Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

The most recent Bank of America Fund Manager Survey finds that the most crowded trade is “long bitcoin.” Nonetheless, 75% of fund managers say the cryptocurrency is in a bubble zone.

Fund Managers Say Long Bitcoin Is Most Crowded Trade but Most See Bubble

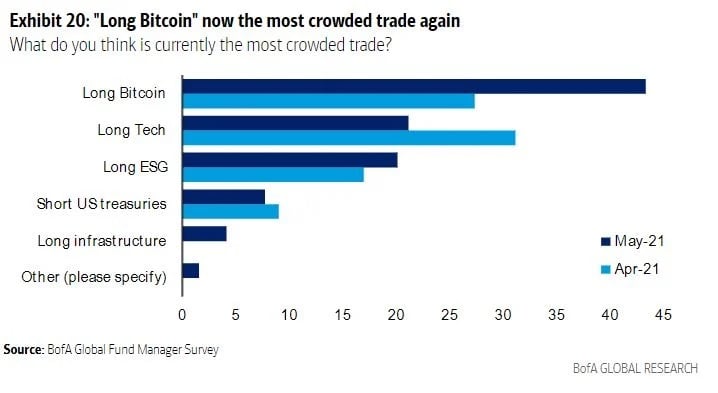

The Bank of America (BoA) Fund Manager Survey for May, published Tuesday, shows that “long bitcoin” is currently the most crowded trade in the world. Last month, long bitcoin was the second-most crowded trade, with the most crowded trade being “long tech.”

Bank of America surveyed 216 fund managers with $625 billion in total assets under management (AUM) between May 7 and May 13.

According to the results, fund managers say “long bitcoin” is the most crowded trade at 43%. The survey notes that being identified as crowded has historically been associated with tops.

This was not the first time bitcoin topped the list as the most crowded trade in a Bank of America Fund Manager Survey. It was also the most crowded trade in January before the BTC price hit record highs. The cryptocurrency also topped the chart during the 2017 bull run.

Other popular trades among fund managers are long technology, long ESG, and short U.S. treasuries. The survey also found that inflation was identified as the top tail risk.

Meanwhile, 75% of the fund managers surveyed said bitcoin is in a bubble zone. This was a slight increase from the previous month when 74% of fund managers said BTC was a bubble. Bank of America itself has also warned about the cryptocurrency being in a bubble. In January, the bank’s chief investment strategist said bitcoin was “the mother of all bubbles.”

What do you think about this Bank of America survey? Let us know in the comments section below.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.