Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

Tl;dr: UMA’s airdrop of the uTVL KPI Options tokens will target the UMA community and a selection of DeFi governance communities. The qualifying addresses are listed below. Skip to the readme on Github.

Airdrop Criteria

This airdrop is in reference to this announcement where we described a new mechanism called a “KPI Option.” This is a token whose redemption value in the future will depend on the success of a chosen KPI. In UMA’s case, that KPI is Total Value Locked.

In choosing the airdrop recipients, Risk Labs has been intentional in targeting groups that exhibit behavior most likely to lead to positive outcomes.

The first group we have identified are those who have helped build UMA into what it is today. UMA will have an influx of new activity and attention, the existing community will be the ones to support and guide them. Traders, developers, liquidity providers and project teams will need guidance. The UMA community is well equipped to do this and is being rewarded now as well.

The UMA community will also be best equipped to do outreach into other DeFi Communities. There are a number of teams in the pipeline to launch their own KPI Options products. It is our intention that the UMA community scale this up and act as ambassadors to other communities, helping to write proposals like this one — A tailored KPI Options proposal for a DeFi project in their own Discourse.

Our KPI Options experiment should act as a demonstration to the rest of the industry about how this mechanism can be deployed, and the UMA community will now be extra incentivized to introduce the mechanism to other projects.

The second group targeted are DeFi governance participants across a handful of DeFi projects. It was our aim to capture the mindshare of the people who build protocols we all use.

It has been impossible to craft an airdrop criteria that hits everyone. Our initial design considered a wider group, but we worried we were spreading the incentives too thin. It is also our opinion that it would be easier to arrange cross-community efforts with a more targeted focus.

Airdrops will be awarded to governance participants from these five projects: Yearn, Yam, Sushi, BadgerDAO, and Balancer. This applies only to governance actions taken on snapshot.page.

Airdrop Addresses and Details

Each option token is worth between .1 UMA and 2 UMA, depending on the TVL of UMA at the end of June.

The tokens will be awarded in the following fashion

UMA Community

Voted or minted — 120 optionsHold over 10 $UMA in a self-custodied wallet — 60 optionsTop 50 UMA Discord participant — 100 options

The links above are for the lists of addresses. The Discord participants will be shared in Discord, and we will need to collect those addresses.

Our intention was to focus rewards on actions more than mere token ownership, which is why voting, minting, and social interaction on Discord receive the most. If an address has ever minted or voted before the snapshot they will receive 120 options, and if they also have more than 10 $UMA they will receive an additional 60 options.

The reward for UMA ownership does not apply to tokens that are LPing on Sushiswap or Uniswap.

DeFi Governance Communities

Snapshot voters for Yearn, Yam, Sushi, BadgerDAO, and Balancer — 90 Options

See the list of addresses here.

Rewards for outside actions are not additive and will not stack. This means addresses that have voted in multiple protocols will still only receive a flat 90 options.

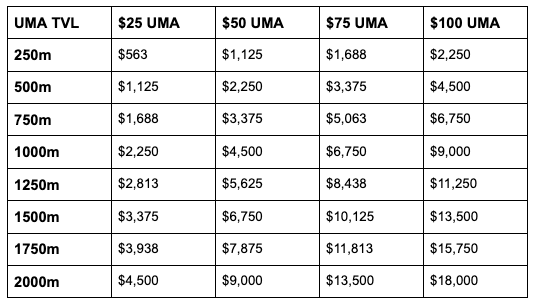

How much can 90 uTVL Token Options be worth?You can project the airdrop value for the 90 external governance airdrop tokens using this table.

Potential value of 90 uTVL tokens based on different TVLs at expiry and potential $UMA token prices

Potential value of 90 uTVL tokens based on different TVLs at expiry and potential $UMA token prices

Here is how we can get to the bottom row of that table

The difference between the minimum and maximum payouts in the table above can be realized by hitting the KPI target of $2 billion TVL in UMA. These are some ways to help hit that target:

Introduce KPI Options to DeFi

Review this one-pager and share it as a proposal in other DeFi communities. You might start with communities you are already active in, and you can be the liaison between the UMA protocol and DeFi community. Here is an example of a proposal to a DeFi team. Several teams are already in the pipeline and will blaze the trail.

Consider how platforms can integrate with UMA

UMA is known for “synthetic assets.” Less well known is that it offers a novel oracle solution to DeFi projects that is flash-loan resistant and settles optimistically. This means that a lot of projects in DeFi could switch over to being secured by UMA.

It is also possible to have any ERC20 approved as a collateral type (including LP tokens) and borrow against them. These products have a high potential to increase TVL. Join the Discord community to investigate how to build that yourself or propose it to your communities.

Use one of the many live products built on UMA

There are a suite of live products that can be used in UMA. You can hedge your gas exposure, express a position on bitcoin dominance, or soon, buy the uSTONKS product tracking Wall Street Bets meme stocks. In addition, you can earn 30–40% APY farming with stablecoins or up to 100% APY with other assets — Check a community-made dashboard here for more farming information: http://bit.ly/umadashboard.

Promote liquidity mining opportunities on UMA

After you yourself participate in liquidity mining listed above, you can teach others how to do so as well. The liquidity mining opportunities listed in the spreadsheet are “too high,” meaning the market still needs to understand how to use them. If we as a community can promote them better, we’ll increase TVL.

What’s Next

We will make the final announcement with the claim process when the site is ready. Claiming these tokens is only one small step towards securing their value: the big step is working together with your other 10,000 airdrop recipients to increase their value.

The first best step to get started with this is to hop into Discord.

UMA Airdrop Recipient Addresses was originally published in UMA Project on Medium, where people are continuing the conversation by highlighting and responding to this story.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.