Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

Yo. Today I am unbelievably excited to announce and publicly release Pay Me in Bitcoin with Strike. Today, Strike users can use their account and routing numbers to enable direct deposit to their account and configure any amount of the incoming money to be converted into bitcoin, with no fees.

At Strike, our mission is to secure financial freedom and build a more financially-connected world. We accomplish this by making Bitcoin and the Lightning Network easily accessible and usable. Pay Me In Bitcoin allows anyone to convert a portion of their income into bitcoin with no fees, allowing them easy access to save and grow wealth, empowering them economically, and enhancing the quality of their life.

Today, we take a giant leap forward in economic empowerment with the world’s best monetary asset, bitcoin. Today, we continue our march towards ensuring everyone has easy and cheap access to the best savings technology in human history. Today anyone with a Strike account, no matter your employer, can get paid in bitcoin.

The Story

To understand Pay Me In Bitcoin with Strike, we first have to understand the saving problem we all face today. How does one save up for a house? How does one ensure they’re retired at a reasonable age? How does one save enough to make sure their kids’ education is paid for?

Is it as simple as stashing away some cash into a rainy-day fund? Making sure you fight the urge to break the piggy bank? Opening a savings account and using the whopping 0.06% average interest rate to grow your savings?

No. Not only is it not that simple, but saving and growing wealth is one of humanity’s oldest, and most difficult, challenges. In fact, it’s arguably never been harder than it is today.

An estimated 54% of US consumers (125M adults) are living paycheck-to-paycheck. Of those consumers, 21% are struggling to pay their bills. After they spend their paycheck on living expenses, they barely have anything left to invest in their savings.

A hard-to-believe 70% of consumers have less than $15,000 in savings. Out of the consumers living paycheck-to-paycheck, those struggling to pay their bills average savings significantly less than that, at around $4,000.

Who exactly are we talking about? Are we talking about teenage lifeguards? Are we talking about college students working summer internships? No, we’re talking about your neighbors, your friends, your family. We’re talking about the everyday person.

According to the standard research, having sufficient savings is an indicator of one’s ability to cover large, sometimes unexpected purchases.

What is “sufficient savings” and what causes a purchase to be unexpectedly large?

Inflation driven by central banks is rapidly decreasing the value of our dollars and drastically increasing the cost of living. The US dollars that we’re all being paid in are becoming increasingly less valuable, causing the things around us to become increasingly more expensive.

Or, as researchers may put it, unexpectedly large 😉

Today, inflation is a global crisis. As of October 12th, annual inflation in the US was reported at 5.4%, a 13-year high. The average savings account yields 0.06%.

You simply cannot save by holding dollars.

As bad as 5.4% inflation sounds, even that metric is grossly optimistic and misleading. Everything priced in US dollars has its own unique inflation rate. The severity and unprecedented levels of inflation today are best understood when looking at assets, not Happy Meals. Assets are the things in life we all sacrifice for and aspire to have, such as a roof over our heads.

In the US, inflation isn’t 5.4% to live in a house, but 24%. Or in more simple words:

US home prices got 24% more expensive this year and at this rate, will double in price within the next five years. If you want to own a home and provide a roof over your head, you need to outpace 24% inflation.

You need a 25% raise every single year or your savings need to appreciate an average of 25% per year to make progress towards having a roof over your head, staying warm in the winter, washing your clothes, and providing food for your family. Not to mention meats/fish/eggs are at +10.5% inflation, used cars +24.4% inflation, gasoline +42.1% inflation, electricity +5.2% inflation, and the US government is expecting Americans’ heating bills to jump as much as 54% this winter.

Allow me to make this abundantly clear to you: if you are not getting a 25% raise every year and you are saving in dollars, you are not out-earning or out-saving the rate of inflation or the increase in cost of living, and your quality of life will degrade as time goes on.

Does anyone reading this know anyone getting a 25%+ raise every single year?

No.

So are we doomed? Is this the start of the end?

No.

How can we outpace everything getting so expensive if we aren’t earning more?

