Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

What is Quickswap?

Quickswap is a permissionless decentralized exchange (DEX) that launched less than a year ago on Polygon, the Ethereum side-chain. Being one of the first movers on the Polygon ecosystem, Quickswap has gained fast adoption and a respected reputation.

Quickswap implemented a governance structure managed by its token QUICK. The token initially distributed by liquidity mining and staking on the Quickswap protocol gives holders the ability to participate in the protocol’s decisions by their respective share of tokens. Proposals are passed through the protocols forum in order for holders to vote on.

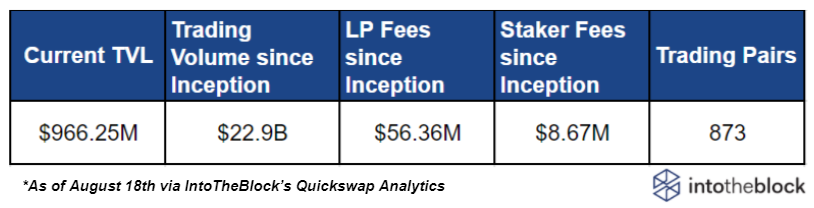

Key Metrics

Within less than a year, Quickswap has managed to process nearly $23billion in trading volume and currently has approximately $966 million in liquidity supplied, making up 18% of the total value locked (TVL) on the Polygon ecosystem. Out of the 0.3% trading fee charged, 0.25% of it goes for liquidity providers of which since inception date have generated over $56 million. Moreover, 0.04% goes for stakers which have generated an astounding $8.67 million. Finally, 0.01% goes to the Quickswap foundation.

Quickswap has currently 39k holders on Polygon and 16k for dragon quick.

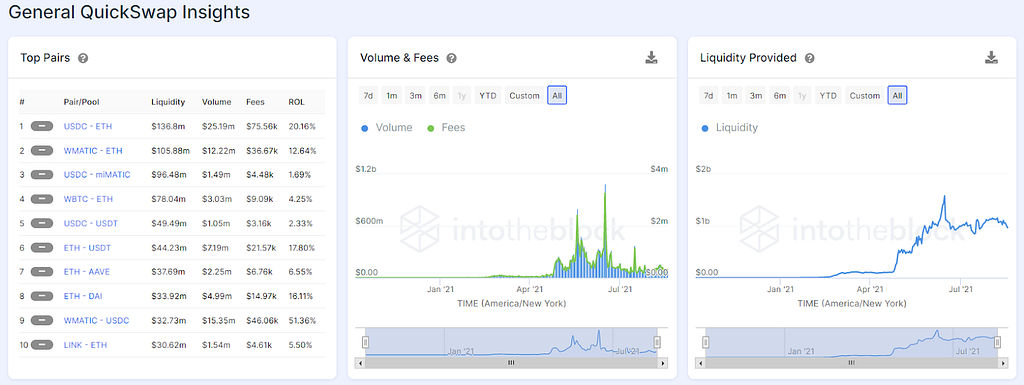

Users of Quickswap can gain valuable insights from these metrics whether they are liquidity providers (LPs), traders on Quickswap or investors in the Quick token.

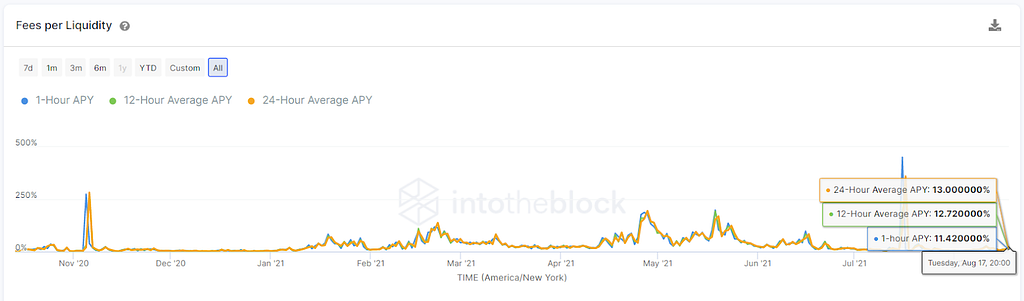

The Fees per Liquidity metric provides the annual percentage yield (APY) that LPs can expect based on 1-hour, 12-hour or 24-hour averages. The data for this and all indicators is broken down into hourly intervals to provide a level of extra granularity for LPs that may allocate funds dynamically as APYs shift.

