Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

As the final Polkadot 1.0 release, complete with Parachains draws close, the Cross-Consensus Messaging format, XCM for short, is approaching its first production-ready release. This is an introduction to the format, its goals, how it works and can be used to achieve typical cross-chain tasks.

One fun fact to begin with… XCM is the “cross-consensus” messaging format, rather than just “cross-chain”. This difference is a sign of the goals of the format which is designed for communicating the kinds of ideas sent not just between chains, but also smart-contracts and pallets, and over bridges and sharded enclaves like Polkadot’s Spree.

🤟 A Format, not a Protocol

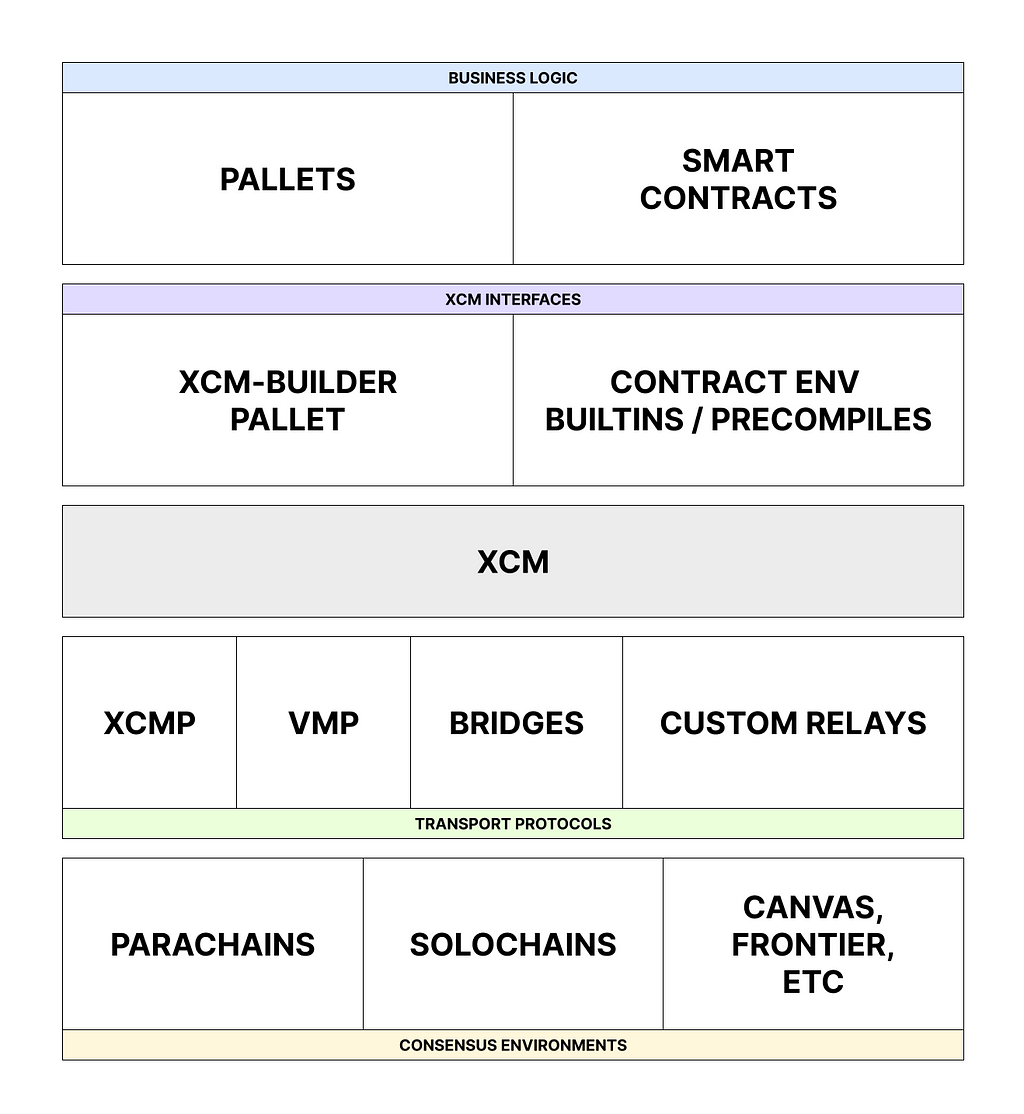

To understand XCM better, it’s important to understand its boundaries and where it fits in the Polkadot technology stack. XCM is a messaging format. It is not a messaging protocol. It cannot be used to actually “send” any message between systems; its utility is only in expressing what should be done by the receiver.

