Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

uLABS: CryptoPunks Synthetic Token — uPUNK

First Synthetic NFT Index Token Will Be Live Soon

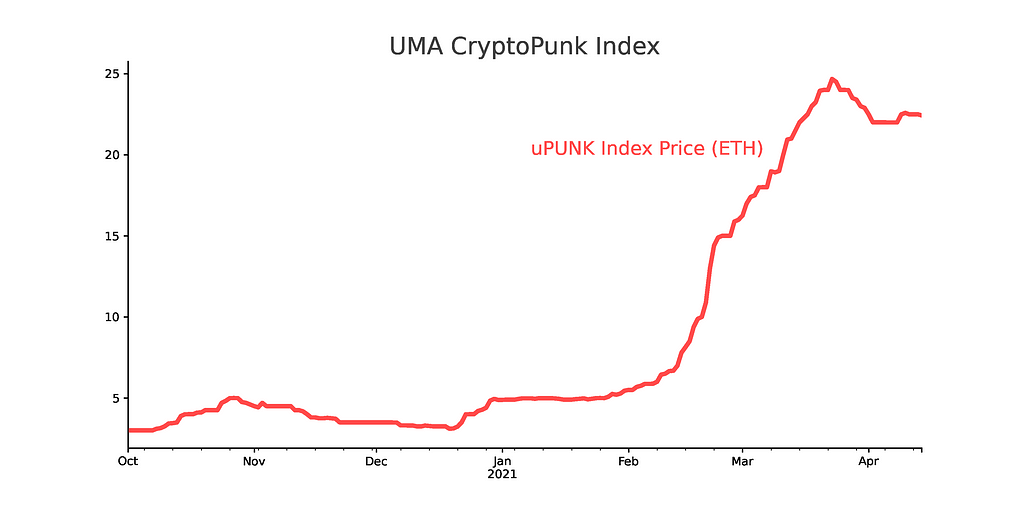

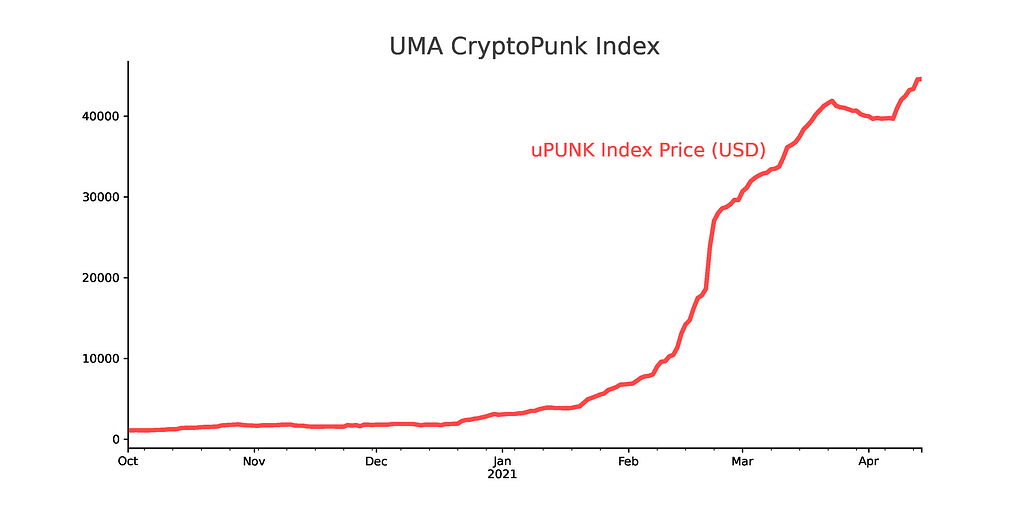

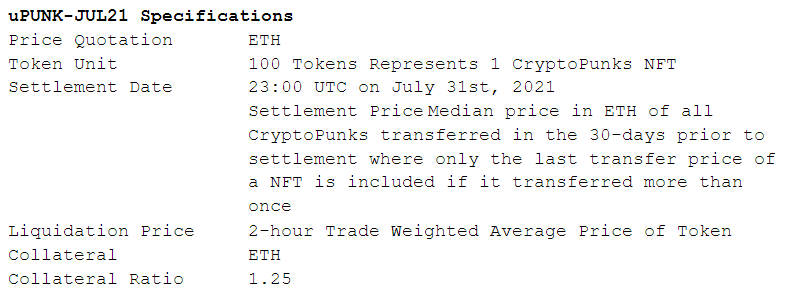

TL;DR: uLABS designed a synthetic NFT index token on the CryptoPunks collection. This token will be built on UMA’s infrastructure and will be named uPUNK. The index value is calculated by computing the median transfer price of all CryptoPunks transferred over the last 30-days. Only the last transfer price of each individual NFT is used in this computation which removes all prior trades of a single NFT in that 30-day period. The result is an index that best captures the value and price trend of the CryptoPunks collection and minimizes any price manipulation. With the uPUNK synthetic token, users can now create long or short positions on CryptoPunks to reflect their views or hedge any existing positions. The methodology for constructing the CryptoPunks index can easily be applied to other NFT collections.

uLABS has designed a methodology to create a tradable index on any collection of NFTs. This index can be used on UMA’s infrastructure to easily build a synthetic token that tracks the value of these NFTs. CryptoPunks is the OG of NFTs so it is fitting to build the first NFT synthetic index and token on this collectible. This token will be named uPUNK and we will explain the journey of its birth and how other NFT synthetic indices can spawn from its design.

Non-fungible tokens (NFTs) have gained a significant amount of attention recently with large volumes being transacted and eye popping sales of individual works in the millions of dollars. It is also a very controversial asset class as some people believe it is a revolutionary innovation for artists and content creators while others dismiss it as a fad and speculation gone wild. In either case, it is not easy for a casual crypto investor or even a seasoned DeFi user to express a broad macro view in this market.

If you want to have exposure to a set of NFTs you may ask “which one do I choose or how do I gain ownership if I can’t even afford to buy one of them?”

A NFT bear may ask, how do I short one of these things? uLABS provides a solution by taking advantage of the ease of use and flexibility of UMA’s infrastructure.

The Challenge

Building a tradable index on NFTs is more challenging than it appears. To date, the only comparable are physical baskets where actual NFTs are deposited into a contract and then traded.