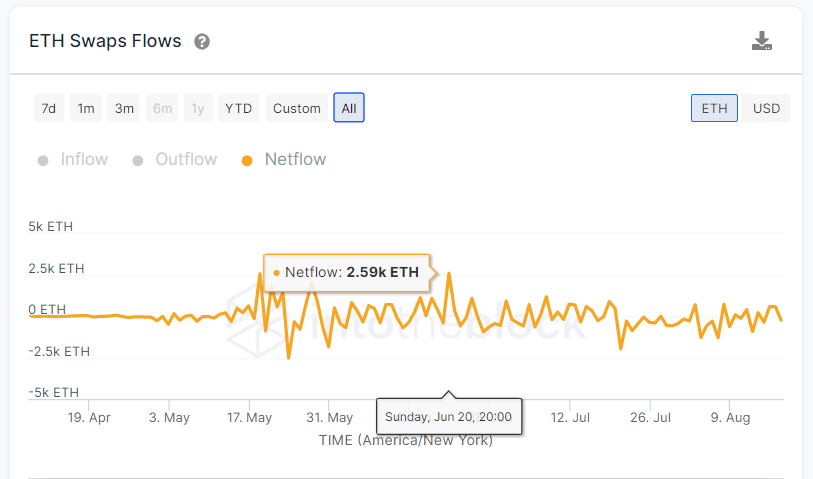

For traders, one of the most pertinent data points to gain from Quickswap is the amount being traded of each token in a pair. Being fully transparent, we can track the input and output behind every transaction taking place on Quickswap. As traders deposit one token in exchange for another, we can aggregate the total amount of inflows and outflows for each asset to get an understanding of market demand. This is displayed in the Swaps Flows indicator.

The netflow measures the amount of inflows minus outflows for a particular crypto-asset. In the image above, for example, we are observing the aggregate amount of volume of ETH being deposited in exchange for USDC minus the amount of USDC being traded for ETH. This relationship means that high inflows relative to outflows point to higher demand for the secondary asset, in this case USDC. On June 20 as Ether’s price had decreased for four straight days taking a hit of around 15%, there was understandably higher demand for USDC as evidenced by the spike to 2.59k ETH in netflows.

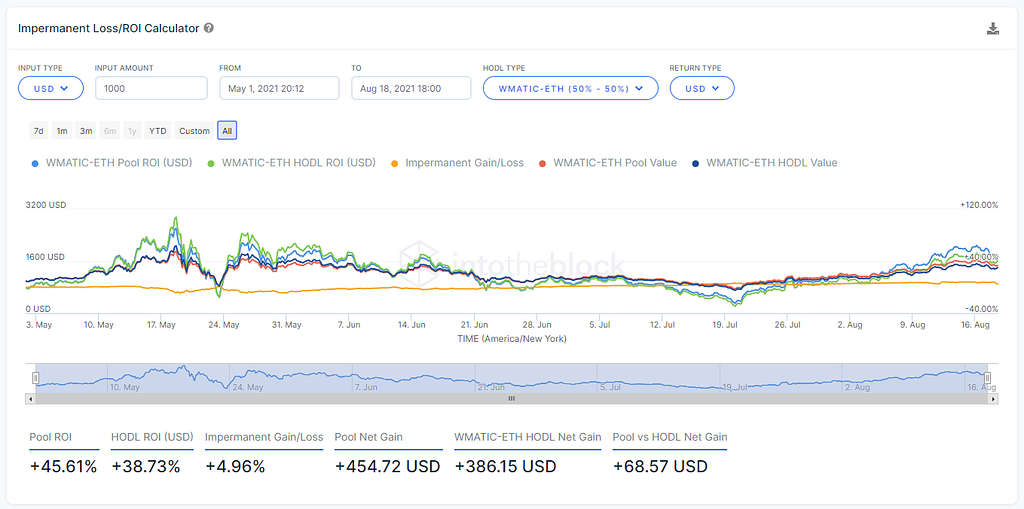

Going back to liquidity providers, one of the metrics we are the most excited about is the Impermanent Loss/ROI Calculator. This indicator allows users to adjust parameters on their positions on Quickswap to simulate their returns in comparison to the return they would have received simply holding the two assets separately.

Following the example of the WMATIC — ETH pool, we can track the returns being generated by liquidity providers. For instance, if an LP had deposited $1,000 split evenly between ETH and WMATIC into the pool on May 1st, they would have gained an astonishing 45.61%, while simply holding these two assets separately would have netted them 38.73% gain, which is the equivalent of 6.88% less. Therefore, it is evident in this case that it has been beneficial for LPs to supply liquidity to this pool, generating them a higher relative return.

