Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

Bitcoin’s price continues its near-term pullback consolidation, but $60K is holing up nicely, which is a positive signal. If this level fails, we could see downside momentum towards $58.3K to $53K, likely triggered by liquidations and panic-selling.

It is very important to see the $60K level hold as support and for the price to close above $63.7 to form a higher high.

The Technicals

There’s a larger cup and handle pattern that continues to make progress. Closing above $63.7K and $64.8K will help complete the handle. This would ideally lead to a technical breakout above the previous all-time highs.

The Elliot Wave count suggests the latest impulse wave higher has finished sub-wave three at $66.K, where the recent pullback is forming sub-wave 4.

Sub-wave 5 is likely to send BTC towards $70k to $80k, which are the next major targets to the upside. There continues to be strong technical and on-chain support between $58.3K to $53K in case BTC closes below $60K.

The On-Chain

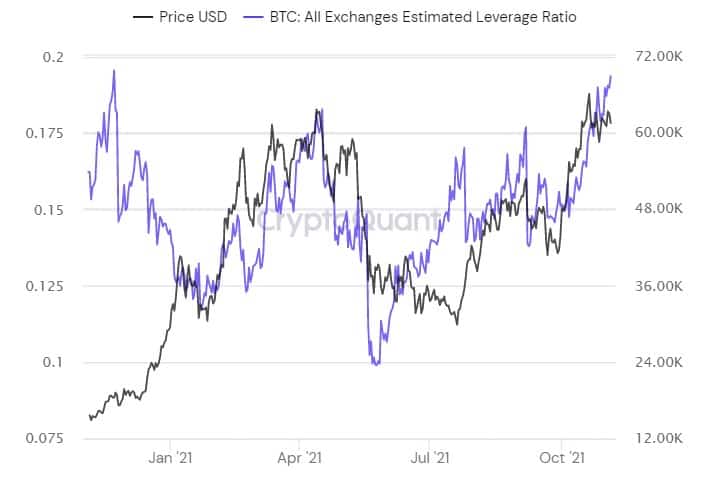

Long-term holders, as well as miners, continue showing no signs of a trend of distribution. The funding remains neutral, though the leverage ratio is still elevated between .19 to .20.

Normally, when the price is increasing with a leverage ratio sitting between .18 to .20, the risk of shakeout increases. The current conditions, however, are slightly different.

BTC has been trending lower, while the leverage ratio has been trending higher. This happened in June to July 2020 and 2021, which led to a massive short liquidation and sent BTC significantly higher.

This suggests that BTC shorts were piling on as the price was trending lower. Once short positions became excessive, a quick rally in the price can easily trigger massive liquidations, sending BTC higher while causing the leverage ratio to drop sharply.

The overall trend in on-chain metrics remains bullish and shows no trend of distribution. Pullbacks to technical and on-chain support levels continue to be attractive buying opportunities.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.