Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

Back in August, Viabtc founder Yang Haipo was one of the first public figures to declare ”Bitcoin Cash is Bitcoin”. His exchange Viabtc was one of the first to list bitcoin cash (BCH), which was heavily criticized by Chinese industrial players for being “controlled” by Bitmain. Now Haipo is planning his new business Coinex, a crypto-crypto exchange that only pairs digital assets against BCH. In an interview with news.Bitcoin.com, Yang Haipo (Yang) shared his thoughts about the initial fork offering (IFO) craze.

Also Reads: USPTO Approves Bank of America’s Cryptocurrency Exchange Patent

The IFOs Craze

Bitcoin.com (BC): If you think BCH is bitcoin, do you think other forked coins are also bitcoin?

Yang: In a broad sense, they are because they forked from the original BTC chain. But in a narrow sense, Satoshi’s whitepaper defined that bitcoin is a peer to peer electronic cash system. And clearly, only BCH is in line with the vision of Satoshi. It is the real bitcoin.

BC: You mean the whitepaper is the sole criterion?

Yang: Exactly. Satoshi created bitcoin to develop it into a form of money, a widely used payment system, even a global currency. The current version of BTC is only a store of value. Its price increases because of additional investment from new participants. Isn’t it basically a Ponzi scheme?

BCH, however, is a totally different story. A lot of people dub BCH “Jihan coin” or “China coin”, but this is not true. BCH was not created overnight. It came out with the joint efforts of big blockers, miners, exchanges and wallet services. It set an example that a forked coin could survive, and that’s why some individuals and teams followed suit and forked bitcoin.

BC: One of the biggest advantages of bitcoin is its store of value brought about in part by its scarcity. But now we have more coins with a 21 million limit, more bearing the name of bitcoin. Do you think this is inflation in disguise? Is bitcoin still immune to inflation?

Yang: I don’t think this is inflation. Just like our species is the only human variation after our closest relatives died out, there will only be one bitcoin that can dominate the global payment system. The cryptocurrency industry is still in its early stage with bitcoin, and altcoins competing for market share. But only one coin will end up with the largest market cap or the highest price. It will be called bitcoin, and its maximum distribution will still be 21 million.

BC: Coinex, your new exchange, is to open at the end of this month. Will it list all forked coins and distribute them to users? Or is there a standard, for example, of not listing pre-mined coins?

Yang: Coinex will list mainstream cryptocurrencies like BTC, ETH, BCH, LTC, ZEC, DASH. I personally welcome people to fork bitcoin and work on different roadmaps. But we don’t support unethical and meaningless coins like Bitcoin Gold (BTG) and Bitcoin God (GOD).

BCH VS LTC

BC: Proponents of BCH want it to be used as a payment system, but LTC has long been recognized as the coin for small payments. It has low fees and fast confirmations. Do you think BCH can compete with LTC as an alternative payment solution?

Yang: BCH has two advantages, larger user base and an open scalability. Firstly, BCH has the same user base as BTC. If you check at reddit and bitcoin talk, you will find that BCH supporters are more active than that of LTC. These supporters will urge more exchanges and wallet services to support BCH, and make it the most successful coin.

Secondly, BCH is more scalable. LTC has the same scalability problem as BTC, and if bitcoin wants to evolve into a global currency, it will have to increase its block size to 100 megabyte (MB) or even 1 gigabyte (GB). At present, only BCH is able to move toward an adaptive block size limit.

BC: LTC’s roadmap gives priority to the lightning network and atomic swap. The BCH community seems to not have a united roadmap. There were rumors about RSK being included in BCH, but nothing official ever came about. What do you think should be the development roadmap for BCH?

Yang: The BCH community is very clear about its roadmap, scale to make bitcoin a great form of money. The technical feature, lightning network, sounds fancy, but it is actually just old wine in a new bottle. Users need to save their assets to a service provider of a lightning network node. Isn’t it exactly like what we have now, saving money at banks? What’s disruptive about it? Bitcoin is a great invention that allows everybody to be his own bank. BCH will make sure users can transfer coins with low fees on the BCH chain and be their own bank.

BC: Do you believe, as some big blockers do, that Core developers work on offchain transactions to maximize the economic interests of Blocksteam?

Yang: There are no hard facts to support such a conspiracy theory. But unless Core developers leave Blockstream and don’t receive their funds, these types of conspiracy theories will remain about Core.

BC: Litecoin creator Charlie Lee had been emphasizing he wants to focus on development, not marketing. But last week he tweeted that LTC would start working on promotion. Do you think the BCH community has done enough marketing? And it seems like BCH has a governance problem. It’s been four months, but BCH still doesn’t have a universal logo.

BC: Litecoin creator Charlie Lee had been emphasizing he wants to focus on development, not marketing. But last week he tweeted that LTC would start working on promotion. Do you think the BCH community has done enough marketing? And it seems like BCH has a governance problem. It’s been four months, but BCH still doesn’t have a universal logo.

