Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

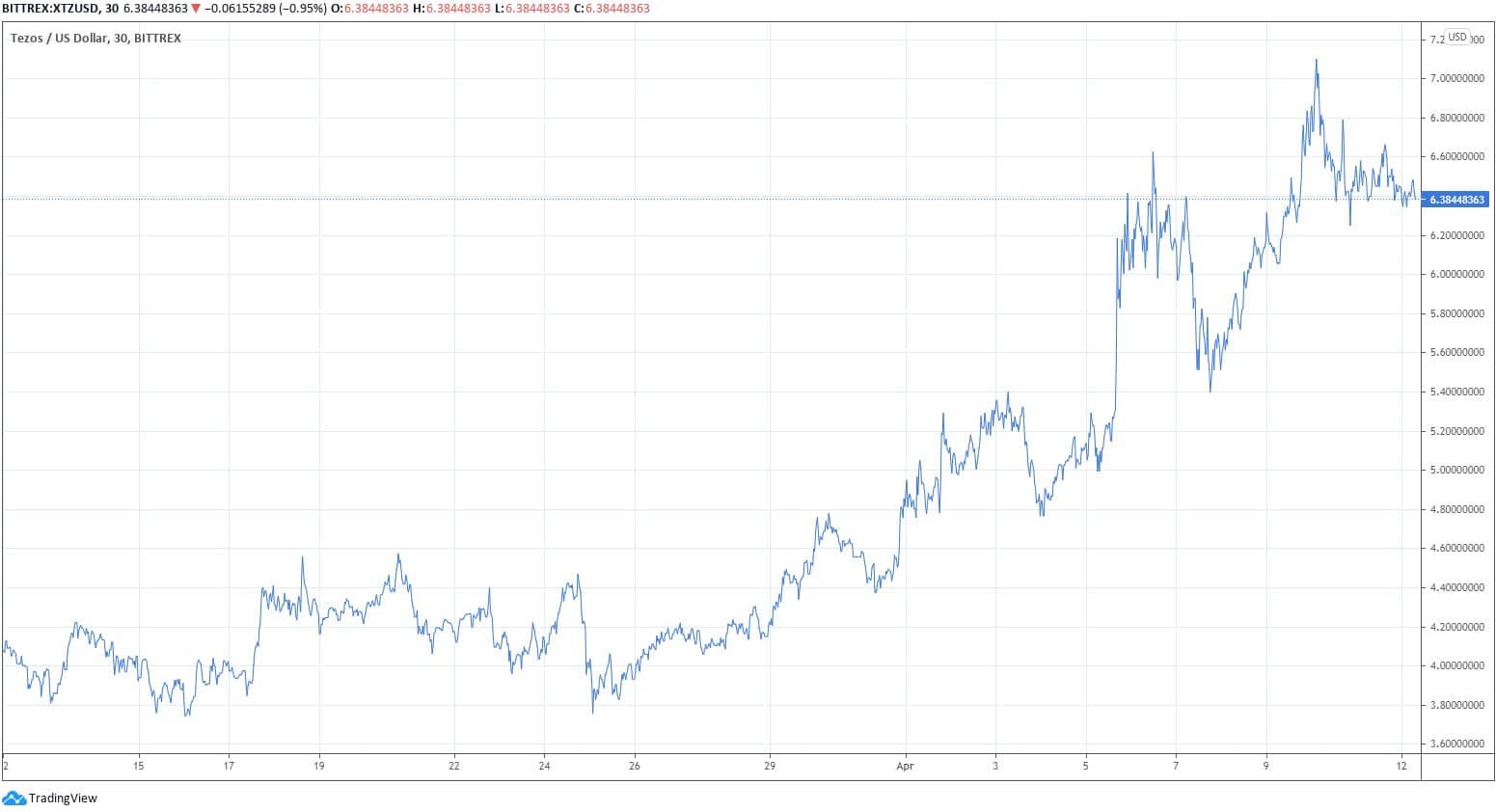

Tezos saw notable gains over the past seven days as the price of its native cryptocurrency, XTZ, surged by around 25%.

This comes amid news of the release of the Tenderbake testnet – a new algorithm adapted to handle an arbitrarily large number of validators.

Tezos Tenderbake – What is it All About?

The update was introduced in a whitepaper called Tenderbake – A Solution to Dynamic Repeated Consensus for Blockchains.

According to the official Medium release, the algorithm is a product of global collaboration between academic researchers and engineers, and it was also supported by the formal verification of Theorems 5 and 6 in the paper.

Tenderbake takes advantage of the classical style of BFT consensus algorithm adapted to handle n arbitrarily large number of validators. In this, it’s different from the current Emmy+ algo that Tezos runs, and replacing them represents a major change to the network, bringing some notable advantages.

Described as a major step forward, with Tenderbake, a block that has just been appended to the chain of some node is known to be final as soon as two additional blocks appear on top of it, irrespective of network latency or chain splits. Referred to as deterministic finality, this means that chain forks will resolve after just two blocks, regardless of chain splits or network latency.

According to the team, this might be the biggest update on the horizon for Tezos in the past three years.

XTZ Price Reacts Positively

Being in a wild bull market, the price of the native cryptocurrency of Tezos, XTZ, spiked positively on the announcement of the Tenderbake testnet.

In the past seven days alone, XTZ is up by 25%, bringing the total by-weekly increase to over 50%. In the past month, the cryptocurrency increased its dollar value by as much as 60%.

Data from CoinGecko positions Tezos as the 32nd-largest project by means of total market capitalization, sitting on a formidable $4.89 billion.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.