Not including bridges and the contracts pallet, Polkadot comes with three distinct systems for actually communicating XCM messages between its constituent chains: UMP, DMP and XCMP. UMP (Upward Message Passing) allows parachains to send messages to their relay chain. DMP (Downward Message Passing) allows the relay chain to pass messages down to one of their parachains. XCMP, which is perhaps the best known of them, allows the parachains to send messages between themselves. XCM can be used to express the meaning of the messages over each of these three communication channels.

In addition to sending messages between chains, XCM is also useful in other contexts, for transacting with a chain whose transaction format you don’t necessarily know well in advance. With chains whose business logic changes little (for example Bitcoin), the transaction format — or the format used by wallets to send instructions to the chain —tends to remain exactly the same, or at least compatible, indefinitely. With highly evolvable metaprotocol-based chains such as Polkadot and its constituent parachains, the business logic can be upgraded across the network with a single transaction. This can change anything, including the transaction format, introducing a potential problem for wallet maintainers, especially for wallets which are required to be kept offline (such as Parity Signer). Since XCM is well-versioned, abstract and general, it can be used as a means of providing a long-lasting transaction format for wallets to use to create many common transactions.

🥅 Goals

XCM aims to be a language communicating ideas between consensus systems. It should be general enough for it to be properly useful throughout a growing ecosystem. It should be extensible. Since the extensibility will inevitably imply change, it should also be future-proof and forwards-compatible. Finally, it should be efficient enough to run on-chain, and possibly in a metered environment.

Like all languages, some individuals will tend to use some elements more than others. XCM is not designed in such a way that every system which supports XCM is expected to be able to interpret any possible XCM message. Some messages will not have reasonable interpretations under some systems. Others might be reasonable, but still intentionally unsupported by the interpreter owing to resource constraints or because the same content can be expressed in a clearer and more canonical manner. Systems will inevitably only support a subset of possible messages. Heavily resource-constrained systems (like smart contracts) may support only a very limited “dialect”.

This generality extends even as far as concepts like payment of fees for executing the XCM message. Since we know that XCM may be used on diverse systems including a gas-metered smart contract platform and community parachains all the way to trusted interactions between system parachains and their relay chain, we do not want to bake elements such as fee payment too deep and irreversibly in the protocol.

😬 Why not just use the native message format?

Piggybacking on the native message/transaction format of a chain or smart contract can be useful in certain circumstances, but does have some big drawbacks that make it less useful for the goals of XCM. Firstly, there is a lack of compatibility between chains, so a system which intends to send messages to more than one destination would need to understand how to author a message for each. On that note, even a single destination may alter its native transaction/message format over time. Smart contracts might get upgrades, blockchains might introduce new features or alter existing ones and in doing so change their transaction format.

Secondly, common use-cases on chains do not easily fit into a single transaction; special tricks may be required to withdraw funds, exchange them and then deposit the result all inside a single transaction. Onward notifications of transfers, needed for a coherent reserve-asset framework, do not exist in chains unaware of others.

Thirdly, operations such as the payment of fees do not easily fit into a model which assumes fee-payment has already been negotiated like smart contract messages. Transaction envelopes, in comparison, provide some system for payment of processing, but are also generally designed to contain a signature which is not something that makes sense when communicating between consensus systems.

🎬 Some Initial Use-cases

While the goal of XCM is to be general, flexible and future-proof, there are of course practical needs which it must address, not least the transfer of tokens between chains. The optional payment of fees (perhaps using those tokens) is another, as is a general interface for conducting an exchange service, common throughout the DeFi world. Finally, it should be possible to use the XCM language to conduct some platform-specific action; for example, within a Substrate chain, it can be desirable to dispatch a remote call into one of its pallets to access a niche feature.

