Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

Ethereum’s sharp drop from historical highs of $4,400 did not find support above $4,000. The high gravitational force saw Ether explore lower price levels before embracing an anchor at $3,500. This support became crucial to the smart contract token by preventing losses from extending to $3,000. Similarly, buyers shifted their attention from $3,500 to levels above $4,000.

Ethereum recovery gradually catches momentum

At the time of writing, Ether has already made it above $3,800 and is trading at $3,820. The immediate upside is limited by the 50 Simple Moving Average (MACD) on the four-hour chart. Trading above this crucial level is vital for proving that recovery beyond $4,000 is possible.

The uptrend seems to have been validated by the Relative Strength Index (RSI) on the four-hour chart. This technical indicator follows the trend of an asset and measures its strength. The RSI identifies overbought and oversold conditions. Despite the 20% decline, Ethereum was not oversold; however, the recovery from around 40 is a bullish signal.

ETH/USD four-hour chart

Read more ETH/USD price chart by Tradingview

ETH/USD price chart by Tradingview

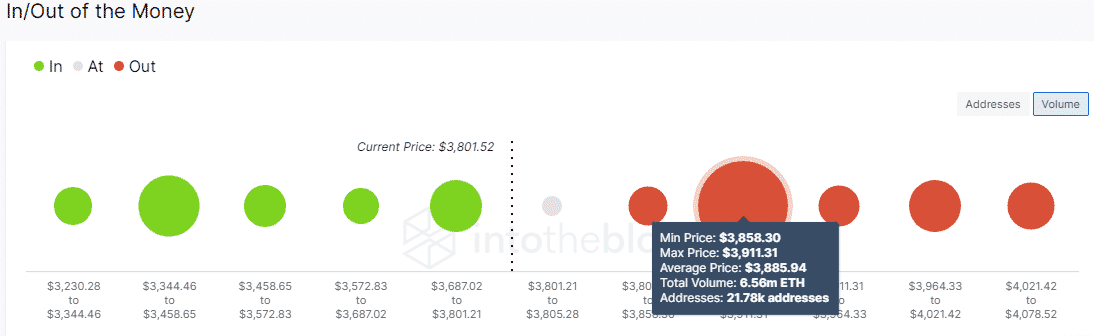

The In/Out of the Money Around Price (IOMAP) on-chain model shines a light on an immense seller congestion zone ahead of Ethereum. This region runs from $3,858 to $3,911. Here, nearly 21,800 addresses previously purchased approximately 6.6 million ETH. Slicing through this zone will not be a walk in the park; thus, the uptrend may be hampered.

Ethereum IOMAP model

Ethereum IOMAP chart by IntoTheBlock

Ethereum IOMAP chart by IntoTheBlock

The model shows ETH sitting on top of relatively weak anchor zones on the downside. The formidable support runs from $3,344 to $3,459. Here, around 301,000 addresses previously bought roughly 2.2 million ETH. If overhead pressure rises in the coming sessions, Ethereum will likely dive toward $3,200 and $3,000 to hunt for a robust anchor zone.

The post Ethereum price secures key support, but recovery to $4,400 will be a daunting task appeared first on Coingape.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.