Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

Real estate is how ordinary people have stored value and ultimately accumulated wealth. Indeed, post World War II societies all but demanded access to credit through politics, and governments responded with in-kind favors to keep power. Compounding of easy, loose money spurred decades of growth in housing construction, materials, land, and requisite financial products. This, in turn, triggered the Business Cycle, and the basis for entire economies was exposed as theft and fraud. Bitcoin might be the chance to starve parasitical redistributive governments, ushering in an entire new way to build equity.

Also read: Silk Road – The Theatrical Version, Funded by Bitcoin, to Debut in London

Real Estate as Malinvestment

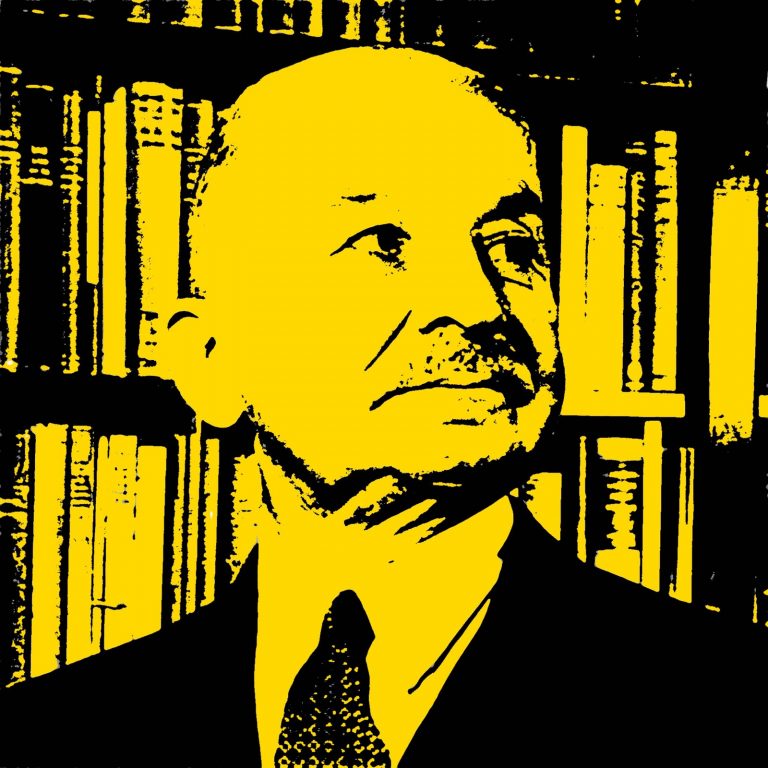

The dean of the Austrian School of Economics, Ludwig von Mises, wrote extensively of malinvestment. Though kept alive in fringe American paleoconservative circles, and as libertarianism’s cult favorite economist, the notion hadn’t gained much popular traction until the US Great Recession of 2008.

My guess is he’s poised to make another appearance in the coming years.

Malinvestment starts the Business Cycle, that boom and bust you’re probably all too familiar with, according to Austrian theory. Central banks are its main culprit. Their monopoly of the money supply has created what is called fiat currency: a paper or digital money backed only by the full faith and credit of a given government. It is without restraint other than inflationary pressure, which governments for over a century have battled using central banks.

Inflation acts as debasement, enabling more tickets or digits to circulate than might otherwise under a sound or tight money, and it is a chance for politicians to promise goodies such as housing guarantees. The trade-off is to keep dollars, pesos, and won flowing enough to produce a wealth effect but not so much that government units of exchange become useless.

Central banks can then artificially slow the rate of fiat through the price of money, interest rates. It’s a faucet, controlling the flow.

Malinvestment is the inevitable result. Even with the myriad of tools available in our present age, you’d think someone crazy if they told you they could predict economic production levels, adequate investment allocations, research and development, etc. Yet that is what a central bank essentially does.