Team, Development Activity, Partners & Investors

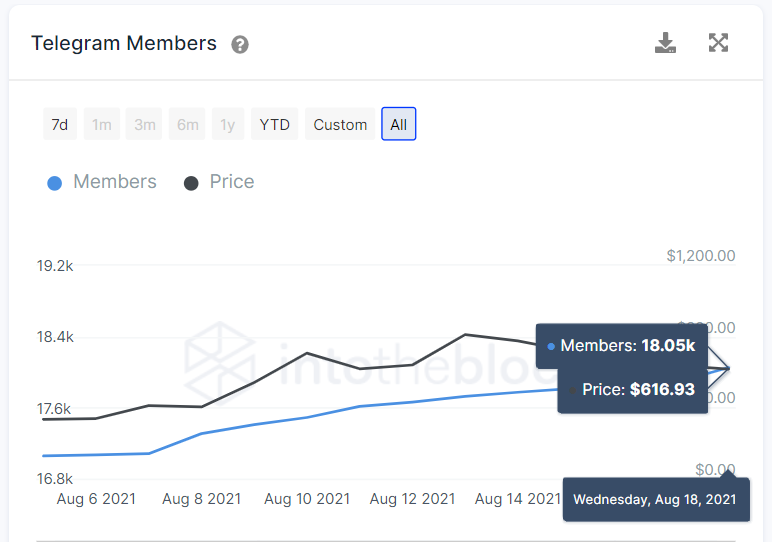

Quickswap is a community led protocol, having many contributors from renowned Hayden Adams, founder of UniSwap Protocol, to Dan Robinson, Researcher at Paradigm to developers all around the Defi community. Its core team of developers include Nick Mudge, one of the discussion participants for the creation of the ERC721 standard (today known as NFTs). Sameep Singhania Co-Founder and Director of the blockchain development and consulting company Ginete Technologies. The protocol also has as an advisor the Matic Foundation, being one of the first adopters and second biggest in terms of TVL of the Polygon side-chain. As of August 11th, QUICK went live on Coinbase Pro enabling trading for a sizable market in the crypto space. Good news like this one, continues to encourage the thriving growing community with over 18k members on Quickswap’s telegram group, showing an engaged and growingcommunity.

Moving on to the protocol’s security, core contracts are the fork of Uniswap V2, perhaps the most battle-tested contracts to date on DeFi. Being one of the first DEXs to support high amounts of deposited liquidity as well as volume processed transactions and no exploit on its track record gives clear evidence of its contracts resistance. In-depth documentation on Uniswap V2 is available here.

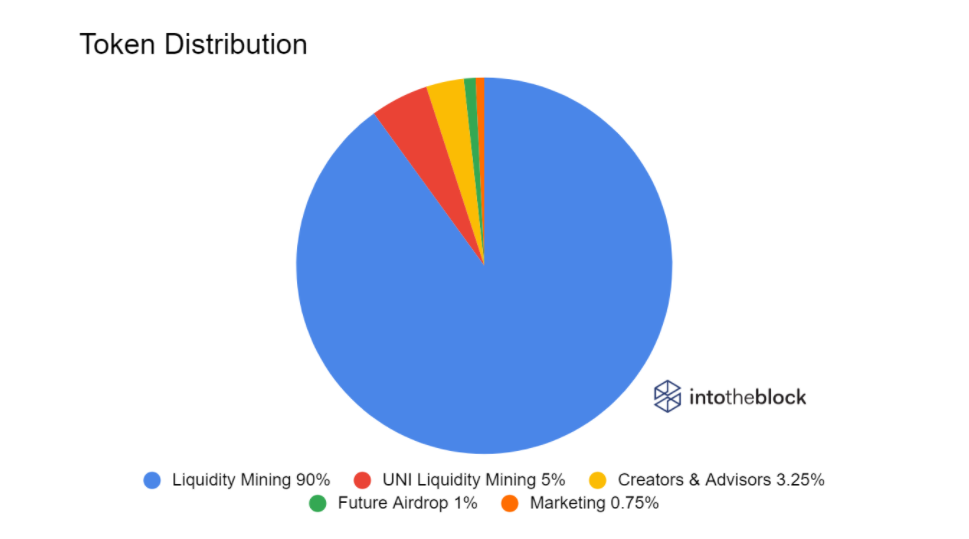

As for the Tokenomics, QUICK was a fair launch distributed token, meaning there was no seed round, no private round, no pre-sale, and no public sale. 96.75% of the total Quick supply is allocated to its community.