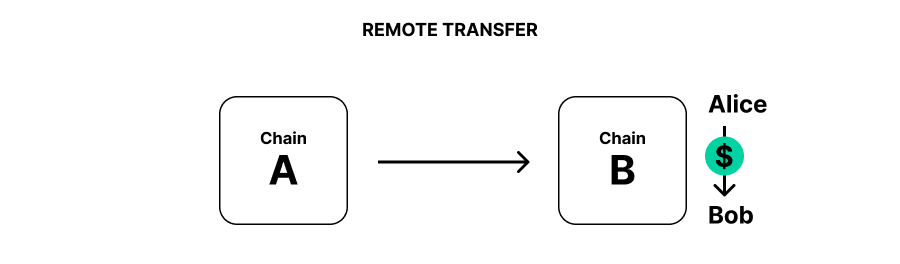

On top of that, there are many models for transferring tokens which we would want to support: We might want to simply control an account on a remote chain, allowing the local chain to have an address on the remote chain for receiving funds and to eventually transfer those funds it controls into other accounts on that remote chain.

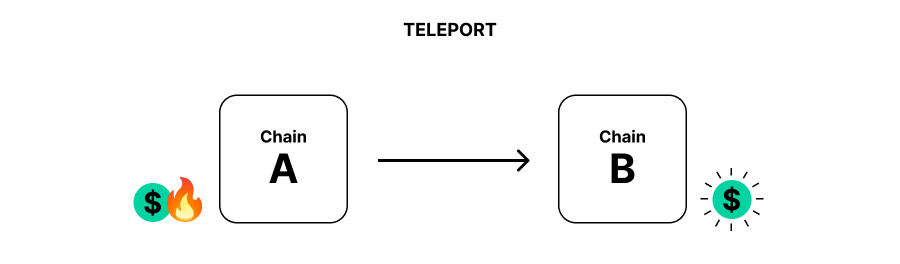

We might have two consensus systems, both of which are native homes for a particular token. Imagine a token such as USDT or USDC, which has instances — all perfectly fungible— on several different chains. It should be possible to burn such a token on one chain and mint a corresponding token on another supported chain. In the parlance of XCM, we call this teleporting owing to the idea that the apparent movement of an asset in fact happens by destroying it on one side and creating a clone on the other side.

Finally, there may be two chains which want to nominate a third chain, one on which an asset might be considered native, to be used as a reserve for that asset. The derivative form of the asset on each of those chains would be fully backed, allowing the derivative asset to be exchanged for the underlying asset on the reserve chain backing it. This might be the case where the two chains do not necessarily trust each other, but (at least as far as the asset in question is concerned) are willing to trust the native chain of the asset. An example here would be where we have several community parachains which would like to send DOT between each other. They each have a local form of DOT which is backed fully by DOT controlled by the parachain on the Statemint chain (a native hub for DOT). When the local form of DOT is sent between the chains, in the background the “real” DOT is moving between parachain accounts on Statemint.

Even this apparently modest level of functionality has a relatively large number of configurations whose usage might be desirable and requires some interesting design to avoid overfitting.

🫀 The Anatomy of XCM

At the core of the XCM format lies the XCVM. Contrary to how it might look to some, this is not a (valid) roman numeral (though if it were, it’d probably mean 905). In fact this stands for Cross-Consensus Virtual Machine. It’s an ultra-high level non-Turing-complete computer whose instructions are designed to be roughly at the same level as transactions.

A “message” in XCM is actually just a programme that runs on the XCVM. It is one or more XCM instructions. The programme executes until it either runs to the end or hits an error, at which point it finishes up (I’m leaving that intentionally unexplained for now) and halts.

The XCVM includes a number of registers, as well as access to the overall state of the consensus system which is hosting it. Instructions might change a register, they might change the state of the consensus system or both.

One example of such an instruction would be TransferAsset which is used to transfer an asset to some other address on the remote system. It needs to be told which asset(s) to transfer and to whom/where the asset is to be transferred. In Rust, it is declared like this:

enum Instruction {

TransferAsset {

assets: MultiAssets,

beneficiary: MultiLocation,

}

/* snip */

}As you might guess, assets is the parameter which expresses which assets are to be transferred, and beneficiary states to whom/where they are to be put. We are of course missing one other piece of information, namely from whom/where the assets are to be taken. This is automatically inferred from the Origin Register. When the programme begins, this register is generally set according to the transport system (the bridge, XCMP or whatever) to reflect where the message actually came from, and it is the same type of information as the beneficiary. The Origin Register operates as a protected register — the programme cannot set it arbitrarily though there are two instructions which can be used to alter it in certain ways.

