Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

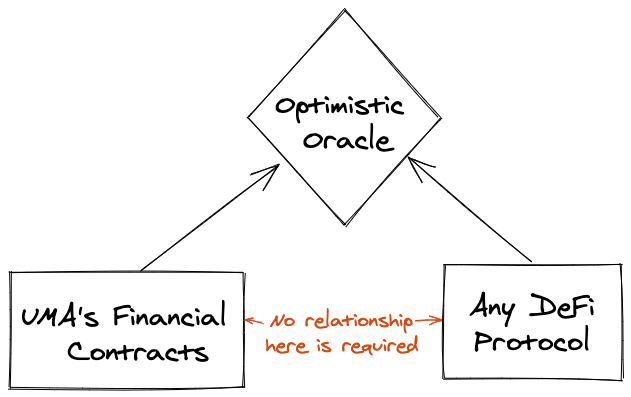

Tl;dr: UMA’s Optimistic Oracle is live now. It can be used to resolve markets and bring all types of data on-chain. It is not limited to use only for UMA financial contracts, but can be “plugged into” by any DeFi protocol.

UMA has quietly built something we call the “Optimistic Oracle.” The concept is simple: Anyone can push an answer on chain, and there will only be a dispute if it’s wrong. Plugging into the optimistic oracle does not require using a contract launched on UMA.

It operates optimistically, meaning that the vast majority of the time you get your answer quickly. It offers the same economic guarantees on data accuracy built into the UMA system. And it minimizes gas usage, so it’s extremely cheap to use.

In other words, the Optimistic Oracle lets you get cheap, accurate data on most anything.

Below we walk through how the Optimistic Oracle works as well as some use cases that make it a powerful DeFi primitive.

How the Optimistic Oracle Works

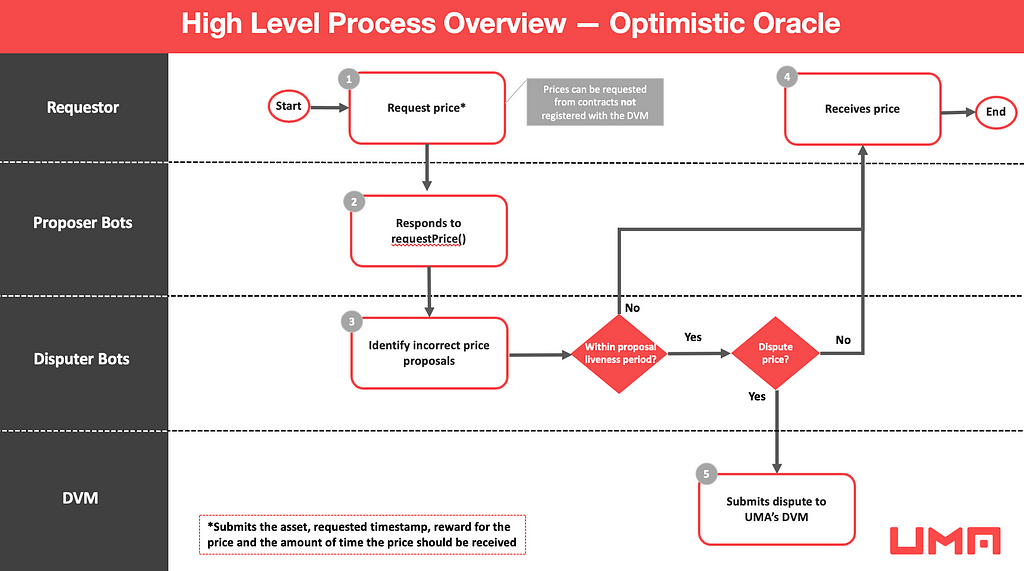

There are three actors in the Optimistic Oracle system: the requester, the contract that is requesting a price; the proposer, an off-chain actor that proposes a price; and the disputer, an off-chain actor that is able to dispute prices they disagree with.

In the happy path, a contract requests a price and specifies a dispute period (which can be as little as a few minutes, or as long as a few days). The proposer posts a bond and proposes a price—and no one disputes this price. After the dispute period passes, the data is finalized and the proposer gets their bond back. The whole thing is fast and cheap.

The unhappy path differs in that a disputer disagrees with the proposed price. The disputer posts a bond equal to the proposer’s bond and escalates the dispute to UMA’s Data Verification Mechanism (DVM). UMA token holders resolve the dispute over a 48 hour period. If the disputer is correct they earn the proposer’s bond as a reward; if the disputer is wrong, they lose that bond as a penalty that goes to the proposer.

The system is optimistic because disputes are designed to be very rare. UMA contracts have been operating optimistically over the past year (through some intense crypto volatility!) and we have only seen fewer than 5 legitimate disputes. This optimistic concept has been proven in production.