By socializing housing’s risk through mortgage guarantees, while privatizing profit, central banks signaled to property speculators, land holders, construction companies and equipment providers, brokers and investment funds that this industry was a “winner.” It created a classic moral hazard. Producers then dedicated resources and time toward housing because customers on the retail side were armed with hundreds of thousands of dollars in risk-free incentives.

It was simply a matter of time before markers were called on outstanding loans of credit, and creative financial instruments, which would have never existed otherwise, were revealed as hustles to take advantage of political cynicism.

As is now well understood, the US economy, the world’s reserve currency, collapsed in short order. Like dominoes clacking, people abandoned newly constructed homes, construction workers filed for unemployment insurance, entire housing neighborhoods ghosted, bankruptcies flooded federal courts for relief, foreclosures swept the world, and the globe’s biggest banks were added to welfare rolls, the dole. In a private, free economy malinvestment is a cruel mistress, unforgiving. In our modern central banking economies, it literally pays to match government folly absurdity for absurdity. They’ll bail you out.

Malinvestment’s keen insight is not the bust, but the blowing up of the bubble or boom. Understand boom times are suspect in a central bank economy, and much of modern economics comes into focus.

It was around this time too Satoshi Nakamoto’s white paper was released in response. Getting out from under the petty machinations of politicians and the whims of their constituents might be finally achievable with the advent of bitcoin.

Real Estate versus Bitcoin

Real estate’s historic appreciation might be a chimera, an illusion, as a store of value. It might be the case real estate in a voluntary, organically free economy could be rather inexpensive and without much fuss with regard to equity.

It’s hard to know without running history’s tape backwards, having no recourse to coercive malinvestment and redistributive policies. We are where we are.

Paul Moore, in a column for Bigger Pockets, completely ignores theory and history as recent as nine years ago, and asserts “I’m particularly passionate about multi-family real estate.” In a post riddled with appeals to authority, anecdotes, and half-truths, he ‘bravely’ comes down on the side of real estate in my proposed debate.

Bitcoin is rank speculation, he argues, insisting it is sexy while investment, the adult way to wealth, should now and forever be boring. He also attributes a bitcoin price fall in November to Jamie Dimon. How Mr. Moore could know this to be the cause isn’t exactly explained, but that doesn’t stop him from rhetorically asking if some yahoo’s statements could ever move real estate markets in such a way. Um, 2008 called, Mr. Moore, and would love to chat.

Nevertheless he continues, “I wanted to know exactly how multi-family stacks up against the other asset classes,” he wrote. “The numbers say that multifamily and retail are: 3x better than the S&P 500, […] 9x better than NASDAQ, 4x better than private equity,” and so on. The rest of his assessment of bitcoin as an investment is hacky and stale, sprinkling words like scam and lottery to leave a decided impression before any real consideration. Oh, and he has charts.

Bitcoin has had close to a decade to burst, but instead has managed to remain resilient, and has advantages over real estate in terms of the future of wealth accumulation. Investors can buy it in fractions. Barriers to entry in the housing market are notorious, but all bitcoin takes is a smart-ish phone.

Indeed, future investors have been raised on real estate kool-aid: they’ve learned to spend rather than save, as fiat economies demand due to inflation, and now cannot afford the down-payment anyway. The average home price has been blown up to such an extent, even if they were savers they’d be out of luck. In fact, bitcoin’s relative ease of purchase and lack of central control apparently appeal to the next investment generation ahead of even government-boosted stocks.

And as a result, the future seems crypto: free from government machinations, borderless, permissionless. It might even end up bringing housing prices down, closer to reality.

Are you buying bitcoin or real estate? Tell us in the comments.

Images courtesy of Pixabay.

Do you like to research and read about Bitcoin technology? Check out Bitcoin.com’s Wiki page for an in-depth look at Bitcoin’s innovative technology and interesting history.

The post Buy Bitcoin, Not Real Estate appeared first on Bitcoin News.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.