Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

Yo. Today I am unbelievably excited and proud to announce Strike Global. Today, the world changes; the fundamentals of value exchange between our species enters a new epoch.

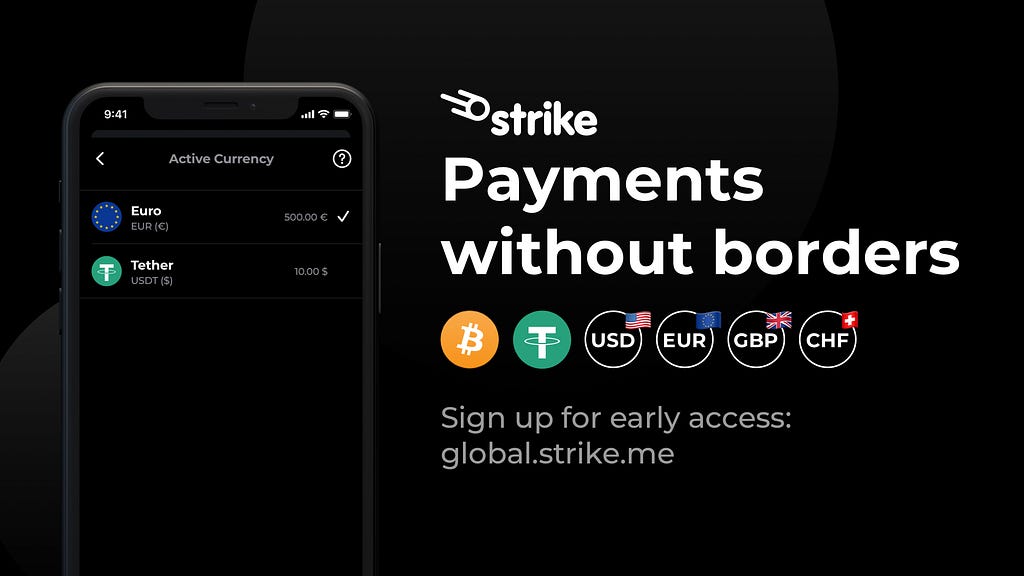

Today we are announcing that Strike:

- Has partnered with Bittrex Global and will be launching in over 200 countries.

- Has added support for USDT, USDC, EUR, GBP, CHF, and more.

- Will be onboarding all 1M+ Bittrex users onto Strike and Lightning.

- Will have the Strike Card available in the US Q1 2021.

- Will have the Strike Card available in the EU and UK Q2 2021.

Strike’s US rollout has been an immense success. In our short 6-month public BETA, we’re well into 5-figure registered users and currently process millions of dollars in volume per month. With our announcement today, the first of its kind, Bitcoin-native, neo-bank is expanding its reach to over 200 countries.

We’re not only bringing bitcoin the asset and Bitcoin the network to billions of people, but we’re also disrupting the international funds transfer sector while doing it.

The Story

Making payments across borders is one of humanity’s most ancient and outdated technologies, with execution times ranging from 3–14 days and fees reaching upwards of 25%. In the thousands of years humans have exchanged value across borders, not a lot has changed, that is until now. Let’s take a look at the current landscape of major international payment networks, how they operate, why they’re flawed, and how Bitcoin + Lightning + Strike has changed the game forever.

SWIFT

For almost 50 years, the majority of international transfers have been processed by the Society for Worldwide Interbank Financial Telecommunication, also known as SWIFT. SWIFT simply provides a network that enables parties worldwide to send and receive information about financial transactions. In 2019, more than 11,000 financial institutions sent over 30,000,000 payments per day via the SWIFT network. Today, over 50% of existing international transfers are done via the SWIFT network. However, 50+ years after its inception, SWIFT remains one of the more expensive ways to transfer funds internationally and settlement times still range from days to weeks.

As popular as the SWIFT network is, society grew tired of the fees and delays in achieving transaction finality. Disruption was inevitable.