Currently with 327,100.00 QUICK in circulation. The QUICK mining rewards continue and will run for 4 years since the protocol’s inception date. As a sign of respect and loyalty for forking Uniswap V2’s code, 5% of QUICK was allocated to liquidity mining via UNI pools. The rest of the tokens were distributed accordingly as depicted by the graph. Incentives for users will reduce gradually over time, counting with future presumed adoption and migration towards the Polygon network. Quickswap foundation treasury holds the majority of the funds that will pay out liquidity mining rewards for the upcoming years. This wallet is equipped with multisig, and it requires 3 out of 4 signatures to authorize fund allocations.

Analyzing Growth & Roadmap

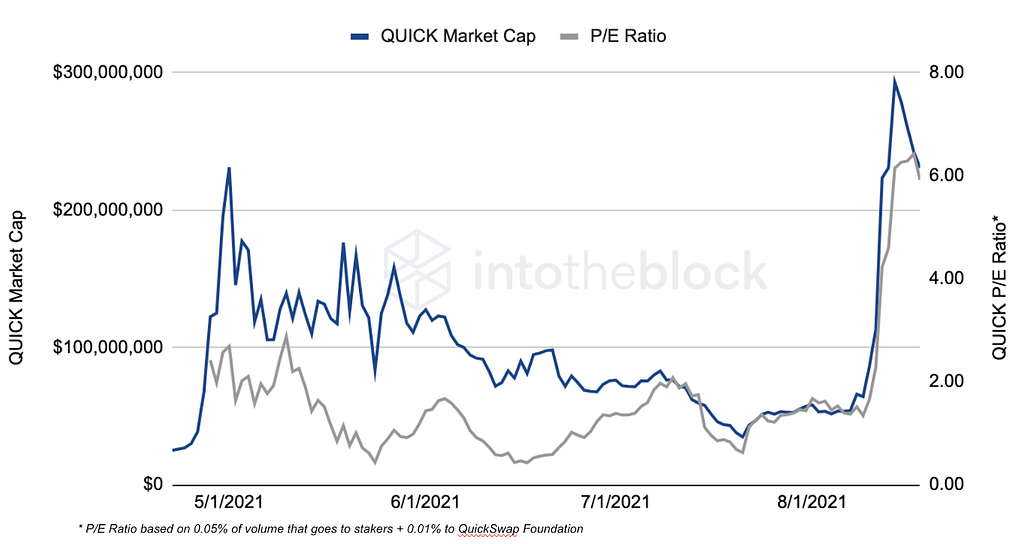

Quickswap has accrued largerevenues since its inception. Contrary to Uniswap where all of these revenues go to LPs, Quickswap gives a portion of fees to dQuick stakers and the Quickswap Foundation as well. Trade fees of 0.30% paid by takers are distributed 0.25% to LPs, 0.04% to stakers and 0.01% to the Quickswap Foundation. The percentage directed to the Quickswap Foundation is allocated to the treasury where token holders will be able to vote in order to choose the right usage of it.

Fees generated by stakers are analogous to dividends distributed in traditional finance, except that here they are sent on every transaction block and can be earned by virtually anyone. Therefore, these dividends provide a proxy to the amount of earnings being generated by QuickSwap, as well as the 0.01% that go to the QuickSwap Foundation. This allows us to measure the valuation of QuickSwap similar to equities, using the price-to-earnings (P/E) ratio.

Based on downloaded data from IntoTheBlock’s QuickSwap Insights, we can estimate a P/E ratio of 5.91 for QUICK. This P/E ratio is significantly lower than other DEXs such as SushiSwap which has a P/E of 38, and is not comparable to Uniswap where fees don’t accrue to holders or their foundation. Considering that QuickSwap grew into a multi-million dollar protocol within less than a year, it is likely that future growth potential is not factored into QUICK’s relatively discounted valuation.

Conclusion

Quickswap has managed to dominate the developing DEXs space in the fast expanding Polygon environment. With over $970 million in TVL the protocol stands as the major DEX and the second biggest protocol in terms of TVL controlling over 18% of the market share. Additionally the protocol has a collaborative community which is looking to innovate and be able to offer the quickest and cheapest possible exchange medium in the decentralized finance ecosystem. The Protocol has incentives in place to keep their momentum and continue its fast growth towards the main exchange site on Polygon, surpassing blue-chip DEXs such as SushiSwap and Curve by TVL on the side-chain.

Resources

- IntoTheBlock’s Quickswap Protocol Metrics

- IntoTheBlock’s Quick Token Metrics

- Quickswap Documentation

- Quickswap Medium

Diving Into QuickSwap with IntoTheBlock’s New Indicators was originally published in IntoTheBlock on Medium, where people are continuing the conversation by highlighting and responding to this story.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.