Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

If you’re hunting for a new cryptocurrency interest account, BlockFi vs. Voyager Invest should be a comparison at the top of your list.

Both BlockFi and Voyager allow you to earn interest on your cryptocurrency assets, but they are both distinctly unique companies.

Voyager currently offers higher interest rates on more altcoins but users need to maintain a minimum balance to earn interest. BlockFi offers interest on stablecoins and doesn’t require minimum balances.

Rates aside, the most distinguishing value proposition comparison for a BlockFi vs. Voyager is their company structure and reputations.

BlockFi has gathered much of its momentum from an impressive list of investors, including SoFi, Winklevoss Capital, Valar Ventures, ConsenSys Ventures, and more.

Comparatively, Voyager Invest is a publicly traded company listed on the Canadian Stock Exchange (CSE) under the symbol VYGR.CN.

Both companies also allow users to buy and sell cryptocurrency:

- BlockFi makes money on the spread, Voyager uses a hidden-spread trading model instead of flat-rate transaction fees.

- BlockFi allows for cryptocurrency withdrawals, whereas Voyager doesn’t.

The following BlockFi vs. Voyager guide specifically focuses on the cryptocurrency interest account product.

Let’s dive into it.

BlockFi vs. Voyager: Key Information

Company Bios: BlockFi vs. Voyager Invest

Both BlockFi and Voyager were founded in 2017, one year before the infamous 2018 bear market.

Founded by Zac Prince and Flori Marquez, BlockFi attracted significant attention from venture capital firms and angel investors such as Winklevoss Capital, Pomp Investments, SoFi, and others interested in cryptocurrency companies.