TransferWise

TransferWise is the latest innovation in international fund transfers, with a slightly different approach. TransferWise decided that actually moving physical value was the problem, and the intermediaries required to do so made it expensive and slow. The solution? Never actually move any money at all. Instead, the TransferWise network nets your balance against others around the world on their network.

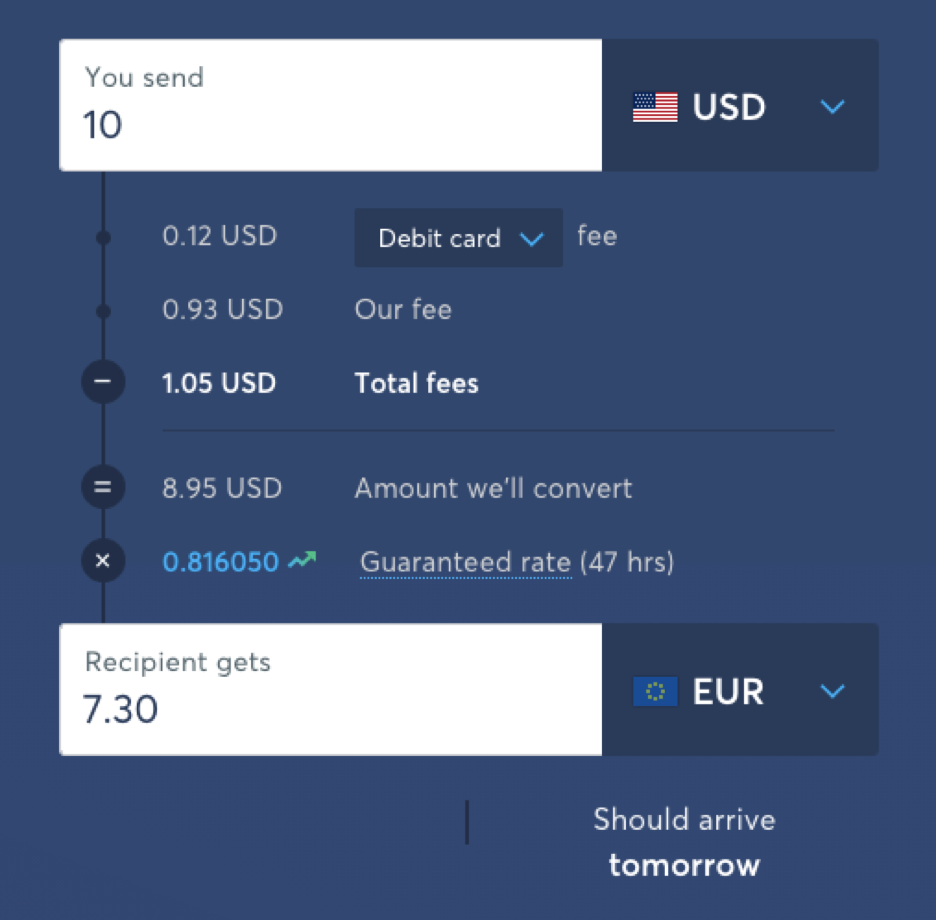

For example, let’s say I wanted to send $10 from the USA to Europe received as EUR. The money “should” arrive tomorrow using the TransferWise network.

However, my USD is not actually going anywhere. Instead, the TransferWise network waits for their European users to send the equivalent in Euros, €7.30 at their rate, as shown above. Once enough users initiate a EUR payment, TransferWise takes their EUR and credits the recipient I was trying to pay, while the USD I gave them will be used to complete a payment for someone else.