The types used are quite fundamental ideas in XCM: assets, represented by MultiAsset and locations-within-consensus, represented by MultiLocation. The Origin Register is an optional MultiLocation (optional, because it can be cleared entirely if desired).

📍 Locations in XCM

The MultiLocation type identifies any single location that exists within the world of consensus. It is quite an abstract idea and can represent all manner of things that exist within consensus, from a scalable multi-shard blockchain such as Polkadot all the way down to a lowly ERC-20 asset account on a parachain. In computer science terms, it’s really just a global singleton data structure, regardless of its size or complexity.

MultiLocation always expresses a location relative to the current location. You can think of it a bit like a file system path but where there is no way of directly expressing the “root” of the file system tree. This is for a simple reason: In the world of Polkadot, blockchains can be merged into, and split from, other blockchains. A blockchain can begin life very much alone, and eventually be elevated to become a parachain within a larger consensus. If it did that, then the meaning of “root” would change overnight and this could spell chaos for XCM messages and anything else using MultiLocation. To keep things simple, we exclude this possibility altogether.

Locations in XCM are hierarchical; some places in consensus are wholly encapsulated within other places in consensus. A parachain of Polkadot exists wholly within the overall Polkadot consensus and we call it an interior location. Putting it more strictly, we can say that whenever there is a consensus system any change in which implies a change in another consensus system, then the former system is interior to the latter. For example, a Canvas smart contract is interior to the contracts pallet which hosts it. An UTXO in Bitcoin is interior to the Bitcoin blockchain.

This means that XCM doesn’t distinguish between the two questions “who?” and “where?”. From the point of view of something fairly abstract like XCM, the difference isn’t really important — the two blur and become essentially the same thing.

MultiLocations are used to identify places to send XCM messages, places which can receive assets and then can even help describe the type of an asset itself, as we will see. Very useful things.

When written down in text like this article, they are expressed as some number of .. (or “parent”, the encapsulating consensus system) components followed by some number of junctions, all separated by /. (This isn’t what generally happens when we express them in a language like Rust, but it makes sense in writing since it’s quite a lot like the familiar directory paths that are in widespread use.) Junctions identify an interior location within its encapsulating consensus system. If there are no parents/junctions at all, then we just say that the location is Here.

Some examples:

- ../Parachain(1000): Evaluated within a parachain, this would identify our sibling parachain of index 1000. (In Rust we would write ParentThen(Parachain(1000)).into().)

- ../AccountId32(0x1234...cdef): Evaluated within a parachain, this would identify the 32-byte account 0x1234…cdef on the relay chain.

- Parachain(42)/AccountKey20(0x1234...abcd): Evaluated on a relay chain, this would identify the 20-byte account 0x1234…abcd on parachain number 42 (presumably something like Moonbeam which hosts Ethereum-compatible accounts).

There are many different types of junction for identifying places you might find on-chain in all sorts of ways such as keys, indices, binary blobs and plurality descriptions.

💰 Assets in XCM

When working in XCM it’s often needed to refer to an asset of some sort. This is because practically all public blockchains in existence rely on some native digital asset to provide the backbone for its internal economy and security mechanism. For Proof-of-Work blockchains such as Bitcoin, the native asset (BTC) is used to reward the miners who grow the blockchain and prevent double-spending. For Proof-of-Stake blockchains such as Polkadot, the native asset (DOT) is used as a form of collateral, where network keepers (known as stakers) must risk it in order to generate valid blocks and be rewarded in kind.

Some blockchains manage multiple assets, e.g. Ethereum’s ERC-20 framework allows for many different assets to be managed on-chain. Some manage assets which are not fungible such as Ethereum’s ETH but rather are non-fungible — one-of-a-kind instances; Crypto-kitties was an early example of such non-fungible tokens or NFTs.

