Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

Following another red weekend, just like the previous ones in June, since Monday, bitcoin increased by a total of 8% as the coin reclaimed the $35K price area, as of writing these lines.

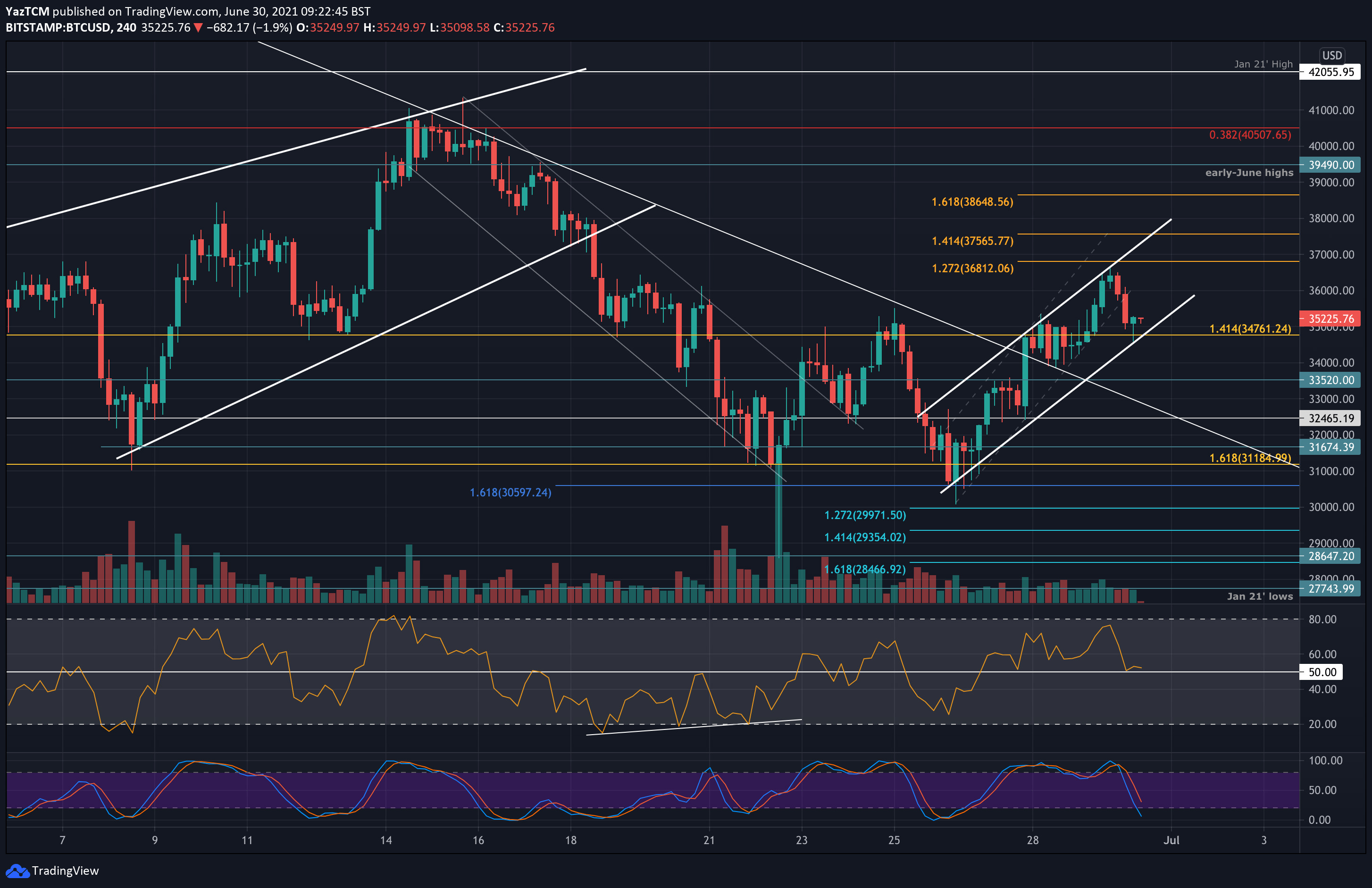

The recent price hike has brought some optimism back into the market, especially after bitcoin sustained the double-bottom bullish formation on the 4-hour chart (at $31.5K). However, the bigger picture hasn’t changed as Bitcoin still trades inside the trading range of $30K – $42K.

