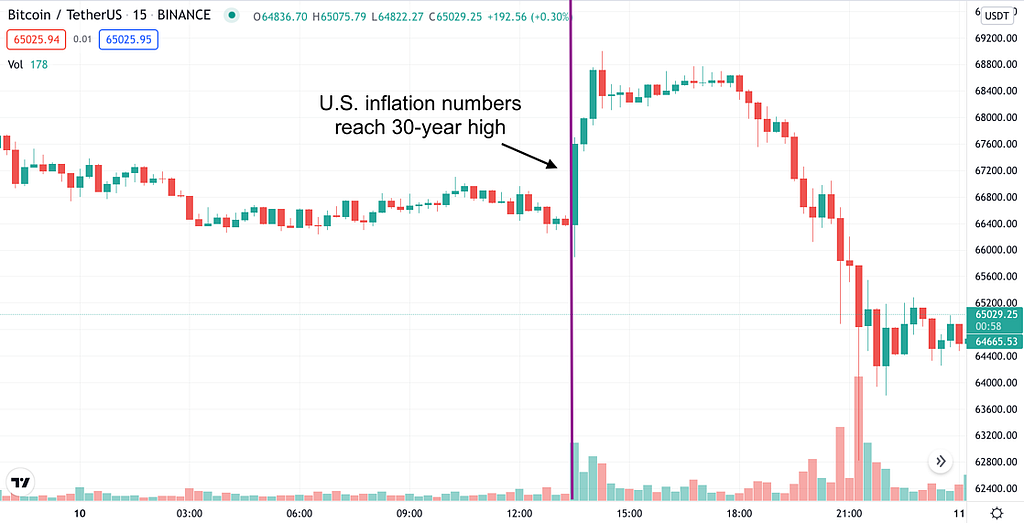

Following the announcement of U.S. inflation reaching 6.2%, stock futures dropped while bond yields increased sharply. Gold, long believed to be an inflation hedge, increased and Bitcoin appeared to follow suit… briefly.

The break-down — Bitcoin’s price climbed nearly 4% in the 2-hour period following the inflation report, but then dropped 8% just a few hours later.

- Bitcoin proponents argue its limited supply make it an ideal hedge for inflation

- The market’s stance on this potential is still inconclusive, particularly since higher inflation may move ahead an interest rate hike

- Crypto markets have benefitted from quantitative easing and near-zero interest rates, potentially making an increase in rates detrimental to the current bull market

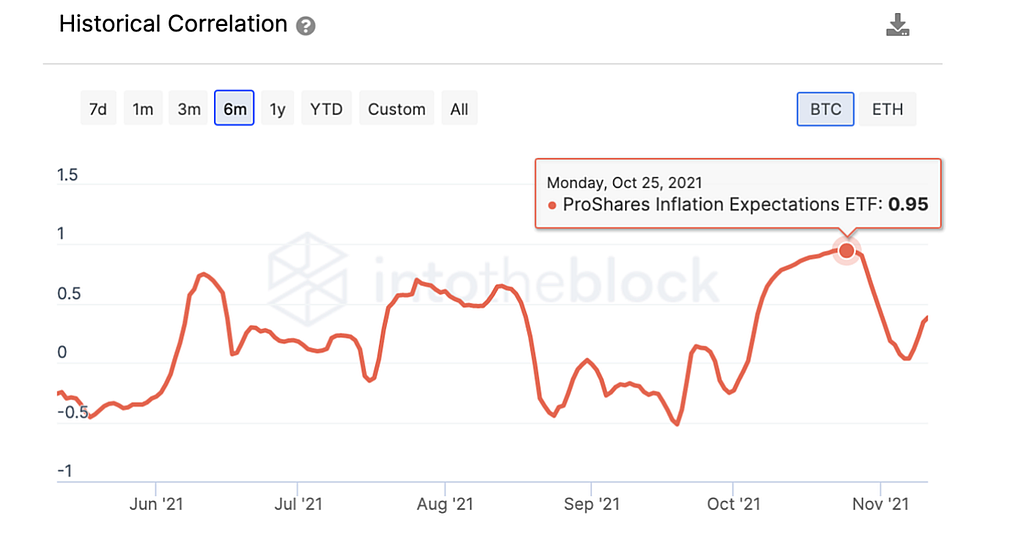

Looking further into capital markets we observe Bitcoin has been increasingly correlated with inflation expectations.

As of November 11 using IntoTheBlock’s Capital Markets Insights

As of November 11 using IntoTheBlock’s Capital Markets Insights

ProShares inflation expectations ETF (RINF) tracks the long-term break-even inflation, a widely followed measure of inflation expectations.

- BTC’s correlation with RINF hit an all-time high of 0.95 in late October, pointing to both Bitcoin and inflation expectations moving in tandem

- Inflation expectations directly influence future inflation as consumers and producers try to anticipate future values

- Having a high correlation between BTC and inflation expectations does not imply causation, but does show a statistical significance in the variations of the two

The bottom line — Bitcoin’s price action following the record inflation numbers left traders scrambling to decipher if it can sustain its value during times of high inflation. Buoyed by its limited supply, Bitcoin acceptance as an inflation hedge appears to be growing as evidenced by the high correlation with inflation expectations.