The code for the Optimistic Oracle has been audited by OpenZeppelin and by UMA synthetic tokens for the past several months to secure ~$200mm. You can see the code here. This system is available for developer use today.

Use Cases for the Optimistic Oracle

Why should a DeFi developer care about the Optimistic Oracle when they can use Chainlink/Maker/Uniswap’s oracle to get most crypto price data? The answer: when you need data on other things, or when you need super precise data. Here’s a quick list with explanations to follow:

- KPI Options

- Insurance

- Options and Structured Products

- Complex Computations

- Financial Contracts for Anything

KPI Options

UMA’s KPI Options are a great example of needing arbitrary data, on things other than crypto prices. KPI options are synthetic tokens that pay out based on a specific metric — this metric can be anything measurable. This is data that is not available on-chain, but can be queried using the Optimistic Oracle.

To date, KPI Options have been built for UMA’s TVL, for the number of positive rebases of Badger’s DIGG token, and for Aragon DAO migrations. Under the surface, all of these contracts are all enforced by the Optimistic Oracle.

Insurance

DeFi is a powerful tool to write insurance contracts on any measurable event or transaction, including real-world events. The limiting factor is getting data on those events. The Optimistic Oracle solves this.

We are thrilled to announce that Opium, a finance platform where anyone can create their own market, has integrated with the Optimistic Oracle to enable DeFi developers to create insurance on any measurable event. The first product built using this system will be announced next week.

“Opium Protocol can work with any on-chain oracle to create financial derivatives, but one of the most attractive is ‘outside world’ data. Having this data on-chain allows the creation of financial primitives that were never in DeFi before. It will grow DeFi to more use cases making a step towards mass adoption.

We are happy to cooperate with UMA mixing their optimistic oracle approach with our financial primitives to create mind-blowing use cases. No spoilers, but we are shooting for the moon.

— Andrey Belyakov, founder of Opium Protocol

Options and Structured Products

Call/put options and more complex structured products are poised to be a rapidly growing market segment in DeFi. The challenge with many of these products is that their payouts are highly sensitive to the underlying price. Given that on-chain price feeds are only accurate to ~0.5% of the real-time price, this is problematic. For example, if a call option is struck at $100, having an oracle report a price of $99.5 vs $100.5 at expiry makes a big difference to the option payouts.

This exposes one limitation of both on-chain price feeds or TWAP based approaches: it is difficult to deliver a super accurate price at a specific time. A TWAP approach, for example, sacrifices precision for security.

The Optimistic Oracle solves this: is it easy to ask for the exact price at a specified time. This will enable the development of more sophisticated structured products where buyers and sellers can rest assured of receiving accurate settlement prices.

Complex Computations

Some of the most sophisticated DeFi contracts are beginning to require complex computations to calculate payouts. Given the complexity of these calculations and today’s high gas prices, many of these computations simply cannot be performed on-chain.

One solution is to use the Optimistic Oracle to perform this calculation off-chain, using the “timelock for data” concept. Off-chain observers can verify the calculation during the dispute period. In other words, the calculation is performed off-chain (where it is cheap to do), and the verification is done on-chain using the Optimistic Oracle. This follows in the footsteps of TrueBit, who pioneered similar concepts. We will be announcing more developments in the area very soon.

Financial Contracts for Anything

UMA’s vision is to enable DeFi developers to build financial contracts for anything. This vision can only be achieved if arbitrary data (data for anything!) can be accessed by these contracts. The Optimistic Oracle is a key component in achieving this vision. The innovation this enables is hard to predict, and will likely be underestimated. I am personally excited to see what emerges here.

What’s Next

The Optimistic Oracle is in production today. Developers interested in building with it should read our docs and join our discord. This announcement comes on the heels of a governance proposal by Vitalik Buterin in Uniwap’s forum about this kind of model that uses shelling-point settlement. We will be publishing a follow up that puts the Optimistic Oracle in the context of Vitalik’s post soon.

We are looking forward to announcing more integrations, partnerships, and improvements in the coming months.

Extra special thanks is owed to the Optimism team (formerly Plasma Group), especially Ben, Jing and Karl. These are the folks that originally taught us to be MORE OPTIMISTIC in our thinking. Their optimism has certainly inspired us.

As we continue to build and innovate, our need for talented people grows as well. Come join us on our journey to making financial markets universally fair and accessible.

Below are our currently open roles with UMA:

Talent Acquisition Specialist: Growing our talented teamSenior Software Engineer: An engineer to work on our entire Ethereum-based web 3 stackSmart Contract Engineer: An engineer who’s expert in solidity and smart contractsLaunch Engineer: An engineer who can take internal and external products from ideation to mainnet (supporting external engineering teams to interact with our contracts and technology).

Introducing UMA’s Optimistic Oracle was originally published in UMA Project on Medium, where people are continuing the conversation by highlighting and responding to this story.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.