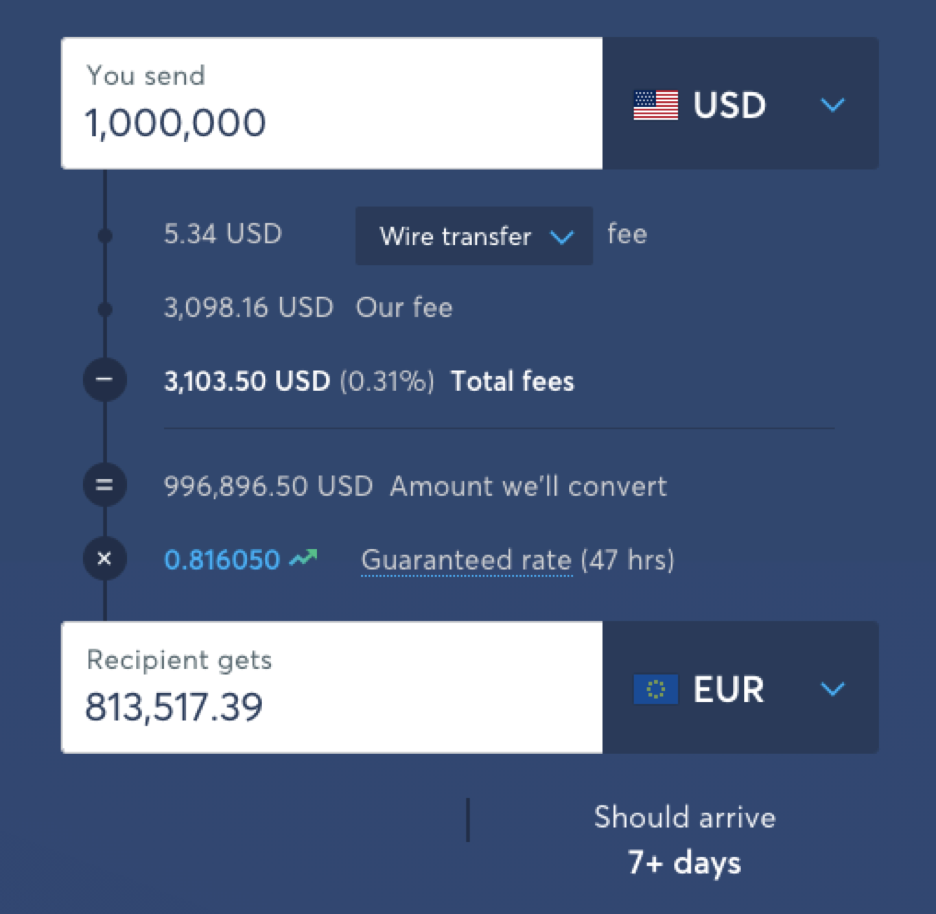

You can see that as the amount you’re trying to send goes up, so does the wait time on the TransferWise network. Below, I now attempt to send $1,000,000 from the USA to Europe received as EUR. The key difference is this time it will take longer than a week to arrive. Why is the TransferWise network getting slower? Well, it’s going to take longer (they estimate over a week) for their European users to want to send the equivalent on the other side, which is €813,517.39.

The idea of avoiding the need to escrow physical value is clever, but as impressive as this workaround is, it’s just a workaround. We’re still left without a real solution to escrowing physical value globally. The two major friction points hindering international fund transfers, fees and time to transaction finality, remain unchanged. Disruption is inevitable.

Strike

TransferWise actually had it right; the friction and cost of sending international fund transfers are caused by settling and clearing physical value, this much we do know. The question then becomes how can we achieve instant global fund transfer at any time with no cost? With over 100 currencies spanning over 200 countries, it seems nearly impossible.

Nearly.

On January 3rd, 2009 the world was gifted the first ever natively digital, inherently global, asset known as Bitcoin. Bitcoin provides an open network of its own that enables parties worldwide to send and receive information about financial transactions. Sound familiar?

The Bitcoin network, however, came with its own flaws:

- Variable cost to achieve transaction finality.

- Variable time to achieve transaction finality.

- Must use bitcoin the asset on the Bitcoin network.

