Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

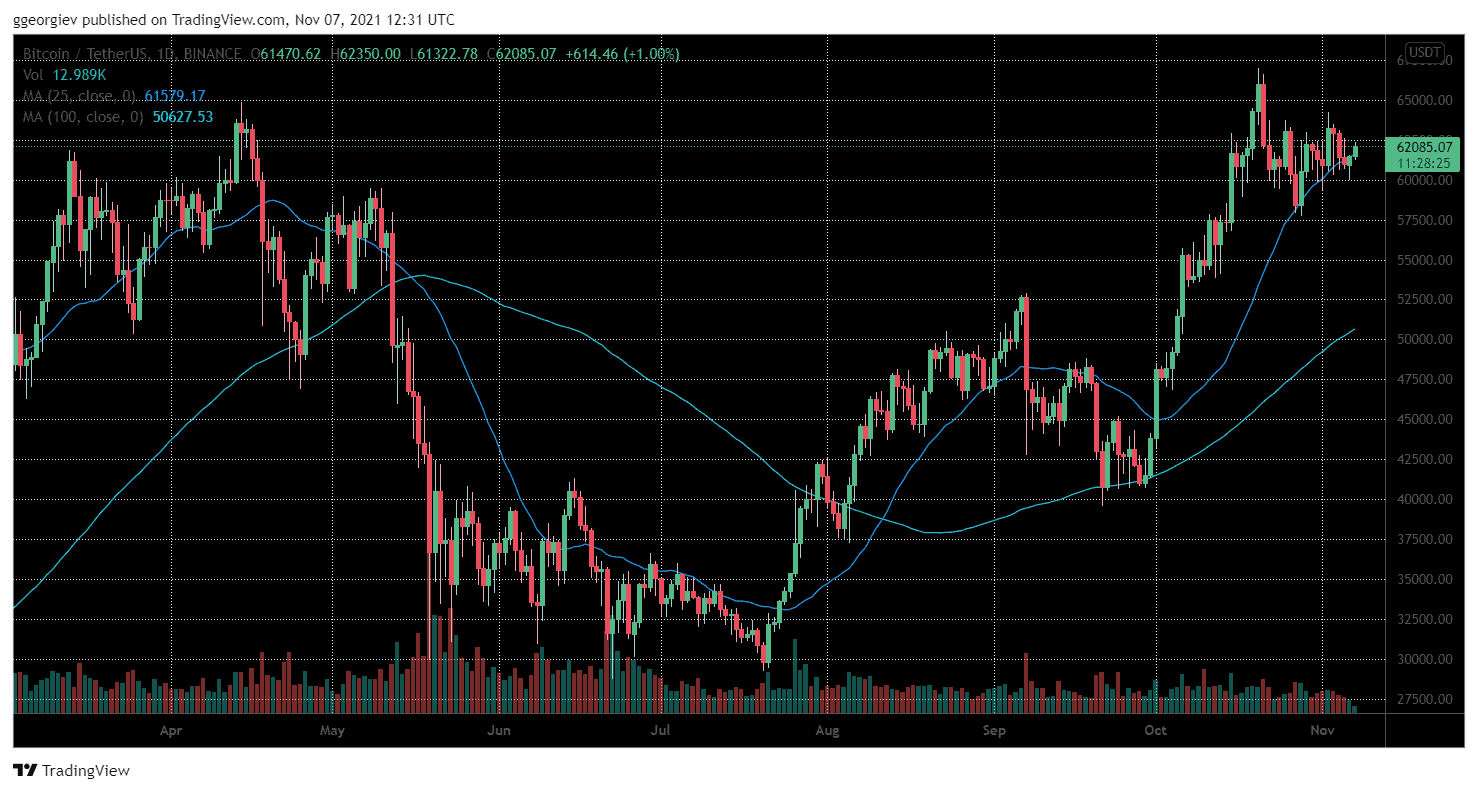

In the past few days, we saw Bitcoin’s price nearly touching $60K again and it’s now important to reclaim the 21-ay MA in the near term. Meanwhile, the strong resistance continues to lie between $63.7K and $64.8K.

The ideal scenario for BTC bulls would be to complete the cup and handle breakout above $63.7K and $64.8K, which should send the price to the range between $70K and $80K.

There are still no signs of a distribution trend forming but we did see some light profit-taking on behalf of older coins. The miners continue to hold and there were no major spikes in CDD or SOPR, which signals that there’s not a lot of profit-taking happening.

As we mentioned in the previous BTC analysis the price action and on-chain performance do resemble these from late 2020 before BTC broke out to all-time highs. The initial breakout to new ATHs in 2020 took multiple attempts and it even saw a correction.

The cycle top indicator is nowhere near to previous bull market peaks but it’s becoming increasingly important for $60K to continue holding. If it fails, we can look at the leaves at $58.3K, $571.K, $56.2K, $55K, and $53K for support. The strong area of both on-chain and technical support, however, is found between this are. It’s highly likely that these levels will hold if tested.

It’s still looking likely that there will be a large breakout towards $70K and $80K later in November and December – there’s no trend of distribution forming which also increases the probability of this bull market to extend into Q1 of 2022.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.