Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

Celsius vs. Crypto.com is often a comparison made by yield-seekers searching for the highest cryptocurrency interest rates. Both platforms pay at the higher end of the crypto interest spectrum but substantially differ in how they go about it.

Celsius was founded in 2017 and is headquartered in London, England. It’s a cryptocurrency borrowing and lending app that lets users deposit and earn interest on their cryptocurrency.

Crypto.com was founded in 2016 and is based in Hong Kong, and it offers a wide variety of products including a cryptocurrency exchange, crypto interest account, NFT storage wallet, and a credit (debit) card.

In a nutshell, the most significant Celsius vs. Crypto.com contrast is the accessibility of each platform’s best possible rates.

Celsius pays out solid interest rates of up to 6.2% for BTC and 5.35% for ETH as soon as you deposit any amount of cryptocurrency on the app.

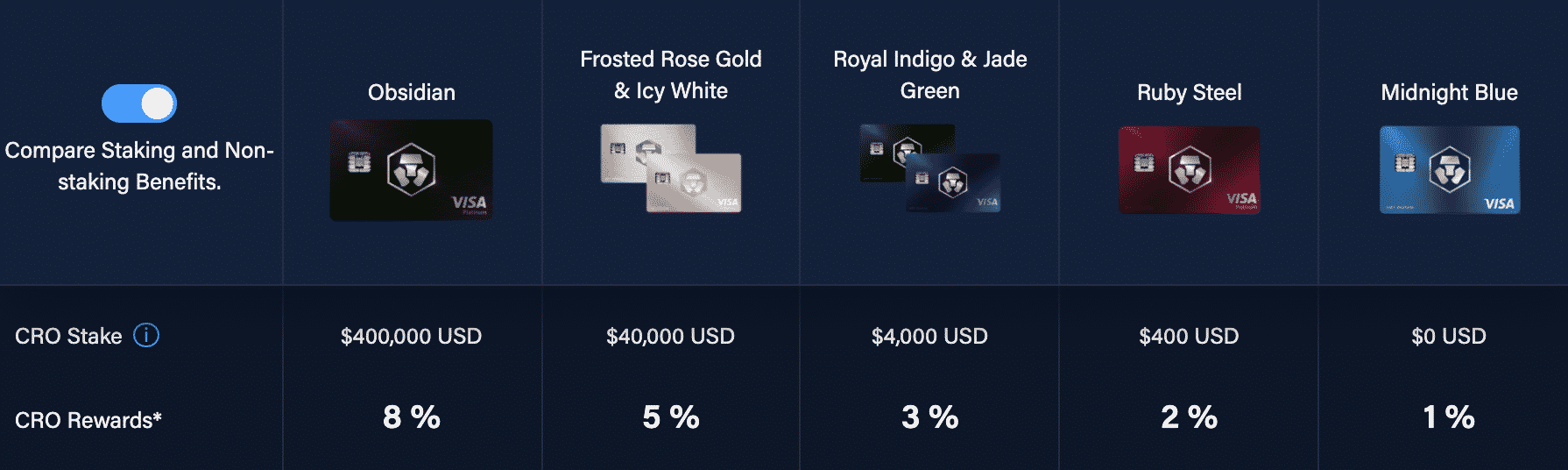

In contrast, Crypto.com’s highest tier pays higher rates of up to 8.5% for BTC and 8.5% for ETH, but with hoops to jump through. It requires its users to hold significant sums of CRO, its native token, to get the best rates, as well as to lock up their funds for a month or longer.

That being said, Celsius and Crypto.com offer certain advantages that the other might not– let’s get into them below.

Celsius vs. Crypto.com: Key Information

Company Bios: Celsius vs. Crypto.com

Celsius was created by Alex Mashinsky and Daniel Leon in 2017. The company raised approximately $100 million in private funding rounds (including one token sale) and has since grown to serve more than 850,000 users. Celsius manages about $16 billion in community assets.

Founder Mashinsky has created or been a key part of a number of successful companies, including:

- Arbinet

- GroundLink

- Gogo Inflight Wireless

- Transit Wireless

Crypto.com was launched under the name Monaco Technologies in Hong Kong in 2016, rebranding to its current name in 2018. The company is led by CEO Kris Marszalek and CFO Rafael Melo. It raised $26.7 million in an initial coin offering on May 18, 2017.

Much of its core team come from big names in traditional finance and cryptocurrency, including the likes of JP Morgan and Binance.

