Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

Dogecoin’s ongoing rally seems unstoppable after striking new record highs. The meme coin trades above $0.6 at the time of writing. It is up 42% in 24 hours and 119% in the last seven days.

The valuation of Dogecoin currently sits at $77 billion. It has outmaneuvered Ripple to become the world’s fourth-largest cryptocurrency. Dogecoin is now more valuable than companies like Twitter and Ford.

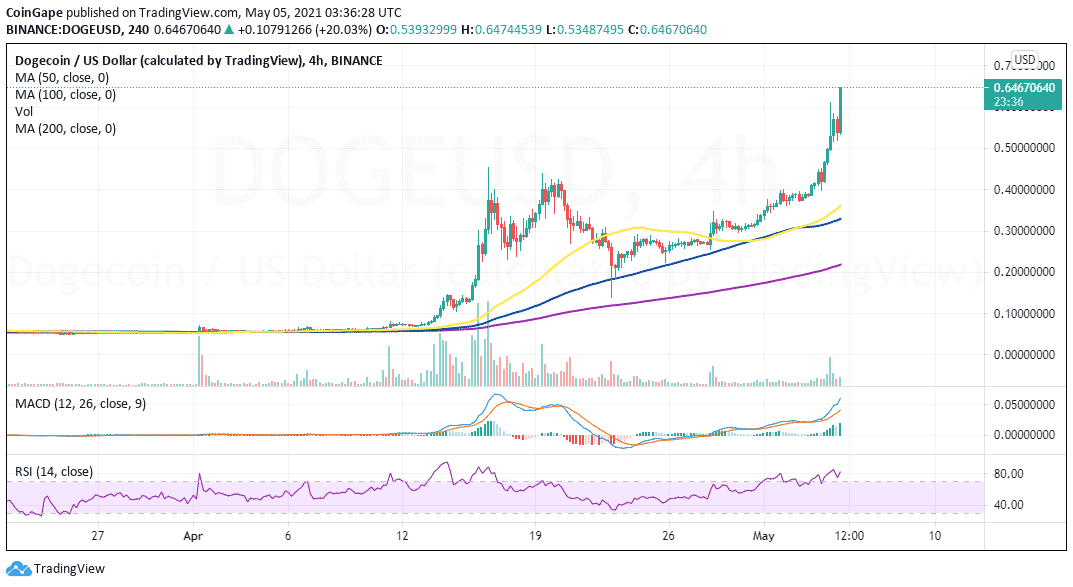

At the time of writing, Dogecoin is exchanging hands at $0.64 after overcoming the resistance at $0.6. Securing support above $0.6 would see the market stabilizing and allowing the bulls to sustain the massive gains.

Short-term technical indicators insinuate that Dogecoin is comfortably in the hands of the bulls. For instance, the Moving Average Convergence Divergence (MACD) is unwavering with the movement above the mean line (0.00). Besides, the MACD line’s wide gap above the signal line indicates that the DOGE’s path with the slightest hurdles is north.

The uptrend has also been validated by the Relative Strength Index (RSI), as illustrated on the four-hour chart. Navigating the confluence resistance at $0.6 allowed the trend strength indicator to continue with its upward motion, encouraging more investors to enter the market.

DOGE/USD four-hour chart

Read more DOGE/USD price chart by Tradingview

DOGE/USD price chart by Tradingview

Meanwhile, bulls have their focus on $1 and Dogecoin may explode to higher levels as speculation builds. The fear of missing out (FOMO) seems to be the reason why the Dogecoin rally is unstoppable. As mentioned, establishing higher support will secure the uptrend.

Dogecoin intraday levels

Spot rate: $0.64

Trend: Bullish

Volatility: Growing

Support: $0.6, $0.5 and $0.4

Resistance: $0.7 and $1

The post Dogecoin price blasts to new highs as valuation surpasses Twitter and Ford appeared first on Coingape.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.