Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

While many are just trying to wrap their head around what NFTs are, crypto art sales have boomed in the last couple of weeks. NFTs, or non-fungible tokens, have created a vast new market of blockchain-based digital assets to buy and sell.

However, most buyers and sellers are probably not aware of what that might mean in regards to NFTs taxation. This topic is especially important in the light of the tax proposal made by US President Joe Biden.

How are NFTs taxed in the United States?

Suddenly a lot of people know what NFTs are. And as soon as something becomes popular, you know it’s going to be pricey.

Now let’s discuss how to calculate NFT taxation in the United States: How taxes work depends on how you’re involved with NFTs. You can create and sell NFTs in one of the many marketplaces, or you can buy and sell NFTs as an investor.

What is important for NFT investors to understand is that NFT taxes work very similarly to crypto trading taxation. Purchasing an NFT using a cryptocurrency and selling them later for a profit create a taxable event for the investor.

The IRS sees NFTs as a property, so when you purchase an NFT using ETH whose value has increased and was acquired a year ago, you incur a long-term capital gain. This is considered long-term because you held the ETH for more than 12 months before disposing of it to purchase the NFT.

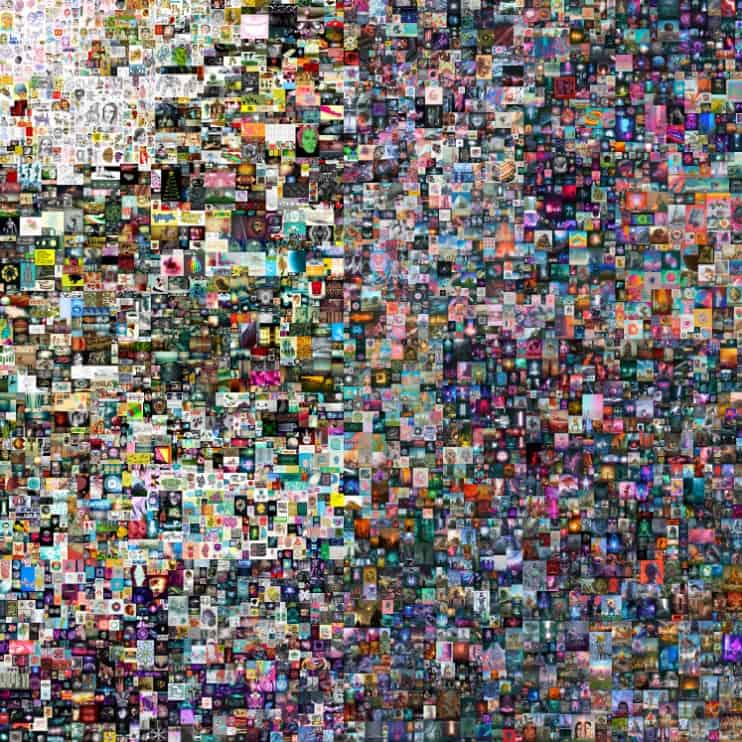

Everydays: The First 5000 Days by Beeple. Source: Christie’s

Everydays: The First 5000 Days by Beeple. Source: Christie’s

Suppose you bought one Ether for $500 and then sold it for $2,000 to make a profit of $1,500. Secondly, you calculate the fiat difference between the purchase and sale price of the NFT. If we assume that is $5,000; it means that you made gains of $6,500.

Long-term capital gains are taxed at the following tax rates: 0%, 15%, or 20%. However, if you hold on to the NFT for less than 12 months before selling, the gain is short-term. Short-term gains are taxed at your ordinary-income tax rates. When you should be taxed? right, at the time when selling the NFTs.

One more thing to keep in mind is that some NFTs are considered collectibles. That just means an even higher tax rate of 28%. But if you aren’t a high-income earner, this shouldn’t concern you.

The total amount owed to the IRS from the NFT boom is unclear, however, estimations talk about hundreds of millions. What’s clear is that many will be surprised when tax day arrives.

Don’t Allow Tax Day to Surprise You

Mike Winkelmann is now in the top three most expensive living artists, following the sale of the $69 million NFT named “Everydays: The First 5,000 Days.” at Christie’s.

He had no idea that the IRS could come for its share, and when he was told he could owe tens of millions in dollars in taxes his reaction was, “Holy shit, that’s a lot of taxes.” A lot of taxes indeed.

This year, the IRS put a question about crypto investments on the first page of 2020 tax returns. People that fail to report digital assets or attempt to hide them could face severe penalties from the IRS. NFTs and cryptocurrencies are tightly linked to one another, and while you don’t have to use cryptocurrency to buy an NFT, many buyers do.

The IRS states that “if you exchange virtual currency held as a capital asset for other property, including for goods or for another virtual currency, you will recognize a capital gain or loss.”

And that is exactly what’s creating major implications for the NFT craze since most NFTs are bought using digital currencies such as bitcoin or ether.

Many crypto and NFT traders are finding themselves in the same position where Shane Brunette, CEO of CryptoTaxCalculator, was back in 2017. Amid the Initial Coin Offering (ICO) boom in 2017, Brunette ran into tax calculation problems.

“If you understand the tax consequences, you can structure your trading activity in a way that minimizes your tax liability. This can amount to significant differences in your net profit over time,” Brunette said.

In order to help crypto and NFT traders, Brunette and his team created CryptoTaxCalculator, which is designed to get the user’s taxes calculated in the shortest time possible.

The platform, which currently supports over 100 exchanges, allows users to easily upload their data either via API or CSV files, review their transactions, and easily calculate their crypto taxes.

Platforms like this help crypto and NFT buyers and sellers better understand how the taxation of these assets works in practice.

Disclaimer: The information contained in this article is provided for informational purposes only, and should not be construed as legal advice on any subject matter. You should not act or refrain from acting on the basis of any content included in this site without seeking legal or other professional advice.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.