Feature #1: Who Pays More? Celsius or Crypto.com Interest Rates:

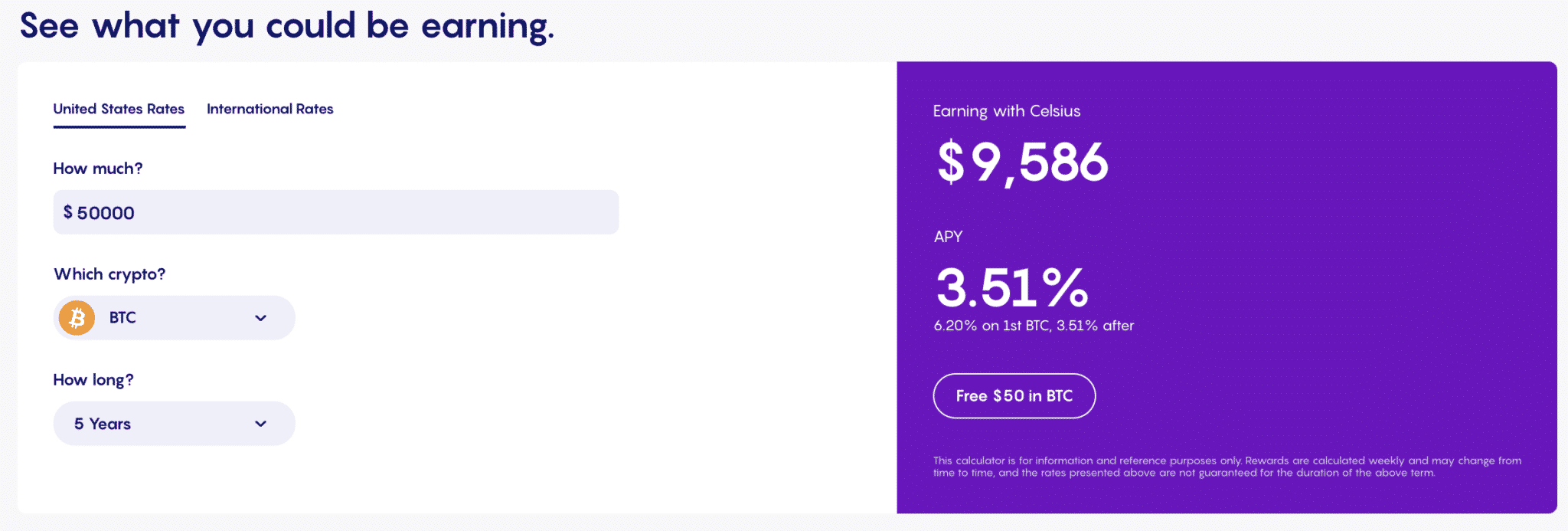

Celsius’ rates are much more straightforward than Crypto.com’s. Users earn a flat rate up to a certain amount and then a lower rate for anything above that amount.

The cutoffs for interest rates change vary from cryptocurrency to cryptocurrency. For example, Celsius users earn maximum interest up to 1 BTC and 100 ETH. Then they get a diminished rate if they store additional amounts of those assets on the platform.

Celsius Network

Crypto.com users have to hold the company’s native cryptocurrency asset CRO to get access to the best rates. The company also pays higher rates to users who commit to locking their funds on the platform for longer amounts of time.

Bitcoin

- Celsius pays 6.2% for a user’s first BTC and 3.51% for any additional amounts

- Crypto.com’s BTC interest rates range from as low as 1.5% to as high as 8.5%. The rate you earn will depend on the value of CRO you have in your account. Users need at least $40,000 in CRO to gain access to the best rates.

Ethereum

- Celius’s ETH rate is 5.35% for a customer’s first 100 ETH and 5.05% for any additional amounts

- Crypto.com’s ETH rates range from 3.5% to 8.5% depending on how long a user commits to storing their funds on the platform and the value of CRO they have in their account.

Alts

Stablecoins

Winner: Celsius. Although Crypto.com offers higher top-end rates on many crypto assets, users must have at least $40,000 in CRO stored on the platform to get those rates. Celsius’ flat rate system is easier to understand and offers competitive interest-earning opportunities on a wide variety of tokens without obstacles.

Celsius offers a higher, less complicated sign-up bonus as well. You can grab a $40 BTC bonus by depositing $400 or more on Celsius for 30 days.

Alternatively, you can get a $25 bonus by signing up for Crypto.com and staking for the Ruby Card.

How Do Celsius and Crypto.com Make Money?

Celsius primarily generates revenue through its crypto lending service. The company lends assets to users at a higher interest rate than it pays them for storing their assets on the platform.

These loans are over-collateralized, which means the risk of default is lower than it would be for a standard loan. However, there is still always a chance (no matter how small) that a default could occur and impact a user’s funds– it has yet to happen, but be aware of the risks before using any cryptocurrency platform.

Crypto.com’s borrowing and lending system is one of its many revenue streams and is the same as described above. The company takes a small percentage of every user exchange. Maker rates range from 0.036% to 0.1% and taker rates range from 0.090% to 0.16%.

Feature #2: Payouts and Withdrawals

Celsius users are free to withdraw their funds at any time without incurring additional fees. Those who wish to withdraw over $50,000 with a single transaction have to wait 24 to 48 hours for it to process. The company makes its weekly interest payments on Mondays.