A popular example is NFT index funds created on NFTX. One such fund, PUNK-BASIC, allows users to deposit any CryptoPunks in exchange for 1 PUNK-BASIC token. To date, there are 99 CryptoPunks deposited in this index and users can redeem 1 PUNK-BASIC token to randomly receive one of them. The PUNK-BASIC token can currently be traded on SushiSwap and aims to reflect the lower bound price of a CryptoPunk.

There are a couple of clear disadvantages to these index funds in comparison to synthetic tokens that do not require the deposit of a NFT for its creation. First, these funds only provide exposure to what people are willing to deposit into the fund. For example, PUNK-BASIC has only 99 out of the 10,000 CryptoPunks minted and, therefore, would not provide exposure to the broad collection which includes rare or sought after pieces that collectors are likely unwilling to part with in this way. There is also no easy way to gain short exposure through the trading of the index. You can only sell the index if you already own the token or if you mint a token by depositing the actual NFT. However, a well constructed index used to build a synthetic token on UMA’s infrastructure can overcome these issues.

NFT Index Construction

Let’s explore different approaches to building a synthetic index on a collection of NFTs. Specific to CryptoPunks, we want to construct an index that represents the overall value and price trend of the entire CryptoPunks collection. One could naively build an index by simply taking the average of the last traded price of all NFTs in a collection. However, each NFT is different (hence non-fungible) with some trading frequently and some never trading at all. As an illustration, almost half of the 10,000 CryptoPunks have never traded while some have traded several times. Taking an average of all these last transacted prices which can differ in time by years would not reflect the current value of the NFT collection.

We decided to approach the problem from a different angle by only taking a set of transaction data in a defined period (such as 30 days) to compute an index value. This would be a good proxy to represent the recent value the marketplace places on a CryptoPunks NFT. Taking the mean of this data could be simple, but brings up a couple of issues. Extreme high or low values in any period can skew the index significantly and cause dramatic volatility that obscures the underlying price trend. This can be mitigated by removing these outliers and focusing on a specific distribution. To make this easier (and avoid needing to pick an arbitrary percentage tail to cut) we can simply use the median of the data set instead.

