Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

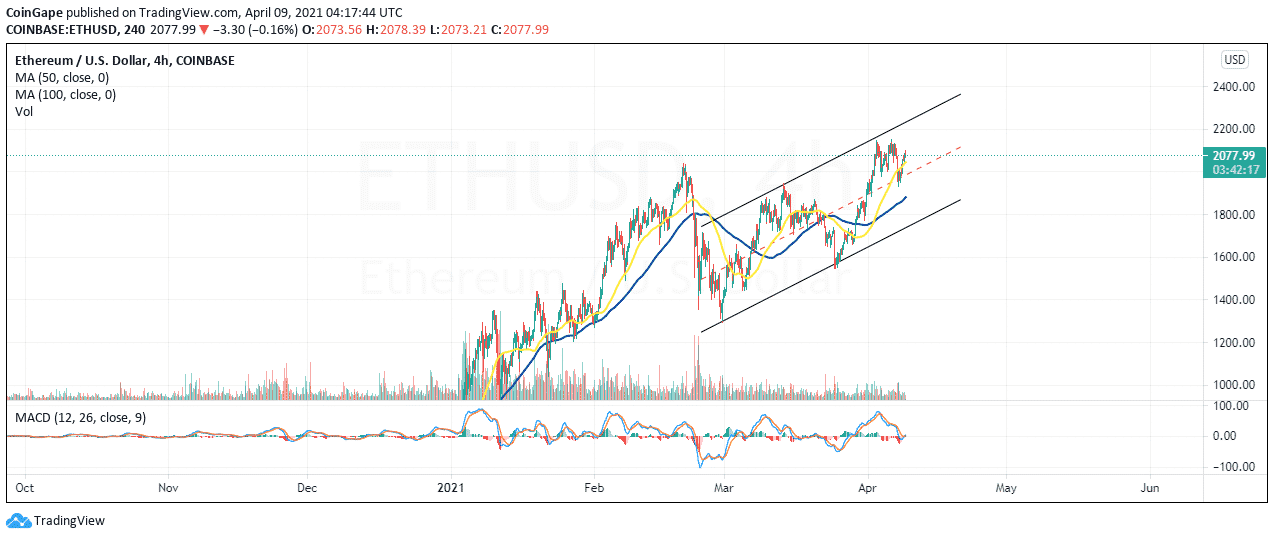

- Ethereum holds at the key ascending parallel channel’s middle boundary support.

- Holding above the 50 SMA on the four-hour chart could validate the gains to a new record high.

- Losing the immediate support at $2,000 could trigger losses toward $1,800.

Ethereum led other altcoins to stage a recovery this week. For the first time in history, the gigantic smart contract token hit highs of $2,146. However, a correction occurred almost immediately, with Ether plunging to $1,930. Intriguingly, buyers wasted no time and took the bull by the horns. The hiccup to $1,930 was quickly erased as ETH reclaimed the ground above $2,000.

At the time of writing, Ethereum is doddering at $2,075 amid the bulls’ push to hit new record highs. The immediate downside is supported by the 50 Simple Moving Average (SMA) on the four-hour chart. Simultaneously, the downside is also protected by the ascending channel’s middle boundary support.

Ethereum’s uptrend might be gradual but appears to have been reinforced by the Moving Average Convergence Divergence (MACD) indicator. This technical indicator reveals when to long or short an asset. As the MACD line (blue) crosses above the signal line, it implies it is time to buy-in. On the flip side, investors are advised to sell when the MACD line slides under the signal line.

ETH/USD four-hour chart

Read more ETH/USD price chart by Tradingview

ETH/USD price chart by Tradingview

It is worth keeping in mind that failure to close the day above the 50 SMA may see overhead pressure rise. Moreover, a break below the channel’s middle boundary and, by extension, the level at $2,000 would trigger massive sell orders, leaving Ethereum to tumble toward $1,800.

Ethereum intraday levels

Spot rate: $2,075

Trend: Bullish

Volatility: Low

Support: $50 SMA and $2,000

Resistance: $2,100 and $2,146

The post Ethereum Price Forecast: ETH bound for $2,500 despite the struggle sustaining uptrend appeared first on Coingape.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.