XCM is designed to be able to handle all such assets without breaking a sweat. For this purpose there is the datatype MultiAsset together with its associated types MultiAssets, WildMultiAsset and MultiAssetFilter. Let’s look at MultiAsset in Rust:

struct MultiAsset {

id: AssetId,

fun: Fungibility,

}So there’s two fields which define our asset: id and fun, this is pretty indicative of how XCM approaches assets. Firstly, an overall asset identity must be provided. For fungible assets this simply identifies the asset. For NFTs this identifies the overall asset “class” — different asset instances may within this class.

enum AssetId {

Concrete(MultiLocation),

Abstract(BinaryBlob),

}The asset identity is expressed in one of two ways; either Concrete or Abstract. Abstract is not really in use, but it allows asset IDs to be specified by name. This is convenient, but relies on the receiver interpreting the name in the way that the sender expects which may not always be so easy. Concrete is in general usage and uses a location to identify an asset unambiguously. For native assets (such as DOT), the asset tends to be identified as the chain which mints the asset (the Polkadot Relay Chain in this case, which would be the location .. from one its parachains). Assets that are primarily administered within a chain’s pallet may be identified by a location including their index within that pallet. For example, the Karura parachain might refer to an asset on the Statemine parachain with the location ../Parachain(1000)/PalletInstance(50)/GeneralIndex(42).

enum Fungibility {

Fungible(NonZeroAmount),

NonFungible(AssetInstance),

}Secondly, they must be either fungible or non-fungible. If they’re fungible, then there should be some associated non-zero amount. If they’re not fungible, then instead of an amount, there should be some indication of which instance they are. (This is commonly expressed with an index, but XCM also allows various other datatypes to be used such as arrays and binary blobs.)

This covers MultiAsset, but there are three other associated types that we sometimes use. MultiAssets is one of them and really just means a set of MultiAsset items. Then we have WildMultiAsset; this is a wildcard which can be used to match against one or more MultiAsset items. There are actually only two kinds of wildcard that it supports: All (which matches against all assets) and AllOf which matches against all assets of a particular identity (AssetId) and fungibility. Notably, for the latter, the amount (in the case of fungibles) or instance(s) (for non-fungibles) does not need to be specified and all are matched.

Finally, there is MultiAssetFilter. This is used most often and is really just a combination of MultiAssets and WildMultiAsset allowing either a wildcard or a list of definite (i.e. not wildcard) assets to be specified.

In the Rust XCM API, we provide a lot of conversions to make working with these datatypes as painless as possible. For example, to specify the fungible MultiAsset which equals 100 indivisible units of the DOT asset (Planck, for those in the know) when we are on the Polkadot Relay Chain, then we would use (Here, 100).into().

👉 The Holding Register

Let’s take a look at another XCM instruction: WithdrawAsset. On the face of it, this is a bit like the first half of TransferAsset: it withdraws some assets from the account of the place specified in the Origin Register. But what does it do with them? — if they don’t get deposited anywhere then it’s surely a pretty useless operation. Let’s look at its Rust declaration:

WithdrawAsset(MultiAssets),

So, there’s only one parameter this time (of type MultiAssets and which dictates which assets must be withdrawn from the ownership of the Origin Register). But there is no location specified in which to put the assets.

The withdrawn and unspent assets are temporarily held in what is known as the Holding Register. (“Holding” because they’re in a temporary position which cannot persist indefinitely.) There are a number of instructions which operate on the Holding Register. One very simple one is the DepositAsset instruction. Let’s take a look at it:

enum Instruction {

DepositAsset {

assets: MultiAssetFilter,

max_assets: u32,

beneficiary: MultiLocation,

},

/* snip */

}Aha! The astute reader will see that this looks rather like the missing half of the TransferAsset instruction. We have the assets parameter which specifies which of the assets should be removed from the Holding Register to be deposited on-chain. max_assets lets the XCM author inform the receiver how many unique assets are intended to be deposited. (This is helpful when calculating fees in advance of knowing the contents of the Holding Register since depositing an asset can be a costly operation.) Finally there is the beneficiary, which is the same parameter we met earlier in the TransferAsset operation.

There are many instructions which express actions to do on the Holding Register, and DepositAsset is one of the simplest. Some others are rather more sophisticated 😬.

🤑 Fee payment in XCM

Fee payment in XCM is a rather important use-case. Most parachains in the Polkadot community will require their interlocutors to pay their way for any operations that they wish to conduct, lest they leave themselves open to “transaction spam” and a denial-of-service attack. Exceptions to this exist when chains have good reason to believe that their interlocutor will be well-behaved—this is the case when the Polkadot Relay Chain corresponds with the Polkadot Statemint common-good chain. However for the general case, fees are a good way of ensuring that XCM messages and their transport protocols cannot be over-used. Let’s look at how fees can be paid when XCM messages arrive into Polkadot.