Yang: It’s funny that Charlie just wants to focus on development, but all he does is marketing. I believe marketing is a must for all businesses. Each and every coin is a brand. The brand name can generate more value if more people know about it. The establishment of the Bitcoin Cash Fund (BCF) will make the marketing and promotion part more efficient and organized. And I don’t think BCH has a governance problem just because it doesn’t have a universal logo. LTC was created by Charlie Lee, so Charlie has the final say on its logo. But BCH was not created by a particular individual or a company. It represents a decentralized community where users, designers and exchanges have their own understanding on BCH. Some want its logo to be gold, some want it to be green. They need to argue for a while before a decision is made.

BCH VS BTC

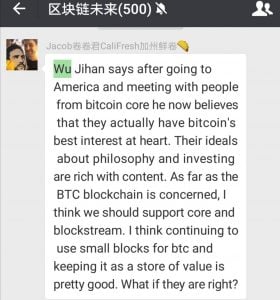

BC: BCH supporters have been back and forth about the brand of bitcoin. You were the first to declare that BCH is bitcoin in the Chinese community. Later Jihan Wu tweeted that “America is not England, Bitcoin Cash is not Bitcoin.” This October, Roger ver and Jiang Zhuoer said only the big block coin BCH is the real bitcoin as well. But this Tuesday Jihan Wu posted on Weibo that Core’s contribution and philosophy on the BTC chain should be recognized and supported. I want to know how you view the brand war between BCH and BTC.

Bitcoiner Jacob’s translation of Jihan’s post

Bitcoiner Jacob’s translation of Jihan’s post

Yang: The key to the brand war involves what is bitcoin ultimately. I suppose Jihan believes the BTC chain is defined by Core and Blockstream; if they believe BTC is bitcoin, then let them focus on BTC. Me, Roger and Jiang Zhuoer, we believe only the big block coin is bitcoin. BCH and BTC represent two different roadmaps and philosophies. If Core took their words back and decided to scale, I would not support them because we already have BCH. But if they actually decide to scale, I believe they might succeed due to their influence.

BC: The media often equates bitcoin with speculation. It seems that BCH might also have this problem. I know some bitcoiners who ask me if I “wanna make money?” They tell me to “buy BCH. It has a monthly pump-and-dump.” Why does BCH price fluctuate so wildly?

Yang: About pump and dump, many bitcoiners think the bitcoin market is just like the stock market where big whales, bankers manipulate the market. In fact, no single person will be able to control such a huge market. And early adopters hate each other these days, and so they will not work to manipulate the market.

I can understand why people have such concerns, but they are not real. About price spikes, BCH price rises because it has gained great support from the community. Some bitcoiners posted on reddit saying they finally realized BCH is the real thing, and that it will have a brighter future. They exchanged all of their BTC for BCH. Besides, any little price rise will always draw the attention of speculators.

BC: If you think BTC development is centralized, don’t you think BCH mining is also centralized?

Yang: Only three Core developers have the right to submit BTC code. In other words, three developers define what is bitcoin. This is centralization. However, the BCH project has Bitcoin ABC, Bitcoin Unlimited, Bitcoin XT and other development teams that are independent from any companies. As for mining centralization, industrial players tend to forget a simple fact: it’s not Bitmain that dominates the market, it’s their products themselves winning in the market. Bitmain leads in the miner business because it perfectly integrates manufacturing, supply chain, sales, shipping and after-sales services. In addition, China is home to the world’s largest bitcoin mining data centers for its cheap labour and low electricity fees, which makes it possible to start a miner business with a small investment. I expect to see more miner manufacturers in the coming months. Bitmain will not dominate the market in the near future.

BCH Priced Exchange Coinex

BC: The new exchange Coinex will use BCH as the base currency. Why give up BTC?

Yang: We will have no competitive edge over our rivals if we start yet another BTC-priced exchange. So why not create an exchange that only pairs digital assets against BCH? It’s both creating history and attracting BCH supporters. And I am very confident about the future of BCH. It’s really huge to be the world’s first BCH-priced exchange.

BC: When Viabtc listed BCH in August, many Chinese users said that Viabtc was “controlled” by Bitmain. Is the new exchange also “controlled” by Bitmain?

Yang: Nobody controls us. Bitmain is just our business partner. We have the final say in decision making, not Bitmain. Since Bitmain invested in our entire company, it’s not strange they are also an investor in Coinex, one of the products of our company.

BC: After China’s ban on ICOs and exchanges, Huobi, Okex and other exchanges see themselves as overseas companies, though their employees work in mainland China. Is Coinex an overseas exchange? What is the team doing to manage regulatory risks?

Yang: Coinex will be an overseas exchange. It is registered in London. And we also have an office in Hong Kong. Our research and development team is still in Shenzhen, but we plan to move it abroad and make Coinex a 100% overseas exchange.

What do you think of Yang’s answers? Leave your comments below!

Images via Shutterstock, Coinex and Weibo.

Get our news feed on your site. Check our widget services.

The post “There Will Only Be One” – an Interview With Viabtc Founder Yang Haipo appeared first on Bitcoin News.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.