Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

ICYMI is an ongoing series of blog posts memorializing important Twitter threads from thought leaders at Coinbase and beyond. In this thread Brian talks about his trip to Washington DC.

One of my biggest takeaways is that the U.S. could really use a safe harbor/sandbox for crypto startups to get off the ground, before having to grapple with these issues. This would go a long way, and give the SEC/CFTC/Treasury/etc a common framework to follow. Also, a signal from the current administration that crypto companies are welcome in the U.S. would go a long way. -Brian Armstrong, 05/14/21

I spent most of [the week of May 14, 2021] in DC meeting with members of Congress and heads of various federal agencies, along with Ron Conway, Kathryn Haun and Paul Grewal.

[The] goal was to establish relationships and help answer questions about crypto. And to see what we can do to help the U.S. get more regulatory clarity in this space, as part of the newly formed Crypto Council.

Crypto is as important as the birth of the internet in terms of the jobs, GDP growth, and innovation it can create. The U.S. will need to be a major player in crypto to stay relevant long term. The reactions ranged from very positive (those who see enormous potential) like Senator Kyrsten Sinema and Congressman Patrick McHenry, to admitted skeptics who asked thoughtful questions about illicit activity and I think left with a much more open mind like Senator Mark Warner, and everyone in between. The politicians and agency heads I met with were all thoughtful and committed individuals, and I was happy to have our teams connected, and new friendships formed.

There is not a ton of regulatory clarity today in the U.S. because crypto is not just one thing. Some cryptos might be securities (SEC), some are commodities (CFTC), some are currencies/property (Treasury/IRS), and some are none of the above. So it’s a bit of a jump ball across existing federal regulators, and this means fewer startups who are able to brave the legal uncertainty. Some of them wind up founding their companies abroad, or not at all. This is a major problem.

Coinbase is big enough to afford the legal costs, and we’ve proactively created our own self regulatory frameworks when needed (for example Crypto Rating Council). Smaller crypto startups are more harmed because they can’t always afford it early on.

One of my biggest takeaways is that the U.S. could really use a safe harbor/sandbox for crypto startups to get off the ground, before having to grapple with these issues. This would go a long way, and give the SEC/CFTC/Treasury/etc a common framework to follow. Also, a signal from the current administration that crypto companies are welcome in the U.S. would go a long way.

Credit to Fred Ehrsam and the Crypto Council for Innovation for finding this gem — but watch this amazing video of the Al Gore and the Clinton administration announcing the Electronic Commerce Initiative in 1997. Al Gore outlines the government’s role to “first do no harm”, to applause, and sets the stage for a safe industry with appropriate consumer protection. Think about the downstream effects we have today of this signal they sent to the market.

Side note: great example of why government is best suited to set the legal and policy frameworks, but not try to pick winners. The two companies they chose to represent the future of the internet were IBM and another one I haven’t heard of!

I also relayed my thoughts on China and their central bank digital currency. It is real, they are moving quickly on it, and I believe it represents a threat to U.S. reserve currency status long term if the U.S. doesn’t move quickly to create their own.

Coinbase provides services to customers in over 100 countries around the world, and we’re seeking to speak with policy makers everywhere. But our parent company is based in the U.S. and I’d love to see the U.S. embrace the exciting use cases of this new industry. Including banking the unbanked (and underbanked), which crypto has the potential to do (especially self-hosted wallets).

Coinbase stands ready to help as a resource for all those who would like to learn more about crypto, and help drive toward regulatory clarity, and innovation.