Enter the Lightning network. Lightning solves the first two issues, both the cost and delay in achieving transaction finality. With Lightning, the Bitcoin network can now achieve physical settlement and final clearance immediately and at virtually no cost.

- V̶a̶r̶i̶a̶b̶l̶e̶ ̶c̶o̶s̶t̶ ̶t̶o̶ ̶a̶c̶h̶i̶e̶v̶e̶ ̶t̶r̶a̶n̶s̶a̶c̶t̶i̶o̶n̶ ̶f̶i̶n̶a̶l̶i̶t̶y̶.̶

- V̶a̶r̶i̶a̶b̶l̶e̶ ̶t̶i̶m̶e̶ ̶t̶o̶ ̶a̶c̶h̶i̶e̶v̶e̶ ̶t̶r̶a̶n̶s̶a̶c̶t̶i̶o̶n̶ ̶f̶i̶n̶a̶l̶i̶t̶y̶.̶

- Must use bitcoin the asset on the Bitcoin network.

That leaves us with the last flaw, the requirement of using bitcoin the asset. However, now with Strike, users can use the Bitcoin network with only their bank account or debit card. They don’t need bitcoin the asset to benefit from Bitcoin the network.

- V̶a̶r̶i̶a̶b̶l̶e̶ ̶c̶o̶s̶t̶ ̶t̶o̶ ̶s̶e̶n̶d̶ ̶a̶ ̶p̶a̶y̶m̶e̶n̶t̶.̶

- ̶V̶a̶r̶i̶a̶b̶l̶e̶ ̶t̶i̶m̶e̶ ̶t̶o̶ ̶a̶c̶h̶i̶e̶v̶e̶ ̶t̶r̶a̶n̶s̶a̶c̶t̶i̶o̶n̶ ̶f̶i̶n̶a̶l̶i̶t̶y̶.̶

- ̶M̶u̶s̶t̶ ̶u̶s̶e̶ ̶b̶i̶t̶c̶o̶i̶n̶ ̶t̶h̶e̶ ̶a̶s̶s̶e̶t̶ ̶o̶n̶ ̶t̶h̶e̶ ̶B̶i̶t̶c̶o̶i̶n̶ ̶n̶e̶t̶w̶o̶r̶k̶.̶

The result? The combination of the Bitcoin network, Lightning network, and Strike allows anyone to send any amount of money, at any time, for zero cost. We now have an open monetary network that can physically settle any amount of value, at any time, to any place, at virtually no cost. Combine that with an application that allows you to utilize this open monetary network with your bank account and you get monumental innovation and pure disruption.

Send $10 from the USA to Europe received as EUR? Easy. Instant. Free.

Disruption, is here.

How Strike Global Works

The world now has an open network that offers real-time, cheap, global settlement and self-clearing to the world’s first natively digital asset class. We’ve put in the work to make this network interoperable with legacy fiat. The result ties everyone on the planet together, making any payment anywhere at any time as easy as sending a text.

If I wanted to send $1,000 from Chicago, USA to Berlin, Germany, Strike is able to take my US dollars and deliver them to the intended Berlin resident in Euros instantly and at no cost. How? Let’s walk through it.

- When I initiate the $1,000 payment, Strike debits my existing USD balance.

- Strike then automatically converts my $1,000 to bitcoins ready for use in its infrastructure using its real-time automated risk management and trading infrastructure.

- Strike then moves the bitcoins across the Atlantic Ocean where it arrives in one of our many European infrastructure pieces in less than a second and for no cost.

- Strike then takes the bitcoins and automatically converts them back into Euros using its real-time automated risk management and trading infrastructure.

- Strike then credits the existing user with the Euros to their Strike account.

US Dollars to Euros in less than a second and for free. No shortcuts. Real physical value escrowed thousands of miles, in real time, and using USD and EUR at the user’s convenience. Did we need rocket scientists to pull this off? No. Why didn’t SWIFT do this 50 years ago? They couldn’t. This is only possible because we now have an asset and open monetary network that can achieve cash finality anywhere in the world, at any time, on any day, at no variable cost, and has 24/7/365 liquidity in any currency pair you need.