Another problem that needs to be combatted when building a synthetic index on a decentralized asset is price manipulation. The average and median of a data set can be easily influenced by a malicious trader. Flooding the blockchain with a lot of low value or high value transfers can dramatically influence the index value. After some careful thought, we decided to further limit the data set to include only the most recent transaction price of each unique NFT in a 30-day window. This way, no matter how many times a malicious trader “wash trades” one NFT it would only be counted once in the index computation. In order to be successful in manipulating the index, one would need to purchase a large collection of NFTs and then wash trade all of them. Doing this is very expensive and it would also tarnish the reputation and value of the NFT collection making it unprofitable for the malicious actor to unwind these NFTs afterwards.

uPUNK Synthetic NFT Token

With these concepts in hand we can define a CryptoPunks Index for the creation of the synthetic CryptoPunks Index Token named uPUNK. The value of uPUNK is calculated by computing the median transfer price of all CryptoPunks transferred over the last 30-days. However, only the last transfer price of each individual NFT is used in this computation which removes all prior trades of a single NFT in that 30-day period. We believe this provides a good representation of the value and price trend of the CryptoPunks collection and minimizes and discourages any price manipulation. The token is collateralized with ETH and does not require the deposit of a CryptoPunks NFT. This allows anybody to gain short exposure to CryptoPunks by simply depositing ETH to mint the uPUNK token and then selling it into an AMM pool. The first uPUNK synthetic will be created with UMA’s Expiring Multi Party (EMP) contract and will expire on July 31st, 2021. Similar to the collateralization monitoring of uGAS and uSTONKS, uPUNK will determine liquidations based on a 2-hour trade weighted average price (TWAP) of the token itself.

There are some obvious uses for the uPUNK token.

For users who want long exposure to CryptoPunks, but don’t have enough funds to buy one (over $40k each) or don’t know how to choose one, they can simply buy uPUNK on a decentralized exchange to gain exposure to the NFT collection in the form of an ERC20 token. They can buy more or sell it back whenever they choose.

For users who already own a CryptoPunks NFT and would like to reduce exposure to price fluctuations, they can sell uPUNK to effectively hedge their risk. In this way they can also keep their favourite NFTs without needing to deposit it into an index fund like NFTX and likely risk losing ownership of it.

And finally, for users who just think CryptoPunks are overvalued pixelated portraits and don’t get the excitement, they can mint uPUNKS with their ETH and sell it into a decentralized exchange to gain short exposure. uPUNK provides the crypto community an idea for a new tool to achieve exposure that was previously not possible in the NFT space.

Next Steps

The CryptoPunks index for the uPUNK price identifier is defined in a draft UMIP and will be voted for by the UMA community in the coming weeks. The uLABS team will provide a real time data feed for the index along with past data for the community to analyze. Once this UMIP is approved, uLABS will launch uPUNK-JUL21 and seed a pool on Uniswap. We will update the community as this process moves forward. We welcome everybody — existing or new partners — to reach out to us if you are interested in supporting this new token.

Universal Market Access to NFTs

The methodology for constructing the CryptoPunks index can easily be applied to other NFT collections. Currently, only UMA has the infrastructure to convert this into a synthetic token due to the flexibility and security of its Optimistic Oracle and the actively voting UMA token holders. Anybody is welcome to create other synthetic tokens based on their favourite NFT collections. In addition, this index design and UMA’s infrastructure allows developers to go outside the boundaries of the Ethereum network to replicate NFT exposure that live on other blockchains. All that’s needed is an accessible and reliable way to extract the data so that UMA token holders can verify it. Given this freedom, uLABS obviously has many ideas for upcoming synthetic NFT index tokens and we are sure you do too! Please share your ideas with us and any feedback on this methodology.

uLABS: CryptoPunks Synthetic Token — uPUNK was originally published in UMA Project on Medium, where people are continuing the conversation by highlighting and responding to this story.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.