Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

April turned out to be a record-breaking month for several cryptocurrencies, but also for the world’s leading digital asset exchange – Binance. The company reported its highest futures trading volume ever of more than $2 trillion.

Binance Futures Trading Volume Over $2T

The Malta-based crypto exchange giant published its April results yesterday, highlighting the record-breaking numbers in terms of trading volume for its futures platform.

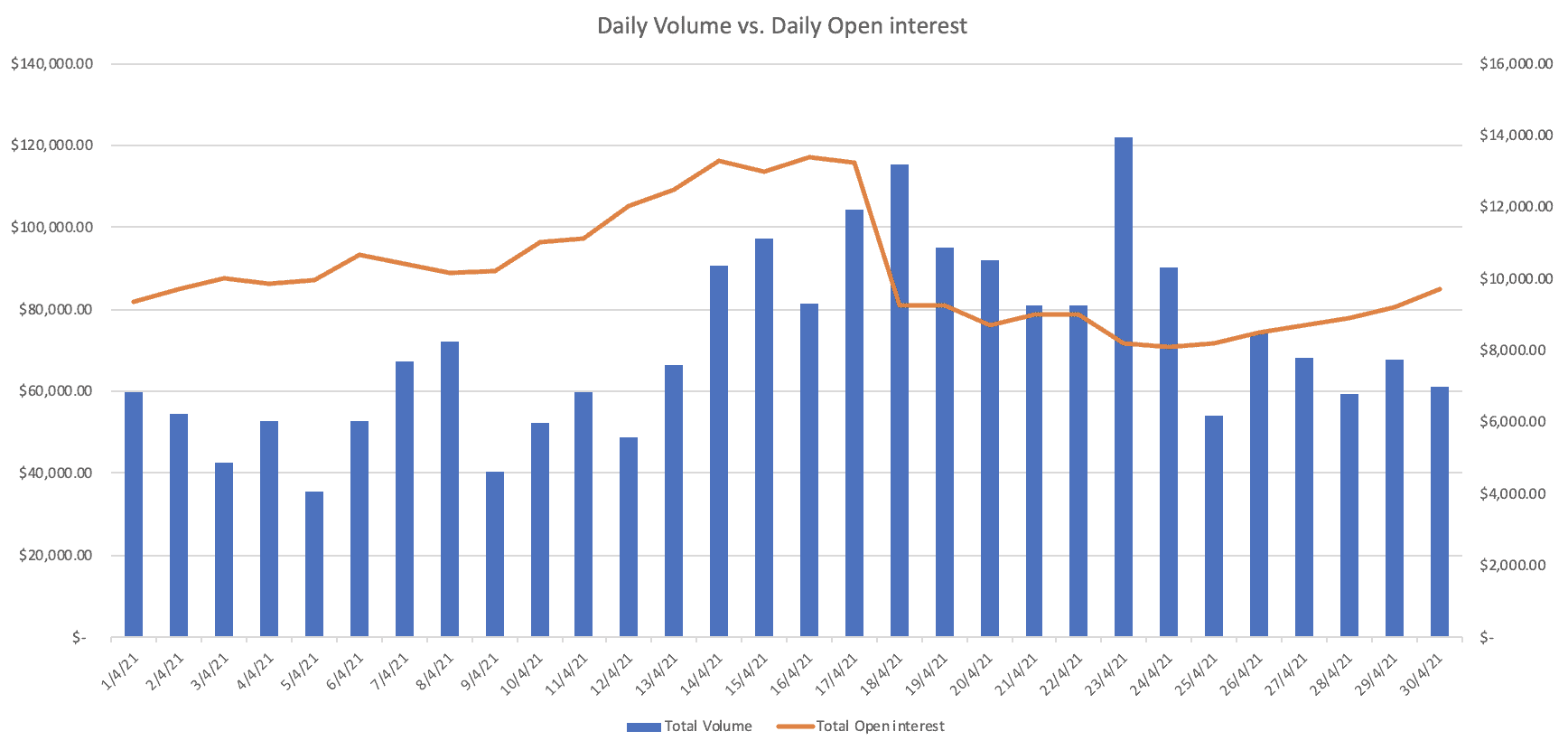

The statement said Binance Futures processed $2.14 trillion in volume, which is a substantial increase of 54% compared to March. Furthermore, the platform also reached a 24-hour record of $121 billion worth of processed contracts.

This came amid a crypto massacre in which bitcoin fell below $50,000, and the entire market capitalization lost $300 billion in 24 hours on April 23rd.

Before this crash, though, BTC had peaked at $65,000 in mid-April, which resulted in a record for the open interest on Binance – over $13 billion.

However, bitcoin’s subsequent retracement forced traders to “unwind their BTC leveraged long positions due to liquidation losses.” Consequently, the open interest fell below $10 billion by the end of the month.

Binance Futures Trading Volume vs. Open Interest. Source: Binance

Binance Futures Trading Volume vs. Open Interest. Source: Binance

CryptoPotato reached out to Binance, and a company representative attributed the growth seen at Binance Futures to several factors. Those include the overall performance in the crypto market, especially with the entrance of new “waves of institutional adopters.”

Since the beginning of the year, we have registered strong increases in both new and existing user activity at Binance Futures. The current upswing in market prices will result in higher demand for more liquidity and hedging tools such as futures and options, and we are well-placed to continue serving our users. – The representative also told CryptoPotato.

BTC Outperformed by ETH in April

Binance’s report touched upon the price performances of the most popular cryptocurrency assets as well. As mentioned above, bitcoin did register a new ATH but fell sharply after that and ultimately closed the month with a minor loss compared to March.

At the same time, Binance described ETH’s April as a “phenomenal month,” in which the second-largest digital asset saw an increase of 44%. Furthermore, ETH was more than 300% up from January 1st to April 30th.

The paper justified Ethereum’s surge with the high utilization of the network and the gradually increasing number of tokens locked in smart contracts. Additionally, the supply on exchanges keeps declining, while the demand for ether is quite high.

Binance believes investors are also bullish on Ethereum due to the upcoming EIP-1559 network upgrade, expected to address the “persistently” high gas fees.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.