Hold on, what Forex rate did Strike use when sending USD received as EUR? Good question. When viewing the above example, you’ll notice Strike didn’t use any Forex rates when making the international transfer.

In the above example, the movement of US Dollars to Euros was comprised of two transactions:

- A BTC/USD BUY (from the sender’s USD to BTC)

- A BTC/EUR SELL (from the BTC to the receiver’s EUR)

We believe the true exchange rate between two individual fiat currencies are the net of a BUY and a SELL between them and Bitcoin. Strike maintains a live Forex rate and compares that to its own rate before every transaction. However, in our testing, a Strike international transfer has never been done at an unfavorable exchange rate when compared to Forex rates. Shockingly (or maybe not) it was even cheaper sometimes, exposing the flaws and lag in Forex rates and how they are used. Bitcoin, as the most liquid, globally transferable asset is already acting as the new world reserve currency with Strike.

User Story

To hammer the point home, I want to preview the BETA pilot we are launching in El Salvador, a small country in Central America, to show the true power of Strike and one of the many ways it will change the world as we know it.

In 1892 El Salvador introduced the Colón as their currency. However, after a devastating civil war in the 1980s, in an effort to refuel the economy, El Salvador privatized the banking system and loosened economic restrictions. This eventually led to the introduction of the US Dollar as its official currency. However, El Salvador cannot legally print US Dollars and banking infrastructure in El Salvador is extremely poor and hardly accessible.

El Salvador currently ranks as the 8th highest country in inbound remittance volume from the United States. In 2017 there was an estimated $4.6B sent from the US to El Salvador alone. When speaking with an El Salvador resident, using services like SWIFT and Western Union can be expensive, slow, and dangerous. Fees can be upwards of 10%, transactions take days to weeks, and gangs will sit outside of physical locations and threaten recipients for a percentage of what they are collecting.

Those days are gone. With Strike, El Salvador users not only get access to free and instant international transfers anywhere in the world, but they also get access to a synthetic digital dollar on their smart phone. Let me explain.

Because of the lack of financial technology infrastructure in El Salvador, using US Dollar banking rails isn’t an option. So instead, Strike now supports stablecoins, a synthetic digital dollar for El Salvador or anyone else in the world to hold their balance in.

Let’s walk through a user story. I want to send $1,000 to a friend of mine in El Salvador:

- When I initiate the $1,000 payment, Strike debits my existing USD balance.

- Strike then automatically converts my $1,000 to bitcoins ready for use in its infrastructure using its real-time automated risk management and trading infrastructure.

- Strike then moves the bitcoins across the Gulf of Mexico where it arrives in our Central American infrastructure in less than a second and for no cost.

- Strike then takes the bitcoins and automatically converts them back into USDT (synthetic digital dollar known as Tether) using its real-time automated risk management and trading infrastructure.

- Strike then credits the existing user with the USDT to their Strike account.

Boom. El Salvador users can now make P2P payments between each other with their synthetic digital dollars and have access to free and instant inbound remittance for no fee. Safe, cheap, instant. Want to send $1? It will get there in less than a second and at no cost. Want to send $1,000,000? It will get there in less than a second and at no cost.

What if an El Salvador user wants local currency in exchange for their Strike USDT balance? Are they stuck with synthetic digital dollars? Nope.

Remember, Strike remains interoperable with the Bitcoin and Lightning networks. We don’t need to install Strike network tellers and ATMs around the world, we are built on top of an open network, the work has already been done for us.

An El Salvador user can simply go to a Bitcoin ATM or local Bitcoin teller and receive their local fiat currency:

- El Salvador user requests to sell $100 worth of Bitcoin from Bitcoin ATM.

- El Salvador user scans the Bitcoin ATM QR code with their Strike app.

- Strike debits their Tether balance and converts it to bitcoin using its real-time automated risk management and trading infrastructure.

