Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

Polkadot has now clocked up a year of live mainnet operations, but this summer will mark one of the most significant milestones on its roadmap to date. The Polkadot parachain slot auctions will mark the first time that projects will be able to connect to Polkadot’s central Relay chain, completing its journey to a live mainnet hosting chains that support decentralized applications.

Before that happens, Polkadot will set a precedent for what’s to come as its experimental sibling network, Kusama, tests out the process in a live production environment.

So, this means that the full token utility of the DOT and KSM tokens will finally be live, enabling the economic model underpinning the tokens to play out. So whether you’re a long-time DOT holder or a relative newcomer seeking to learn more, this guide explains everything you need to know about DOT tokenomics.

Within the Polkadot ecosystem, DOT holders can do the following with their tokens:

- Participate in the governance of the Polkadot network

- Participate in staking either to become a validator or to nominate validators

- Bond tokens to connect a chain to the Polkadot Relay chain as a parachain

the DOT token. Source: Medium

the DOT token. Source: Medium

Governance

DOT token holders have certain voting entitlements within the governance framework of the platform, similar to how shareholders can vote on matters regarding a listed company. Decisions that fall under governance may involve fees, the addition or removal of parachains, or technical issues, such as upgrades or improvements.

Token holders may also use their DOT tokens to make proposals on which the rest of the network participants can vote. Submissions are then entered into the standard Polkadot governance mechanism, which is designed to ensure that only proposals with a majority of the stake behind them can pass successfully.

Staking

Polkadot operates under a variation of proof-of-stake called Nominated Proof of Stake (NPoS.) Under the NPoS consensus rules, a large but fixed number of validators will participate in block production, while token holders can stake their tokens to nominate a validator.

Polkadot is one of the largest networks by staked value and offers some of the highest rewards, averaging around 13%, which is generous considering that participation is a relatively passive activity.

Bonding for Parachains

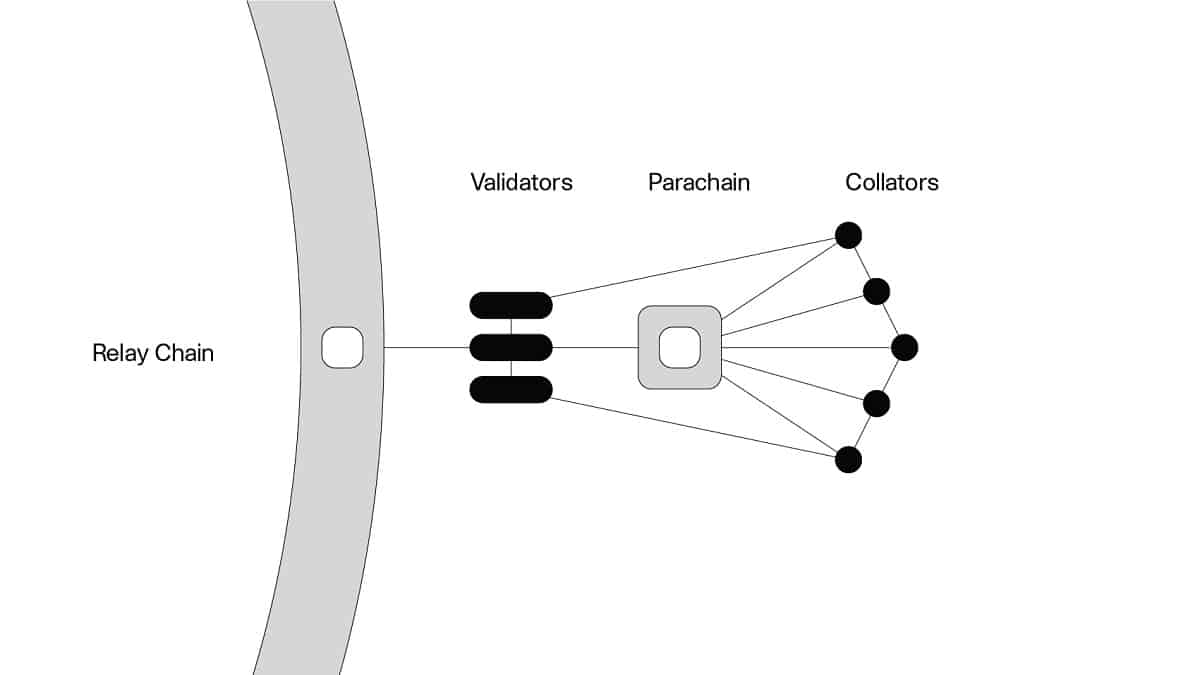

Polkadot and Kusama can support a limited number of parachains, at least while the platforms are still relatively young. Parachain slots are awarded based on a project successfully bidding for one at a parachain slot auction. Slot winners only lease their slots for a fixed period; they will have to rebid at the time of renewal. The value of the successful bid in DOT is bonded for the duration of the lease.

To give themselves the best chance of succeeding in a parachain slot auction and leverage their community’s support, projects can engage in parachain crowd loans.

Crowdloans are a new feature offering an interesting proposition for token investors, as they create a competitive environment in which projects have to offer incentives for participation. In general, projects will offer rewards in their own tokens, perhaps on a vesting schedule, to those willing to bond their DOT tokens in a crowd loan for the duration of the lease.

Parachains. Source: Polkadot’s Wiki

Parachains. Source: Polkadot’s Wiki

Bonding DOT in crowd loans also offers a high-security guarantee, as the funds are held transparently on the Polkadot Relay chain, meaning that there’s no opportunity for founders to execute any exit scams with the funds. If the project successfully gains a slot at a parachain auction, the DOTs are bonded until the end of the lease. If the bid at auction fails, the DOTs are returned to the originator’s wallet.

For the projects themselves, crowd loans also offer several advantages, the most obvious one being the increased likelihood of winning a slot at auction due to a higher bid. However, they also offer the opportunity to distribute project tokens far and wide in advance of the launch, thereby ensuring that their own governance and token spread are more decentralized. Crowdloans are also a way of building an engaged and invested community.

DOT Tokenomics – Putting it all together

The staking and bonding/crowd loan process creates an intriguing dynamic in the DOT tokenomic model when you consider that both are effectively competing for the same audience of DOT holders.

Staking offers attractive benefits and is relatively low risk. Users can withdraw their staked funds at any time they choose, and staking rewards can fluctuate depending on the levels of DOT being staked.

If people start withdrawing their DOTs from staking to participate in a crowd loan, the number of DOTs staked decreases and the yields on staking increase accordingly.

However, the terms of the crowd loan must be compelling enough to compete with the rewards of staking in the first instance. Furthermore, it also needs to prove alluring enough that DOT holders are willing to miss opportunities arising from fluctuations in token prices and staking rewards during the period of the parachain slot lease.

Token price volatility is almost a given in cryptocurrency. Therefore, projects need to consider the current market both for DOT prices and for staking returns when setting the rewards on offer for participation in their crowd loans.

Finally, add into the mix the fact that parachain slot auctions and crowd loans will be a recurring feature of the Polkadot calendar from now on by design.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.