Saving.

Saving and growing wealth is one of humanity’s most trying and difficult challenges, and up until 2009, was largely an unsolved problem. The human species has iterated through many forms of money ranging from collectibles, precious metals, fine art, jewelry, real estate, central bank paper, and so on. All of these have been used at some point in our species’ history as money but have considerable drawbacks.

Even the money we’re familiar with today is a relatively new experiment. This may surprise you, but the internet is older than the euro. When we rang in the new millennium in the year 2000, Germany was using a currency that now no longer exists, the Deutsche Mark. As advanced as society has become, we are still living through the great fiat monetary experiment, and it’s sad to see that experiment is failing over half of our country.

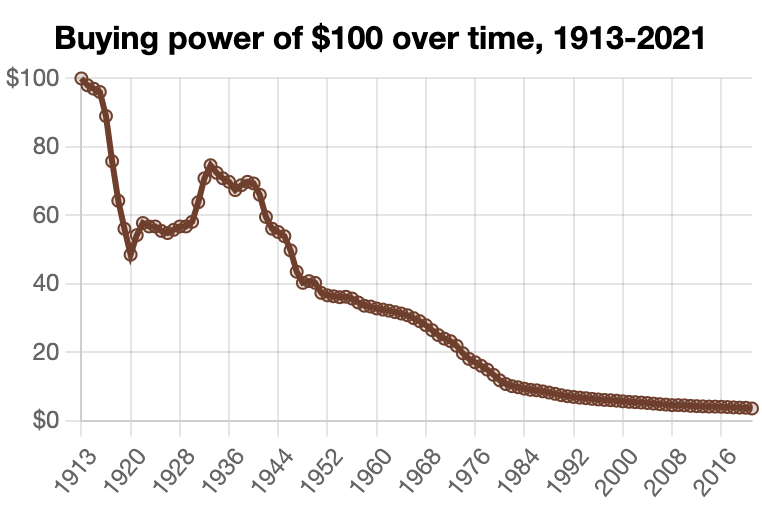

There are many properties that make a good money: scarcity, divisibility, verifiability, transportability, storability, and storing value. Money such as gold is relatively scarce; however, it isn’t easy to store, transport, verify, or divide. Money like the US dollar solves for a number of these properties but compromises on one of the most important, namely saving and storing value; $100 in 1913 would barely be able to buy you a Happy Meal today.

We’ve iterated through many forms of money, trying new things, using many at once, etc. but we’ve never been able to engineer a money from scratch. But what if we did? What if we applied what we’ve learned over the last few thousand years and incorporated modern-day technology in the pursuit of building the world’s best money? What if we engineered the premier savings technology that allowed us all to outpace the unprecedented levels of inflation and rise in living costs?

Enter, bitcoin.

Bitcoin is the most perfect money ever engineered in the history of humanity. How? Well, now that we can engineer money, we simply incorporated all we’ve learned.

Bitcoin is the scarcest asset of all time, infinitely divisible, trivial to verify, can transport at the speed of light, and can be safely secured with as little as one’s memory. Bitcoin is the most perfect money of all time because we built it to be. It was intentionally engineered to address the inefficiencies of monies prior and optimize its important properties, namely storing value.

How good is bitcoin at storing value? Well, bitcoin averages 100%+ year over year returns, making it the best savings vehicle in human history. That shouldn’t surprise anyone, we designed it that way. It’s no accident. It’s not happenstance. Bitcoin has emerged as the best-performing, most advanced, and most accessible money and savings vehicle by incorporating modern-day technology and utilizing what we’ve learned over the last few thousand years.

You need to save in money that grows with inflation or all of your desired purchases in life will be unexpectedly large, leaving you with no savings, living paycheck-to-paycheck.

Over the last three years, saving $50 per week in a savings account turned $7,850 into $7,190 worth of purchasing power. You not only weren’t able to save and grow your wealth, you went backwards and lost wealth. Why? Inflation and the cost of living outpaced you.