As already mentioned, XCM does not include the idea of fees and fee-payment as a first-class citizen: Unlike, say, the Ethereum transaction model, fee payment is not something baked into the protocol that use-cases which have no need for must conspicuously circumvent. Like Rust with its zero-cost abstractions, fee payment comes with no great design overhead in XCM.

For systems that do require some fee payment though, XCM provides the ability to buy execution resources with assets. Doing so, broadly speaking, consists of three parts:

- Firstly, some assets need to be provided.

- Secondly, the exchange of assets for compute time (or weight, in Substrate parlance) must be negotiated.

- Finally, the XCM operations will be performed as instructed.

The first part is managed by one of a number of XCM instructions which provide assets. We already know one of these (WithdrawAsset), but there are several others which we will see later. The resultant assets in the Holding Register will of course be used for paying fees associated with executing the XCM. Any assets not used to pay fees we will be depositing in some destination account. For our example, we’ll assume that the XCM is happening on the Polkadot Relay Chain and that it’s for 1 DOT (which is 10,000,000,000 indivisible units).

So far our XCM instruction looks like:

WithdrawAsset((Here, 10_000_000_000).into()),

This brings us to the second part, exchanging (some of) these assets for compute time to pay for our XCM. For this we have the XCM instruction BuyExecution. Let’s take a look at it:

enum Instruction {

/* snip */

BuyExecution {

fees: MultiAsset,

weight: u64,

},

}The first item fees is the amount which should be taken from the Holding Register and used for fee-payment. It’s technically just the maximum since any unused balance is immediately returned.

The amount that ends up being spent is determined by the interpreting system — fees only limits it and if the interpreting system needs to be paid more for the execution desired, then the BuyExecution instruction will result in error. The second item specifies an amount of execution time to be purchased. This should generally be no less than the weight of the XCM programme in total.

In our example we’ll assume that all XCM instructions take a million weight, so that’s two million for our two items so far (WithdrawAsset and BuyExecution) and a further one for what’s coming next. We’ll just use all the DOT that we have to pay those fees (which is only a good idea if we trust the destination chain not to have crazy fees — we’ll assume that we do). Let’s have a look at our XCM so far:

WithdrawAsset((Here, 10_000_000_000).into()),

BuyExecution {

fees: (Here, 10_000_000_000).into(),

weight: 3_000_000,

},

The third part of our XCM comes in depositing the funds remaining in the Holding Register. For this we will just use the DepositAsset instruction. We don’t actually know how much is remaining in the Holding Register, but that doesn’t matter since we can specify a wildcard for the asset(s) which should be deposited. We’ll place them in the sovereign account of Statemint (which is identified as Parachain(1000).

Our final XCM instruction therefore looks like this:

WithdrawAsset((Here, 10_000_000_000).into()),

BuyExecution {

fees: (Here, 10_000_000_000).into(),

weight: 3_000_000,

},

DepositAsset {

assets: All.into(),

max_assets: 1,

beneficiary: Parachain(1000).into(),

},

⛓ Moving Assets between Chains in XCM

Sending an asset to another chain is probably the most common use-case for inter-chain messaging. Allowing one chain to administer another chain’s native asset allows for all sorts of derivative use-cases (no pun intended), the simplest being a decentralised exchange but generally grouped together as decentralised finance or DeFi.

Generally speaking there are two ways that assets move between chains and this depends on whether the chains trust each other’s security and logic or not.

✨ Teleporting

For chains that trust each other (such a homogeneous shards under the same overall consensus and security umbrella), we can use a framework that Polkadot calls teleporting, which basically just means destroying an asset on the sending side and minting it on the receiving side. This is simple and efficient — it only requires the coordination of the two chains and only involves one action on either side. Unfortunately, if the receiving chain cannot 100% trust the sending chain to actually destroy the asset which it is minting (and indeed not to mint assets outside of the agreed rules for the asset), then the sending chain really has no basis for minting the asset on the back of a message.

Let’s look at how the XCM would look which teleported (most of) 1 DOT from the Polkadot Relay Chain to its sovereign account on Statemint. We’ll assume that the fees are already paid on the Polkadot side.