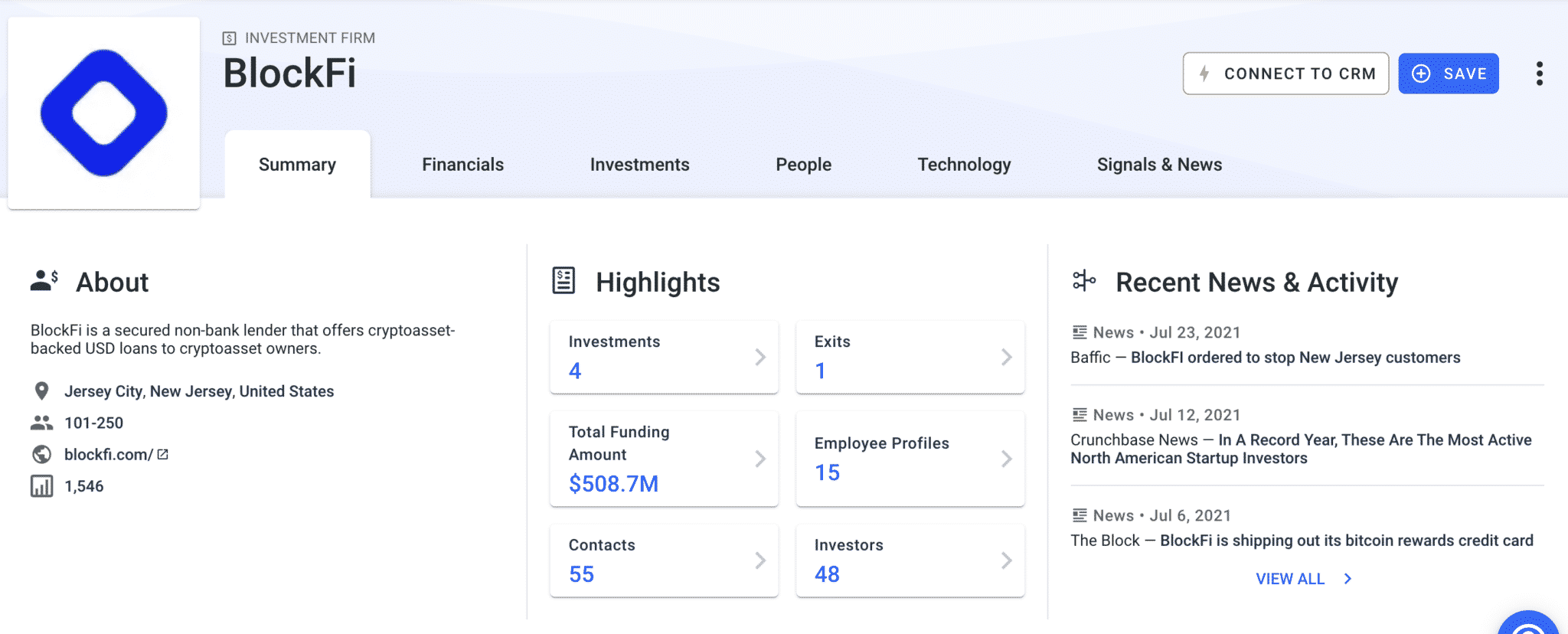

BlockFi on Crunchbase (courtesy of Crunchbase)

Its last funding round took place in March 2021, raising another $350 million, landing it at a valuation of $3 billion.

BlockFi has about $15 billion assets under management and over 225,000 users.

