Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

Following the latest all-time high just shy of $65,000 and a subsequent $4,000 retracement, bitcoin has calmed down around $63,000. However, its dominance continues to suffer and is below 53%. This comes amid an impressive increase from Ethereum, which neared $2,500 and marked yet another record of its own.

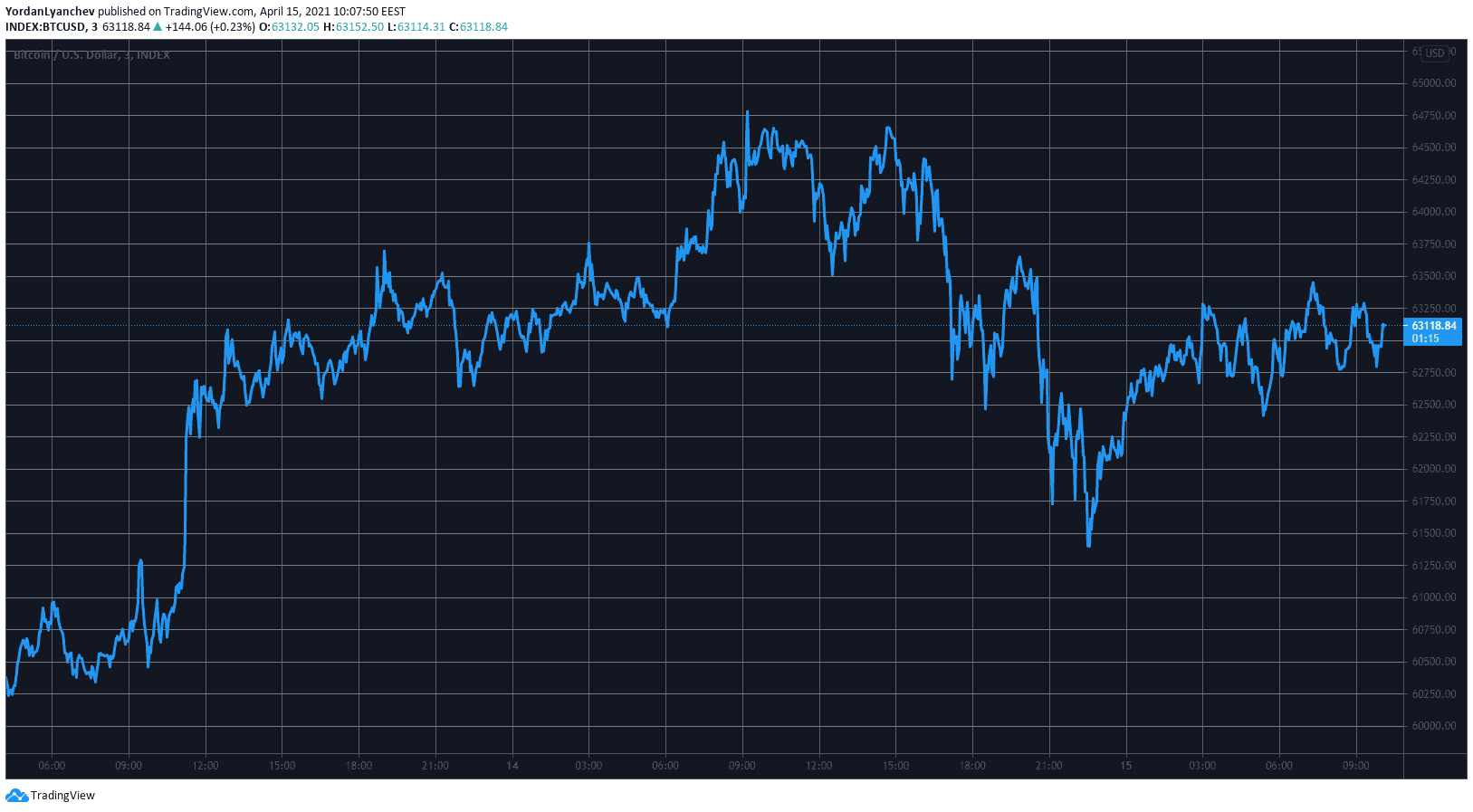

Bitcoin’s ATH and $4K Turbulence

As reported two days ago, the primary cryptocurrency had finally broken above its long-time nemesis at $60,000. Furthermore, the asset continued upwards to new all-time high levels on the same day at about $63,000.

Yesterday seemed even more bullish as BTC added roughly $2,000 of value to its latest ATH record of almost $65,000 (on Bitstamp).

However, the infamous volatility struck again, perhaps led by the anticipation for the public listing of the largest US crypto exchange – Coinbase.

Approximately at the time when it became official, bitcoin dropped by nearly $4,000 from its peak and tested $61,000. Nevertheless, the asset has bounced off and currently stands just above $63,000.

Despite its bullish week, though, bitcoin’s dominance over the market keeps declining. The metric comparing BTC’s market capitalization with all other cryptocurrencies has fallen beneath 53% for the first time in more than two years.

Just for comparison, bitcoin’s dominance was well above 72% in early January 2021.

Ethereum Aims at $2,500

Most alternative coins followed their leader north in the past few days, which led to new all-time high records for Binance Coin, Cardano, Dogecoin, and Ethereum. Although the first two have declined by roughly 5% since yesterday, the second-largest cryptocurrency by market cap has only enhanced its performance.

ETH spiked once more and exceeded $2,480 for its latest ATH. However, it has failed to overcome $2,500 so far and has retraced slightly to about $2,470.

Uniswap is also well in the green from the top ten coins. A 6.5% surge has taken UNI above $38. Chainlink has surged by nearly 10% and, with a price tag of almost $41, is back in the top ten.

Cryptocurrency Market Overview. Source: Quantify Crypto

Cryptocurrency Market Overview. Source: Quantify Crypto

More price pumps come from DigiByte (22%), WazirX (20%), VeChain (18%), Yearn.Finance (15%), Stacks (15%), Ravencoin (13%), Avalanche (10%), and Maker (10%).

Ultimately, the total crypto market cap has remained well above $2.2 trillion.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.