WithdrawAsset((Here, 10_000_000_000).into()),

InitiateTeleport {

assets: All.into(),

dest: Parachain(1000).into(),

xcm: Xcm(vec![

BuyExecution {

fees: (Parent, 10_000_000_000).into(),

weight: 3_000_000,

},

DepositAsset {

assets: All.into(),

max_assets: 1,

beneficiary: Parent.into(),

},

]),

}

As you can see, this looks fairly similar to the straight withdraw-buy-deposit pattern that we saw last. The difference is the InitiateTeleport instruction which is inserted around the last two instructions (BuyExecution and DepositAsset). Behind the scenes, the sender (Polkadot Relay) chain is creating a whole new message when it executes the InitiateTeleport instruction; it takes the xcm field and places it inside a new XCM, ReceiveTeleportedAsset, and sends this XCM on to the receiver (Statemint) chain. Statemint trusts the Polkadot Relay Chain to have destroyed the 1 DOT on its side prior to sending the message. (It does!)

The beneficiary is stated as Parent.into(), and an astute reader might be wondering what this could refer to in the context on the Polkadot Relay Chain. The answer would be “nothing”, but there is no mistake here. Everything in the xcm parameter is written from the perspective of the receiving side, so despite this being a part of the overall XCM which is fed into the Polkadot Relay Chain, it is only actually executed on Statemint, and thus it is in Statemint’s context which is it written.

When Statemint eventually gets the message, it looks like this:

ReceiveTeleportedAsset((Parent, 10_000_000_000).into()),

BuyExecution {

fees: (Parent, 10_000_000_000).into(),

weight: 3_000_000,

},

DepositAsset {

assets: All.into(),

max_assets: 1,

beneficiary: Parent.into(),

},

You might notice that this looks rather similar to the previous WithdrawAsset XCM. The only major difference is that rather than funding the fees and deposit through a withdrawal from a local account, it is being “magicked” into existence by trusting that the DOT was faithfully destroyed on the sending (Polkadot Relay Chain) side and honouring the ReceiveTeleportedAsset message.

Notably, the asset identifier of the 1 DOT we sent on Polkadot Relay Chain (Here, referring to the Relay Chain itself the native home for DOT) has been automatically mutated into its representation on Statemint: Parent.into(), which is the Relay Chain’s location from Statemint’s context.

The beneficiary is specified as the Polkadot Relay Chain also and so its sovereign account (on Statemint) is credited with newly minted 1 DOT minus fees. The XCM might just have easily named an account or other place for the beneficiary. As it is, a later TransferAsset sent from the Relay Chain could be used to move this 1 DOT.

🏦 Reserves

The alternative way to transfer assets across chains is slightly more complicated. A third-party is used known as the reserve. The name comes from reserve banking, where assets are held “in reserve” to give credibility to the idea that some issued promise is valuable. For example, if we can reasonably believe exactly 1 “real” (e.g. Statemint or Relay Chain) DOT is redeemable for each “derivative” DOT issued on an independent parachain, then we can treat the parachain’s DOT as being economically equivalent to real DOT. (Most banks do something called fractional reserve banking, which means they keep less than the face-value in reserve. This works fine until too many people wish to redeem, and then everything can go quite wrong quite fast.) So, the reserve is the place which stores the “real” assets and, for the purposes of transferral, whose logic and security is trusted by both sender and receiver. Any corresponding assets on the sender and receiver side would then be derivatives, but they would be backed with the “real” reserve asset 100%. Assuming that the parachain behaved well (i.e. that it was bug-free and its governance didn’t decide to run off with the reserve), this would make the derivative DOT more or less of the same value as the underlying reserve DOT. The reserve assets are held in the sender/receiver’s sovereign account (i.e. the account controllable by the sender or receiver chain) on the reserve chain, so there’s good reason that unless something went wrong with the parachain, they’d be well guarded.

Back to the transfer mechanism, the sender would instruct the reserve to move the assets which the sender owns (and uses as a reserve for its own version of the same asset) into the receiver’s sovereign account, and the reserve — not the sender! — informs the receiver about their new credit. This means that the sender and receiver do not need to trust each other’s logic or security, but only that of the chain used as the reserve. However it does imply that the three sides need to coordinate, which increases the overall cost, time and complexity.

Let’s look at the XCM required. This time we’ll be sending 1 DOT from parachain 2000 to parachain 2001, which use reserve-backed DOT on parachain 1000. Again, we’ll assume the fees are already paid on the sender side.