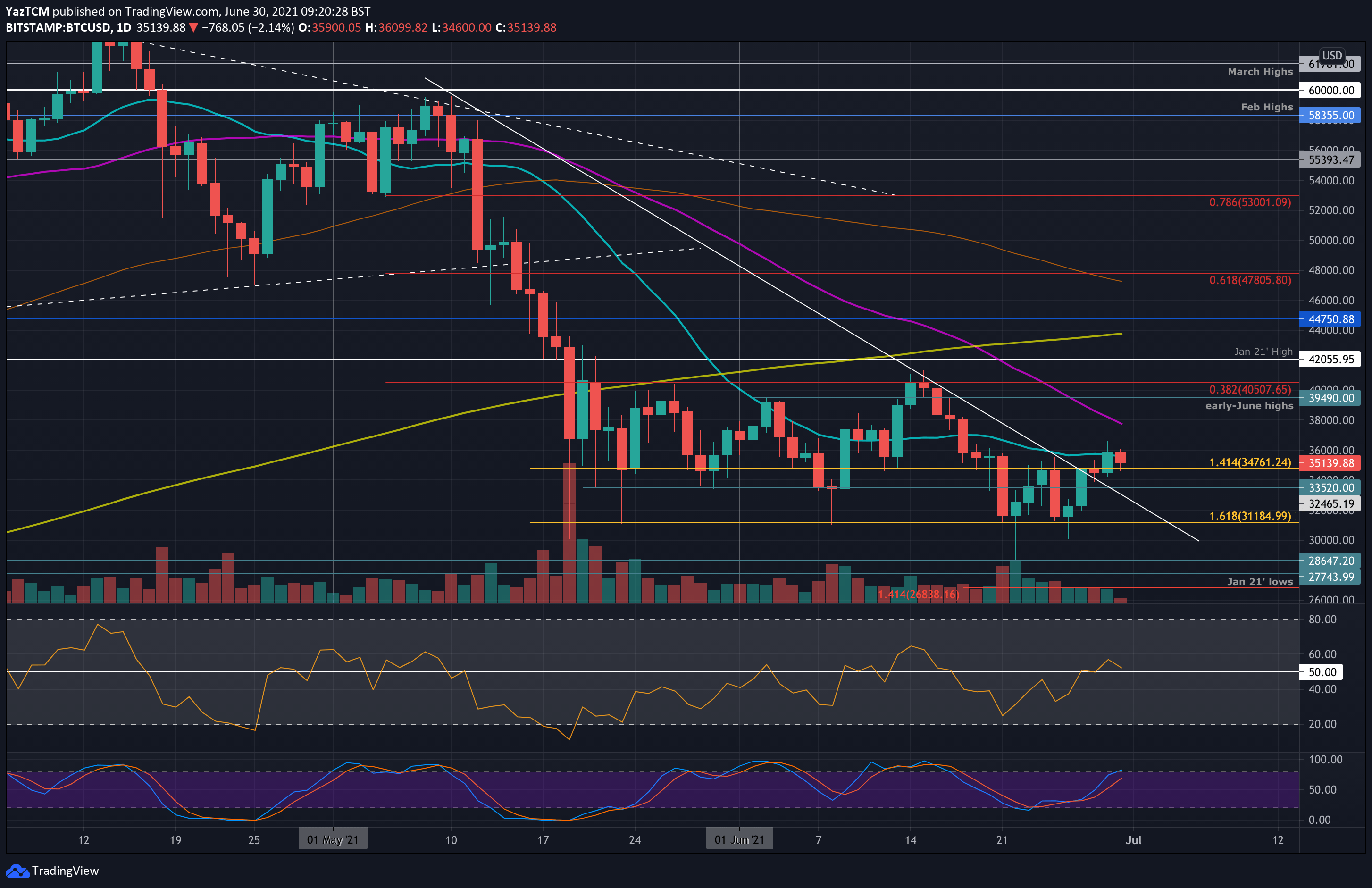

BTC also managed to break a long-term descending trendline that dates back to the May highs during the move higher. Yesterday, it found resistance at the 20-day MA amid $36K, which was the highest level it reached since June 18. However, bitcoin couldn’t hold it and dropped towards $35k over the past hours.

As shown on the following short-term charts, bitcoin continues trading inside an ascending price channel, after it found support around $34,600 earlier today. It is currently battling to remain above $35,000 and, if this level holds, we could expect it to head toward the upper angle next at around the $37-38k range.

Before we can continue the optimism in the market, it would be critical for BTC to produce a daily close above the 20-day MA, which currently lies at $35.6K, after spending almost twelve days beneath the significant moving average line. Also – the daily RSI is showing some worrying signs for the bulls (more info below).

BTC Price Support and Resistance Levels to Watch

Key Support Levels: $35,000, $34,000, $33,520, $32,460, $31,185.

Key Resistance Levels: $35,620, $36,810, $37,800, $38,650, $39,500.

Looking ahead, the first resistance lies betwee $35,600 (20-day MA). This is followed by $36,810 (1.272 Fib Extension, and yesterday’s high), $37,800 (50-day MA), $38,650 (1.618 Fib Extension), and $39,500 (early-June Highs).

On the other side, the first resistance turned support lies at $34,600 (lower angle of price channel and today’s low). This is followed by $33,520, $32,460, $31,185 (downside 1.618 Fib Extension), and $30,600.

The daily RSI recently poked above the midline with the push toward the 20-day MA. It has since fallen as it returns to the midline again, indicating indecision within the market. However, on the daily, we can clearly see the RSI forming lower-highs, a trajectory that started forming in mid-February. in order to turn mid-term bullish, BTC has to break this bearish pattern.

Bitstamp BTC/USD Daily Chart

BTC/USD Daily Chart. Source: TradingView.

BTC/USD Daily Chart. Source: TradingView.

Bitstamp BTC/USD 4-Hour Chart

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.