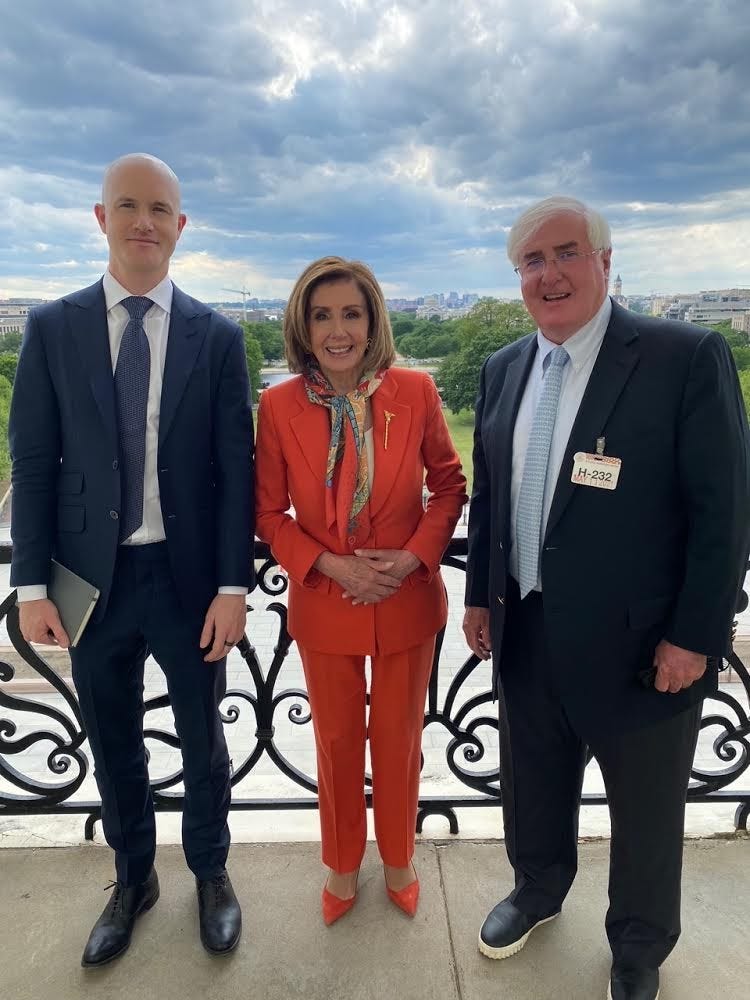

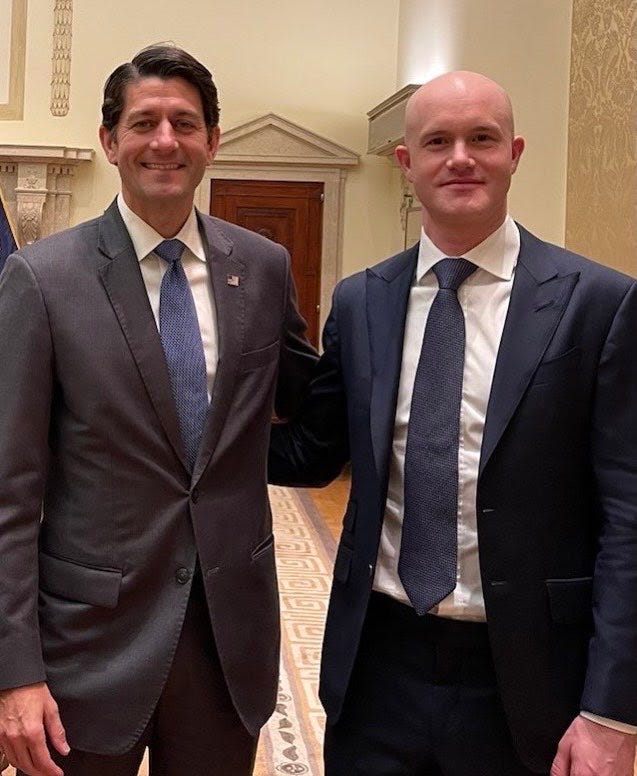

Here are a few fun photos — I only got permission to post a few (there were a lot more meetings where I didn’t!).

Left : U.S. Speaker of the House Nancy Pelosi in a full orange pantsuit with a silk scarf stands between Coinbase CEO Brian Armstrong in a blue suit and tie and Silicon Valley “Super Angel” Investor Ron Conway in a black suit and blue tie. Right: Coinbase CEO Brian Armstrong stands in a blue suit and tie next to former Speaker of the House Paul Ryan wearing a grey suit, blue tie, and American flag lapel pin.

Left : U.S. Speaker of the House Nancy Pelosi in a full orange pantsuit with a silk scarf stands between Coinbase CEO Brian Armstrong in a blue suit and tie and Silicon Valley “Super Angel” Investor Ron Conway in a black suit and blue tie. Right: Coinbase CEO Brian Armstrong stands in a blue suit and tie next to former Speaker of the House Paul Ryan wearing a grey suit, blue tie, and American flag lapel pin.

Btw Coinbase is committed to being bipartisan in any policy efforts.

The U.S. is at a critical juncture in making holistic decisions around cryptocurrency. Imagine the U.S. without the internet.

If you’re a policymaker interested in learning more, reach out to: info@cryptoforinnovation.org

*We’ve added links where appropriate. You can see original thread here.

ICYMI: Brian Goes to DC… was originally published in The Coinbase Blog on Medium, where people are continuing the conversation by highlighting and responding to this story.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.