WithdrawAsset((Parent, 10_000_000_000).into()),

InitiateReserveWithdraw {

assets: All.into(),

dest: ParentThen(Parachain(1000)).into(),

xcm: Xcm(vec![

BuyExecution {

fees: (Parent, 10_000_000_000).into(),

weight: 3_000_000,

},

DepositReserveAsset {

assets: All.into(),

max_assets: 1,

dest: ParentThen(Parachain(2001)).into(),

xcm: Xcm(vec![

BuyExecution {

fees: (Parent, 10_000_000_000).into(),

weight: 3_000_000,

},

DepositAsset {

assets: All.into(),

max_assets: 1,

beneficiary: ParentThen(Parachain(2000)).into(),

},

]),

},

]),

},

This is a little more complex, as promised. Let’s walk through it. The outer part deals with extracting the 1 DOT on the sender side (parachain 2000) and withdrawing the corresponding 1 DOT held on Statemint (parachain 1000) — it uses InitiateReserveWithdraw for this purpose and it pretty self-explanatory.

WithdrawAsset((Parent, 10_000_000_000).into()),

InitiateReserveWithdraw {

assets: All.into(),

dest: ParentThen(Parachain(1000)).into(),

xcm: /* snip */

}

Now we have 1 DOT in the Holding Register on Statemint. Before we can do anything else, we need to buy some execution time on Statemint. This, again, looks pretty familiar:

/*snip*/

xcm: Xcm(vec![

BuyExecution {

fees: (Parent, 10_000_000_000).into(),

weight: 3_000_000,

},

DepositReserveAsset {

assets: All.into(),

max_assets: 1,

dest: ParentThen(Parachain(2001)).into(),

xcm: /* snip */

},

]),

/*snip*/

We’re using our 1 DOT to pay for fees, and we’re assuming one million per XCM operation. With that one operation paid for, we deposit the 1 DOT (minus fees, and we’re lazy so we just use All.into()) into the sovereign account for parachain 2001, but do so as a reserve asset meaning that we also require Statemint to send a notification XCM to that receiving chain informing it of the transfer along with some instructions to be executed on the resulting derivate assets. DepositReserveAsset instructions don’t always make much sense; for it to make sense, the dest must be a location which can reasonably hold funds on the reserve chain, but also one to which the reserve chain can send an XCM. Sibling parachains happen to fit the bill perfectly.

/*snip*/

xcm: Xcm(vec![

BuyExecution {

fees: (Parent, 10_000_000_000).into(),

weight: 3_000_000,

},

DepositAsset {

assets: All.into(),

max_assets: 1,

beneficiary: ParentThen(Parachain(2000)).into(),

},

]),

/*snip*/

The final part defines part of the message which arrives at parachain 2001. Like with initiating a teleport operation, DepositReserveAsset composes and sends a new message in this case ReserveAssetDeposited. It is this message, albeit containing the XCM programme which we define, which arrives at the receiving parachain. It will look something like this:

ReserveAssetDeposited((Parent, 10_000_000_000).into()),

BuyExecution {

fees: (Parent, 10_000_000_000).into(),

weight: 3_000_000,

},

DepositAsset {

assets: All.into(),

max_assets: 1,

beneficiary: ParentThen(Parachain(2000)).into(),

},

(This assumes that no fees were actually taken on Statemint and the whole 1 DOT made it over. That’s not especially realistic, so the assets line is probably going to have a lower number.)

Most of the message should look pretty familiar; the only significant difference with the ReceiveTeleportedAsset message we saw in the last section is the top-level instruction ReserveAssetDeposited, which fulfills a similar purpose, only rather than meaning “the sending chain burned assets so you can mint equivalent assets”, it means “the sending chain received assets and is holding them for you in reserve, so you can mint fully-backed derivates”. Either way the destination chain mints them into the Holding Register, and we deposit them in the sender’s sovereign account on the receiving chain. 🎉

🏁 Conclusion

That’s it for this article; I hope it was helpful in explaining what XCM is and the basics of how it is designed to work. In the next article(s?), we will take a deeper look into the XCVM’s architecture, its execution model and its error handling, XCM’s versioning system and how upgrades to the format can be managed in a well-connected interdependent ecosystem, as well as its query-response system and how XCM works in Substrate. We will also discuss some of the future directions of XCM, planned features and the process for evolving it.

XCM: The Cross-Consensus Message Format was originally published in Polkadot Network on Medium, where people are continuing the conversation by highlighting and responding to this story.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.