- Strike then sends the bitcoin to the desired Bitcoin ATM address.

- The ATM receives the bitcoin and issues the user their local fiat currency.

Remember, your Strike balance is spendable wherever bitcoin is accepted! It’s your mobile bank account interoperable with the Bitcoin network.

What if an El Salvador user wants to get access to bitcoin the asset and doesn’t want USDT? Buying bitcoin with Strike is easy and free.

With Strike, billions of unbanked individuals now have:

- Access to synthetic and digital USD.

- Access to P2P payments.

- Access to free and instant international money transfers anywhere in the world at any time.

- Access to bitcoin.

- Neo-bank Account

- All from your phone.

Strike is an interoperable open-network CashApp on steroids for the other 7,000,000,000 people on the planet.

What’s Next

Today, the way we interact and are connected changes. Using the open networks that are Bitcoin and Lightning, we have done the real-time and automated risk management, trading, compliance, legal, policy, application and protocol development to flip the world on its head. However, rolling this out responsibly to millions of you will take time, so here is the plan.

Strike is actively being tested in the US, EU, UK, and our El Salvador BETA is being deployed as we speak. We are going to continually widen access to Strike all over the world as the days go by. In order to gain early access to the BETA and help us test, you can register at global.strike.me. Refer friends to climb the list and get access first. The country with the most user signups will be our next to launch. Share with your friends and family, represent your country. We need to know where to enter and onboard first. Help us help you help us.

The rollout plan is as follows:

Q1

- Private BETA testing with USDT, USDC, EUR, GBP, CHF.

- Public BETA with USDT, USDC, EUR, GBP, CHF.

- Onboard 1M+ Bittrex users onto Strike and the Lightning network.

- Issue Strike cards in the US.

Q2

- Issue Strike Cards to our European and UK users.

- Add more fiat currency pairs.

At this point, we now have:

- Bitcoin-native neo-bank

- Instant and free international fund transfers

- Partnerships with the biggest exchanges in the space and companies in the world (Bittrex, CMT, VISA)

- Support in hundreds of countries

- Major fiat currency support

- Stablecoin support

- Strike Card

- Strike Payday

This is not a drill. I have more partnerships and products to announce and release. Too much work to do, too much world to change. As exciting as this is, I promise this is only the beginning.

Thanks

Ok, everyone, that’s all I have for now. I’ve never been prouder and more excited for a technology, community, and team. Today feels special, because it is.

I’d like to take a moment to shoutout the Strike team. While Bitcoin was dead, we kept building. While Bitcoin was down, we kept building. While Bitcoin was making ATHs, we kept building. While the world kept rotating, every single day, we kept building. We went through it all, together. This team is united through our passion for Bitcoin and our belief that Bitcoin represents a better future and a better world. We are all lucky to have this group working on Bitcoin and I am so lucky to not only spend so much time with such smart people, but to also call them some of my closest friends. To my team, you all should be so proud.

Lastly, to the community. Designing products, building applications, implementing advanced protocols, building live/automated global trading infrastructure, managing a team, adapting to sudden regulatory proposals, and so on is hard. In recent months I’d find myself calling my parents crying, you can ask them (BitcoinMom, willb20). However, the next morning, I’d wake up to support from you all. This community is my family. You all are my people. I work and fight for Bitcoin and the support I get in return is nothing I take for granted. From the bottom of my heart, I love and appreciate you all. That’s the best way I can put this into words. Thank you so much ❤️.

You can contact me @JackMallers on Twitter or jack@strike.me via email. Register for early access to Strike Global at global.strike.me and help us test. Top countries will get access first and top referrers will get 1,000,000 sats. We need your help! In any event, I’m going to release it all publicly and blow the roof off the place soon enough.

As I said above, I’ve got more coming. I’ll talk to you sooner than you think.

Much love. Be easy. We’re all changing the world.

Peace out 👊 🍻

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.