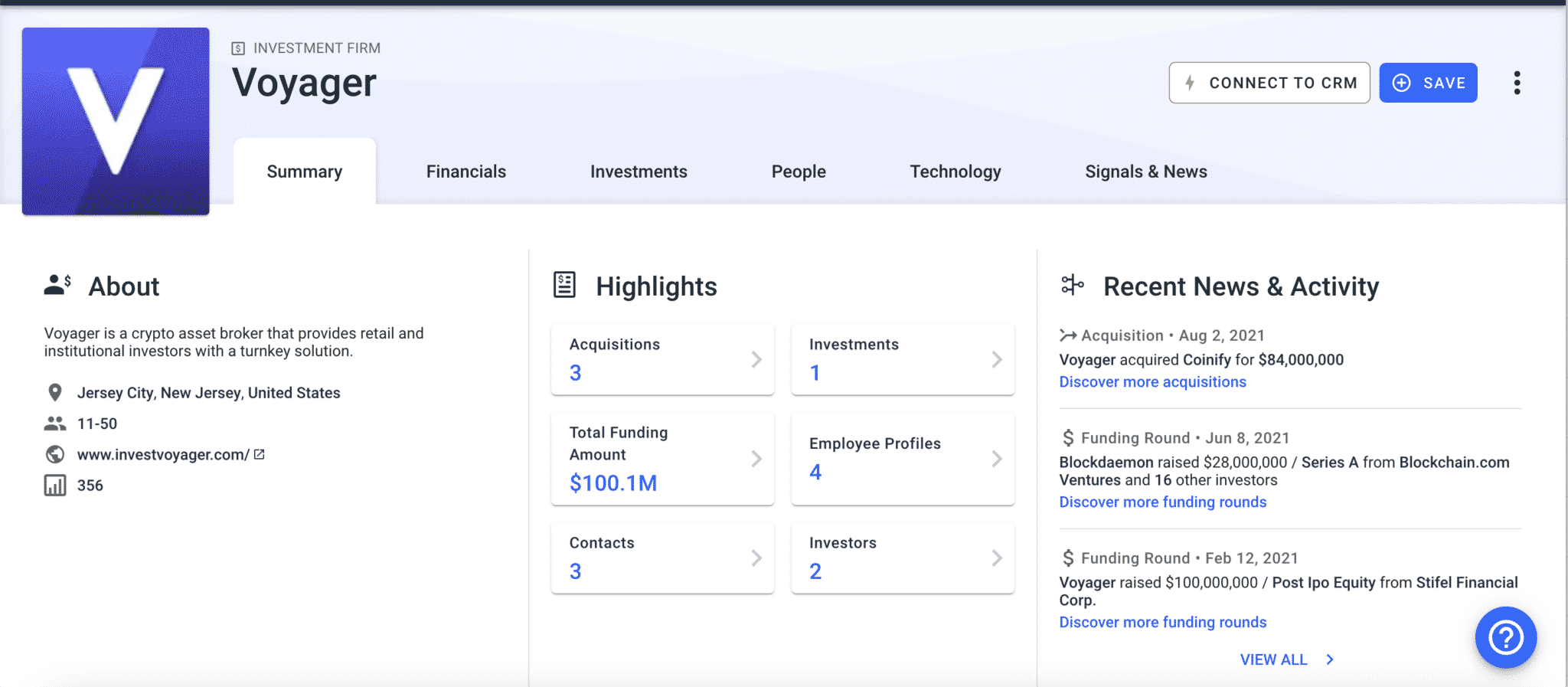

Voyager was created by Stephen Ehrlic, Serge Kreiker, Oscar Salazar, Philip Eytan, and Gaspard de Dreuzy.

It raised over $100 million in private funding before going public on the Canadian Stock Exchange, under the ticker symbol VYGR.

Voyager Invest on Crunchbase (courtesy of Crunchbase)

Feature #1: Interest Rates: Who Pays More, BlockFi or Voyager?

Both platforms payout above-average interest rates.

Voyager changes its rates every month while BlockFi states that its rates are subject to change based on market conditions.

Bitcoin

- BlockFi uses a tiered interest-rate system for Bitcoin; APY scales based on how much BTC you store on the platform. Rates are around 4% for 0 – 0.25 BTC, 1.5% for 0.25 – 5 BTC, and 0.25% for > 5 BTC, but are subject to change.

- Voyager offers 5.75% APY on all of a user’s BTC, but the customer must maintain a balance of at least 0.01 BTC to qualify to earn any interest.

Ethereum

- BlockFi also uses a tiered interest-rate system for Ethereum. Current rates are 4% for 0 to 5 ETH, 1.5% for 5 to 50 ETH, and 0.25% for > 50 ETH.

- Voyager offers 4.6% APY on ETH and users must maintain a 0.5 ETH balance to earn any interest.

Alts

Stablecoins

Winner: BlockFi

Voyager beats out BlockFi on most cryptocurrencies by virtue of offering better rates for staples like Bitcoin and Ethereum, while also providing a wider array of opportunities to earn interest on smaller-cap coins like Aave and Compound.

That being said, users will need to keep a minimum amount of each crypto asset they want to earn interest on in their Voyager account to qualify.

BlockFi wins out substantially on the stablecoin interest rates, whereas Voyager doesn’t offer the option.

Want to start earning these rates yourself?

CoinCentral readers can earn up to $250 when signing up for BlockFi or receive a $25 bonus when trading $100 on Voyager.

How Do BlockFi and Voyager Make Money?

BlockFi generates revenue by lending out user deposits at a higher interest rate than what it pays its users. These loans are over-collateralized, which reduces the risk of default significantly.

Voyager’s bread-and-butter is its exchange, and it uses a hidden-spread trading system. It keeps a percentage of the difference between what a user pays for a crypto asset on the company’s exchange and the rate at which Voyager actually purchases the asset.

For example, a user might buy 10 LINK on Voyager’s exchange for $200. But Voyager may be able to purchase them for $190. In that case, the user would still pay $200 and Voyager would pocket the $10.

The company’s CEO says that this method doesn’t impact its users’ profitability. But Redditors and reviewers disagree.

Feature #2: Payouts and Withdrawals

BlockFi accounts accrue interest daily but only pay that interest out on a monthly basis. Users are allotted one free crypto and one free stablecoin withdrawal each month. Extra withdrawals incur a fee.

Voyager also pays out interest monthly and offers unlimited penalty-free withdrawals– but there’s a catch; users can’t directly withdraw crypto, and they must sell their crypto-asset for USD before withdrawing it from the platform. This typically incurs a tax liability if profits were made.

Winner: BlockFi. This one’s close. But Voyager requiring its users to sell crypto assets to USD before withdrawing them is a potentially huge negative for the user experience, especially if a user has earned significant profits.

Feature #3: BlockFi vs. Voyager Invest Security

BlockFi stores 95% of the funds it manages in cold storage. These are managed by the Gemini Trust Company, which is SOC certified by Deloitte.