ETH’s Deflationary Alternative

Though perhaps unexpected by many, Ether has outperformed Bitcoin since the release of the inflation numbers, remaining slightly above its value prior to the report and within 2% of its all-time high at the time of writing.

A potential reason behind Ether’s rally is its decreasing supply.

As of November 12 through IntoTheBlock’s ETH supply indicators

As of November 12 through IntoTheBlock’s ETH supply indicators

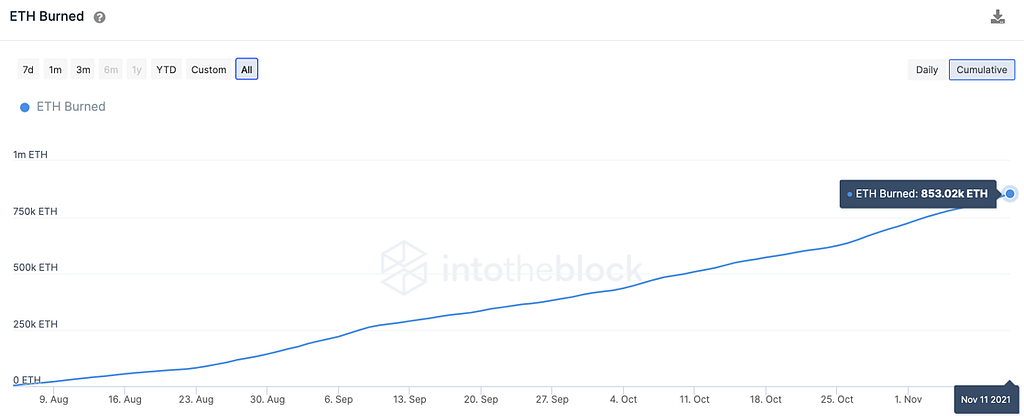

Understanding ETH’s deflation — Ethereum implemented EIP-1559 in early August, leading to most of the Ether used as transaction fees being burned, or removed from circulation. This has led to several days where more Ether is burned than issued, briefly making it deflationary.

- Since deployment of EIP-1559, Ether’s net issuance has dropped from over 4% to an average of just 0.21% this week

- Over 850,000 ETH ($4B+) has been burned since

As of November 12 through IntoTheBlock’s ETH supply indicators

As of November 12 through IntoTheBlock’s ETH supply indicators

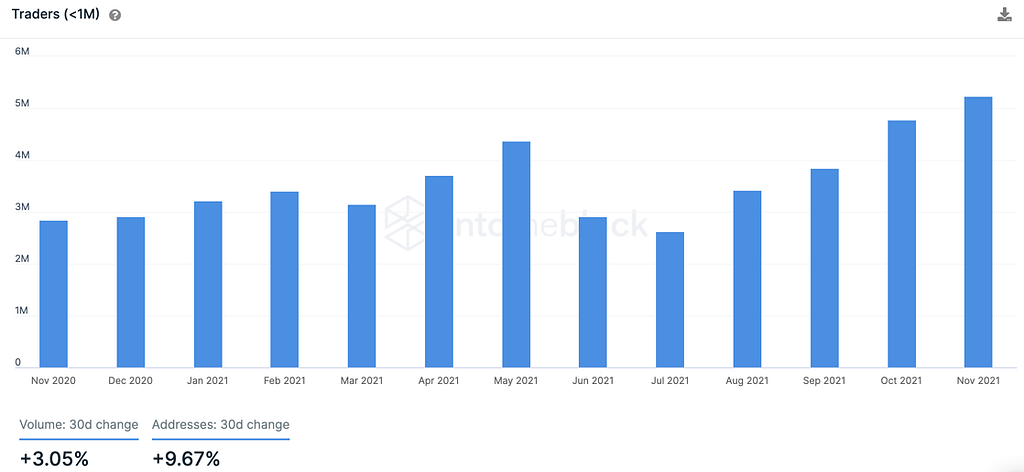

Behind the burn — High transaction fees lead to Ether being burned, but the action behind these has varied over the past few months.

- NFT mania drove the first drop in ETH’s issuance as trading volumes in OpenSea reached record levels in August and September

- While the NFT market has cooled down, SHIB and metaverse tokens saw a spike in activity, leading to trading on decentralized exchanges such as Uniswap hitting record numbers

The spike in trading activity on top of Ethereum is also reflected in Ether’s holders.

As of November 11 through IntoTheBlock’s Ether ownership indicators

As of November 11 through IntoTheBlock’s Ether ownership indicators

ETH as an inflation hedge? It may be too early to classify Ether as such given that it has had less than ten deflationary days. However, with the merge and transition to proof of stake, Ether’s issuance is projected to drop 90%, which would make it consistently deflationary.

The increased activity on Ethereum is slowly making Ether more scarce. So far this has not translated into a correlation with inflation expectations like in Bitcoin’s case though. Ultimately, both Bitcoin and Ethereum have compelling cases to outperform both in the short- and long-term though it may be too early to classify it as an inflation hedge.

Upcoming Webinar

Sign up for our next webinar. Limited amount of free seats available:

A Quantitative Approach to Trading NFTs

Sign up here!

Bitcoin as an Inflation Hedge was originally published in IntoTheBlock on Medium, where people are continuing the conversation by highlighting and responding to this story.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.