Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

Call Options on UMA — The 2x4 Lego

X-wing starfighters may not have this brick, but every car or building I ever made has.

X-wing starfighters may not have this brick, but every car or building I ever made has.

Tl;dr: Call options can be used to incentivize the community without undue sell pressure, and any foundation with reserve tokens can provide liquidity for them in an elegant manner.

Call Options went live on UMA this week. What they are and how they work are covered by Kevin Chan in his writeup.

This article is to outline a few of the ways that other DeFi communities can use call options and why I believe they are the “2x4” block in the lego pile.

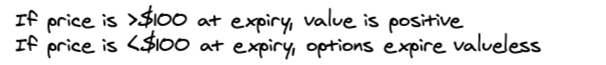

Review: a call option pays out if the price is above a certain level on a certain date.

Better Airdrops and Farms

Options are a popular form of compensation because they align incentives. A token economics benefit is that they only result in sell pressure if the market is bullish. A certain price target is set by the deployer, and option recipients can only cash out if the token price exceeds the strike price at expiry.

Example 1: A team airdrops call options to their competitor’s community. Suddenly, they have a financial incentive to understand their competition. This is safer than a simple token airdrop, where the token may be automatically dumped without consideration.

Example 2: A team awards a mix of project tokens and call options for a liquidity mining farm. This could work similarly to “pool 2” farming, except at least some portion of these rewards would only pay out if the underlying token has value over $100. This would encourage liquidity but reduce sell pressure.

Example 3: Anonymous employment on Ethereum protocols has become more popular. Call options can replace options contracts, so for example a team like Yearn can hire an anonymous employee via governance and issue call options to this hire to align incentives.

Better Bounties

Community managers can control a “slush fund” of call options to pay out to community contributors. The same is true for bounty payouts. Some combination of options and base tokens would guarantee a minimum payout with variable upside. Because these tokens expire, they are well suited to gig work that requires re-upping.

Benefits

There are benefits to these use cases:

Better economics — Sell pressure only if the token is doing well.

Utilize Treasuries — Many foundations have token treasuries that sit idle. By definition, these tokens are intended to incentivize protocol and platform growth. Call options allow them to serve this purpose without irresponsibly creating sell pressure.

Market Price Stability — Market makers can use call options to hedge their risk.

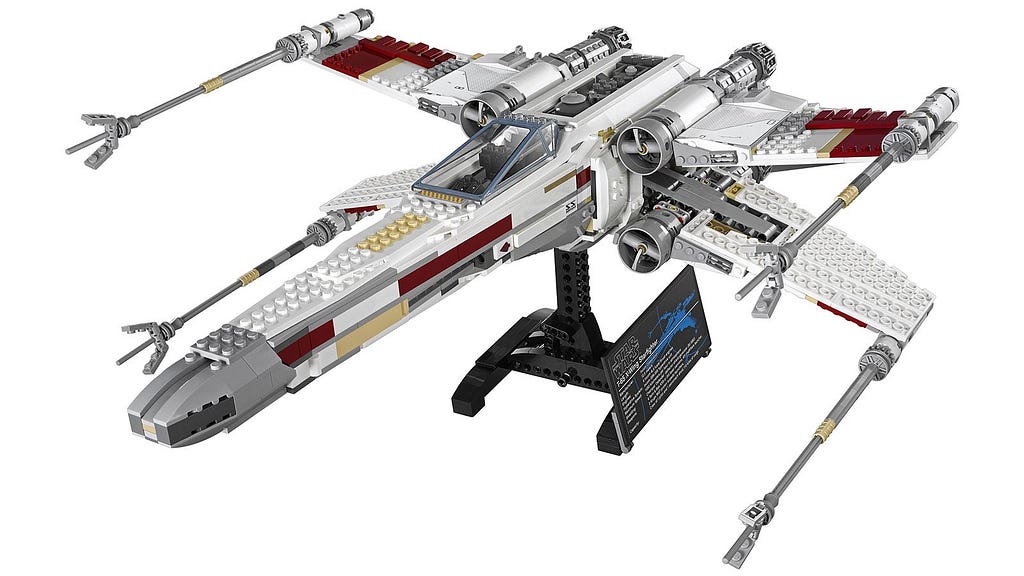

There must be one in there somewhere. Credit: Gizmodo.

There must be one in there somewhere. Credit: Gizmodo.

How to Get Started

The best way to get started is to write a proposal for your community. Link this article, explain the benefits to your particular team, and propose a strike price and expiry date.

When you’re ready to launch, review this link on deploying an EMP contract.

UMA‘s community is well motivated to support these efforts. Feel free to join UMA’s discord to speak to the community about these efforts.

Call Options on UMA — The 2x4 Lego was originally published in UMA Project on Medium, where people are continuing the conversation by highlighting and responding to this story.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.