Over the last three years, saving $50 per week in bitcoin turned $7,850 into $59,929. Not only were you saving and growing wealth, but you removed yourself from the 70% of Americans with savings under $15,000. How? You outpaced inflation and the cost of living.

When you save in dollars, a high quality of life gets more expensive and increasingly impossible. When you save in bitcoin, a high quality of life gets cheaper and increasingly attainable.

How does one save up for a house? How does one ensure they’re retired at a reasonable age? How do you save to make sure your kids’ college tuition is paid for? Surely the answer is not the US dollar.

Pay 👏 Me 👏 In 👏 Bitcoin 👏

With Strike, everyone now has access to the most advanced way of saving and building for their future. When you go to work, the time you spend is priced and returned to you in dollars. Your time is traded back to you in the form of one of the worst ways to preserve value over time. Another way to look at it? You can’t work longer than the dollar can be devalued. You will always be in debt to time. With bitcoin, you can put your money to work for you, not the other way around.

Because bitcoin is infinitely divisible, trivial to verify, can transport at the speed of light, and can be safely secured, anyone can now start converting as little as $0.50 of their paycheck into bitcoin with Strike.

Can you get a fraction of your paycheck in real estate? Good luck. How about splitting your side-gig money into gold bars? No chance.

Let’s be clear, this isn’t a pitch to go all-in on bitcoin. This isn’t advocating you to push your chips to the center of the table. This is taking your income and taking the money that you plan to save and allowing you to save it in a way that can outpace inflation and the increase in the cost of living.

Because of the efficiencies bitcoin has achieved as money, everyone now has access to increasing their quality of life, because everyone now has access to getting paid and saving in the best money of all time.

How It Works

Today, anyone with a Strike account, no matter their employer, can get paid in bitcoin.

Today, Strike takes another step forward in becoming the cheapest and easiest place to acquire bitcoin, building the best financial experience, and securing financial freedom for all.

How does it work? A lot simpler than one would assume. Let’s walk through it.

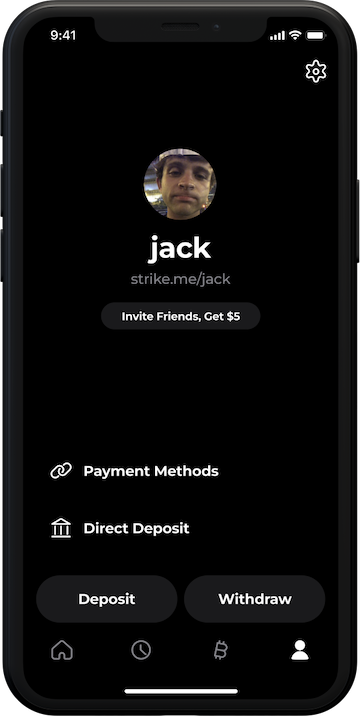

When navigating to the Profile Tab, you’ll now see a Direct Deposit menu item below your Payment Methods.

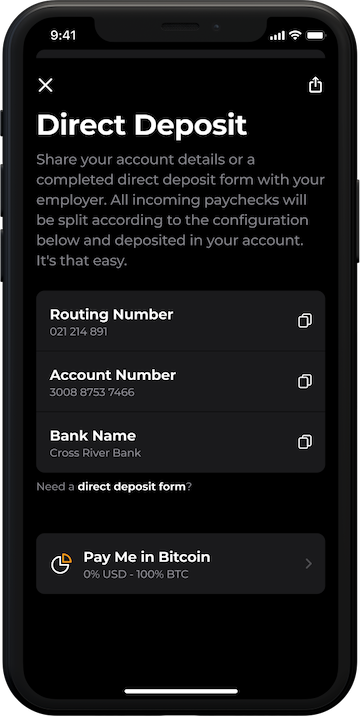

When selecting Direct Deposit, you can view and export all of the account details you’ll need to give to your employer:

- Routing Number

- Account Number

- Bank Name

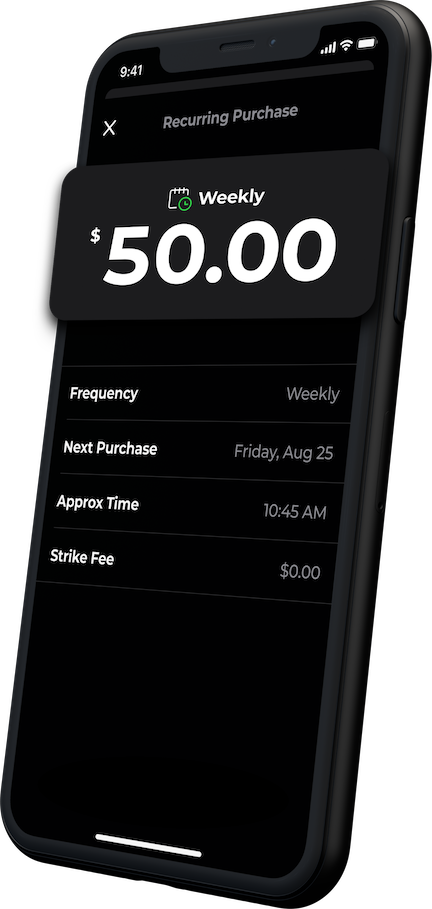

Towards the bottom of the screen, you’ll also notice your Pay Me In Bitcoin configuration. When selected, you can configure how much of each incoming deposit is automatically converted to bitcoin and credited to your bitcoin balance in the Bitcoin Tab.

Simply slide and save.

From there, all you need to do is share your account details with your employer and ensure your deposit is lined up to Strike.

Any incoming deposit will be automatically converted and credited to your account balances according to the configuration you’ve saved. All instantly, and all with no added fees.

Seriously, it’s that easy.

You don’t have to work for a special company, you don’t have to convince your boss to like bitcoin, you don’t need to nag your CFO to put bitcoin on the balance sheet. All you need to do is share your Strike account details and configure your Pay Me In Bitcoin split. Anyone with a Strike account can get paid in bitcoin, no matter who they are, where they work, how much they make, etc.

Take my friend Saquon Barkley, for example. Saquon is the running back for the New York Giants and one of the most popular athletes in the world today. Earlier this year, Saquon announced he’d be taking all of his endorsement money (over $10M/year) in bitcoin. Saquon has endorsement deals with the likes of Pepsi, Toyota, Gillette, Nike, and Visa. All of them are paying him in bitcoin.

How? Did someone orange pill Phil Knight? Does Pepsi offer bitcoin compensation to their employees? Did Visa pull a Michael Saylor and put bitcoin on their balance sheet? Nope.

Saquon simply slid his Pay Me In Bitcoin configuration to 100% and shared his account and routing numbers with his endorsement partners. He’s not timing the market. He’s not trading. He’s not flipping in and out of shitcoins.

Saquon is saving. Saquon is using the best savings technology in human history, one that was engineered to be the world’s best monetary asset, to save and grow his wealth.

And now, everyone can.

Thanks

Alright, y’all, that’s all I have for now. With the CPI report outpacing forecasts, Fed Presidents stating price pressures will not be brief, all while the President of the United States claims inflation is transitory, you could not write a script like this.

Outpace inflation. Enhance the quality of your life. Take some of your paycheck and get paid in bitcoin.

You’ll hear more from me soon. We have more countries to launch, the Strike API to rollout, the Strike Visa Card to release, bitcoin rewards, and much much more.

I know a guy at Strike. Close friend. Keep it between us, but he told me DCA is coming soon 😄

To the community, as always, thank you. Keep me going, keep me honest. We got this. Love y’all.

You can contact me @JackMallers on Twitter or jack@strike.me via email. Download Strike today and start getting paid in bitcoin. Looks like inflation may not be as transitory as some are claiming.

As I said above, we’ve got more coming. I’ll talk to you sooner than you think, don’t blink.

Much love. Be easy.

Peace out ✌️🍻

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.