Crypto.com pays out interest daily, though it doesn’t compound. The company charges a fee for all withdrawals that take place on-chain, but users can avoid these by using Crypto.com’s withdraw-to-app function.

Winner: Celsius. Celsius wins this round as well thanks to its free withdrawals. Users can also withdraw their funds for free on Crypto.com, but only using a workaround.

Feature #3: Celsius vs. Crypto.com Security

Celsius employs a multiparty computation (MPC) system to keep its users’ funds secure. This fits in line with the industry standard. The company also offers numerous user-facing security options, such as:

- 2-factor authentication

- Manual verification for withdrawals

- Biometric security

- Photo and video security

- HODL mode (allows you to disable all outgoing transactions for a set amount of time)

Crypto.com partnered with Ledger to keep the vast majority of its users’ funds in cold storage. This reduces their exposure to internet-based attacks. The company also uses hardware security modules and multi-signature technologies.

Both Celsius and Crypto.com offer up to $250,000 in FDIC insurance to cover their users’ cash funds. Note, this doesn’t cover any cryptocurrency assets.

Winner: It’s a tie. There simply aren’t enough differentiating factors here to declare a winner. Both Celsius and Crypto.com are in line with the industry average for securing their users’ funds.

Feature #4 Ease of Use

The Celsius platform has a much better customer experience than Crypto.com; you only need to deposit their assets on Celsius to begin earning weekly interest payouts.

To get the most out of Crypto.com, users need to fully immerse themselves in its ecosystem– staking for a credit card, holding CRO, and locking up funds.

As far as the user experience goes, both platforms have web-based and mobile account management options that are suited for any beginner. Crypto.com offers more products, and its app is naturally a bit more complex.

Celsius vs. Crypto.com: Standout Features

Celsius’ standout feature is its cryptocurrency asset, CEL. Users who take out loans and make payments with CEL can earn up to a 25% discount on interest payments.

Crypto.com’s standout feature is its credit card. It allows users to start earning cashback in crypto while making everyday purchases.

As far as cryptocurrency credit cards go, Crypto.com’s credit card is more complicated than BlockFi’s comparable offering. Crypto.com does offer a wider variety of perks and rewards, including full CRO reimbursements for Netflix and Spotify at the Frosted Rose Gold & Icy White tiers, and rewards ranging from 1% to 8% based on the user’s cash value of held CRO.

Crypto.coms card tier

The Court of Public Opinion: Celsius vs. Crypto.com Reddit

The Reddit community seems fairly happy with both Celsius and Crypto.com. A common consensus is that crypto-savvy users should use each platform and swap their assets back from one to the other depending on who’s currently paying the highest rates.

If you want a cryptocurrency rewards credit card, though, Reddit has kind things to say about the Crypto.com card.

Celsius vs. Crypto.com Customer Support

Celsius has an online customer support form and phone-based service available at 201-824-2888. It also has a very active Telegram group with over 18,000 members.

Crypto.com has an online help center with answers to common questions. You can also reach out for customer service via email at contact@crypto.com, or within the app.

Can You Trust Celsius and Crypto.com?

The cryptocurrency community at large seems to trust both Celsius and Crypto.com, at least as far as custodial platforms go.

Each company uses industry-standard security practices and hasn’t suffered any major breaches.

That being said, you always assume some level of risk when you allow an external party to hold your crypto assets. Since neither platform offers insurance on tokens like BTC and ETH, you have limited to no recourse if the proverbial dookie hits the fan. This is true of every crypto interest account platform, and is not limited to just Celsius or Crypto.com.

Celsius has claimed it is building an internal insurance product, but it has yet to be released.

Crypto.com has an ISO/IEC 27001:3013 certification and receives regular audits by Bureau Veritas. Celsius has more than 850,000 users and manages billions worth of assets with no history of hackers stealing funds.

Final Thoughts: Which is the Better Crypto Interest Account, Celsius vs. Crypto.com

Celsius beats out Crypto.com as the better crypto interest account. Celsius’s interest system is much more straightforward and doesn’t require users to hold significant sums of a native token to get the best rates. Celsius offers compounding interest, while Crypto.com doesn’t. Many of Celsius’ basic rates are higher than Crypto.com’s basic ones.

CoinCentral readers can get a $40 BTC bonus when depositing $400 or more on Celsius for 30 days.

That being said, Crypto.com does offer a compelling argument if you’re keen on becoming a Crypto.com power user. When maxed out, Crypto.com leads the industry in the highest rates on cryptocurrency, as well as some compelling credit card perks on its highest tier– both of which can be accessed by holding a pretty penny of about $400,000 of CRO.

Perks include:

- Reimbursements for Amazon Prime, Netflix, Spotify, and other popular subscription services

- Airport lounge access

- Private jet partnership

- Exclusive merchandise pack

CoinCentral readers can get $25 when staking for the most basic card tier, the Ruby Card.

The post Celsius vs. Crypto.com: Who Pays the Best APY on Crypto? appeared first on CoinCentral.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.