The company also has numerous user-facing security features such as 2-Factor Authentication and the ability to whitelist specific cryptocurrency addresses for withdrawals.

Voyager is somewhat lacking in this area. The company provides $250,000 in insurance for user USD funds. But it doesn’t insure crypto assets, such as bitcoin. The company offers 2-factor authentication but doesn’t provide much information about how it secures its funds.

Winner: BlockFi. BlockFi is more forthcoming about its security practices so users know exactly how much risk they’re assuming by getting themselves on the platform.

Feature #4: Ease of Use

BlockFi and Voyager are very easy to use. Both platforms allow debit, credit, and bank transfer deposits, which will appeal to crypto beginners. Each company also has a strong mobile offering, which is great for people who want to manage their crypto investments on the go.

There are two real points of differentiation. First, BlockFi has a web app while Voyager does not. Additionally, BlockFi allows crypto withdrawals while Voyager does not.

Winner: BlockFi. BlockFi wins on the basis of having a strong web and mobile app pair, while also allowing for the withdrawal of assets.

BlockFi vs. Voyager: Standout Features

BlockFi’s standout feature is the company’s interest-earning cryptocurrency credit card. It promises to provide 1.5% interest, paid in Bitcoin, on everything a user buys.

Voyager’s standout feature is the company’s “interest boosts” and native token. If a user holds at least 2,500 VGX, they can earn an extra 1% APR on designated coins while active. This figure can change throughout the year.

The Court of Public Opinion: BlockFi vs. Voyager Invest

The majority of Redditors like both BlockFi and Voyager, though for different reasons. Posters enjoy Voyager because, at least at the moment, it offers higher rates on popular digital assets like Bitcoin.

However, BlockFi seems to be more trusted by the cryptocurrency community at large. It’s backed by some of the biggest names in the venture capital industry, which adds a stamp of credibility that many other platforms don’t have. That being said, Voyager is part of a publicly-traded company, so one shouldn’t discredit Voyager from having a similar approval.

The general forum consensus is to use both platforms and put your cryptocurrency where it’ll earn the most interest. The more cautious users opt for BlockFi alone due to its lending disclosures.

Both platforms are custodial, and in theory, riskier than self-custody. The rates are not guaranteed, so don’t view them as savings accounts.

If your experience differs from what we’ve gathered, please let us know! You can sign up for BlockFi here or Voyager here.

BlockFi vs. Voyager Customer Support

BlockFi offers live phone support from 9:30 AM – 5 PM EST. It also has an online FAQ page customers can visit to get answers to common questions.

Voyager doesn’t offer live support. It only has an online contact form for users to fill out with their questions.

Can You Trust BlockFi and Voyager?

Voyager and BlockFi are both considered very trustworthy.

Though Voyager experienced a DNS attack in 2021, its users’ funds were never threatened. The company is publicly traded on the Canadian Stock Exchange.

BlockFi has earned recognition from Deloitte and the New York Department of Financial Services for its security practices. As far as cryptocurrency interest accounts go, BlockFi is considered the blue-chip, along with close competitor Celsius.

BlockFi or Voyager Invest: Which is the Better Crypto Interest Account?

BlockFi and Voyager Invest are two of the better cryptocurrency interest accounts available today.

But in our estimation, BlockFi has the edge for the following reasons:

- BlockFi has a more established pedigree and more community trust than Voyager.

- BlockFi offers external cryptocurrency withdrawals without forcing users to trigger a tax event.

- BlockFi also takes more steps to secure its users’ funds.

That being said, if rates are all that matter to you, Voyager Invest does offer better rates on BTC, ETH, and other altcoins. It also doesn’t use a tiered interest-rate system (though it does require a minimum balance).

BlockFi offers interest on stablecoins, whereas Voyager doesn’t.

If you’re keen on starting with a cryptocurrency interest platform yourself, both BlockFi and Voyager are solid first choices– and they offer some of the higher sign-up bonuses in the space.

The post BlockFi vs. Voyager Invest: Which is Best for Your Crypto Interest APY? appeared first on CoinCentral.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.