Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

By Dmitriy Gurkovskiy, Chief Analyst at RoboForex

On Tuesday, February 16th, Ethereum keeps consolidating — the market is clearly gathering powers to go on actively. The altcoin is now trading at 1,793 USD.

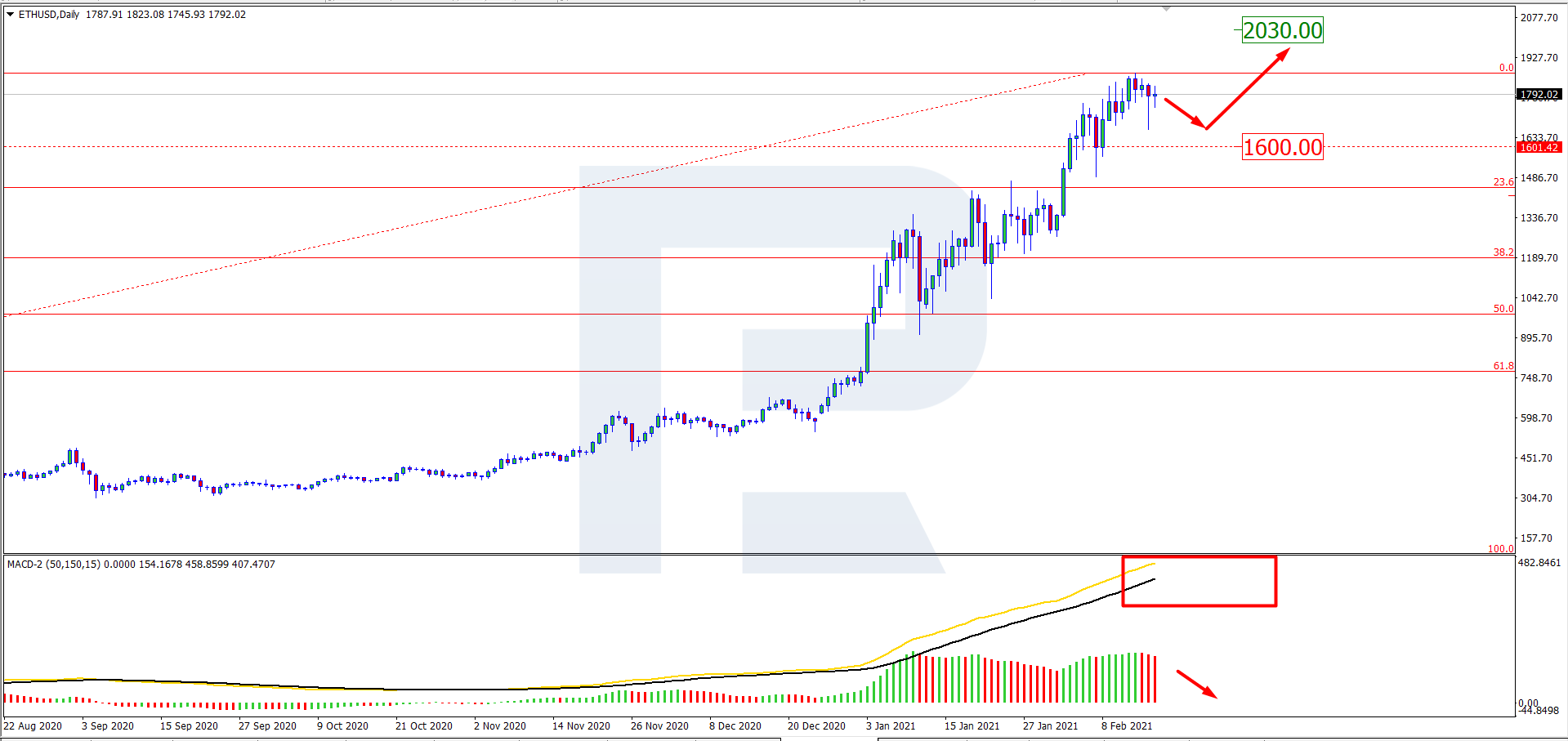

On D1, ETH/USD renewed the highs again. The MACD histogram remains above zero but is declining gradually, signalling the beginning of a correction. Meanwhile, the signal lines of the indicator keep growing; they might even form a Black Cross soon, which will serve as another trigger of a pullback. Judging by previous movements, the quotations might correct to 1,600 USD before brraking through 0.00% Fibo. The uptrend is likely to develop to 2,030 USD.

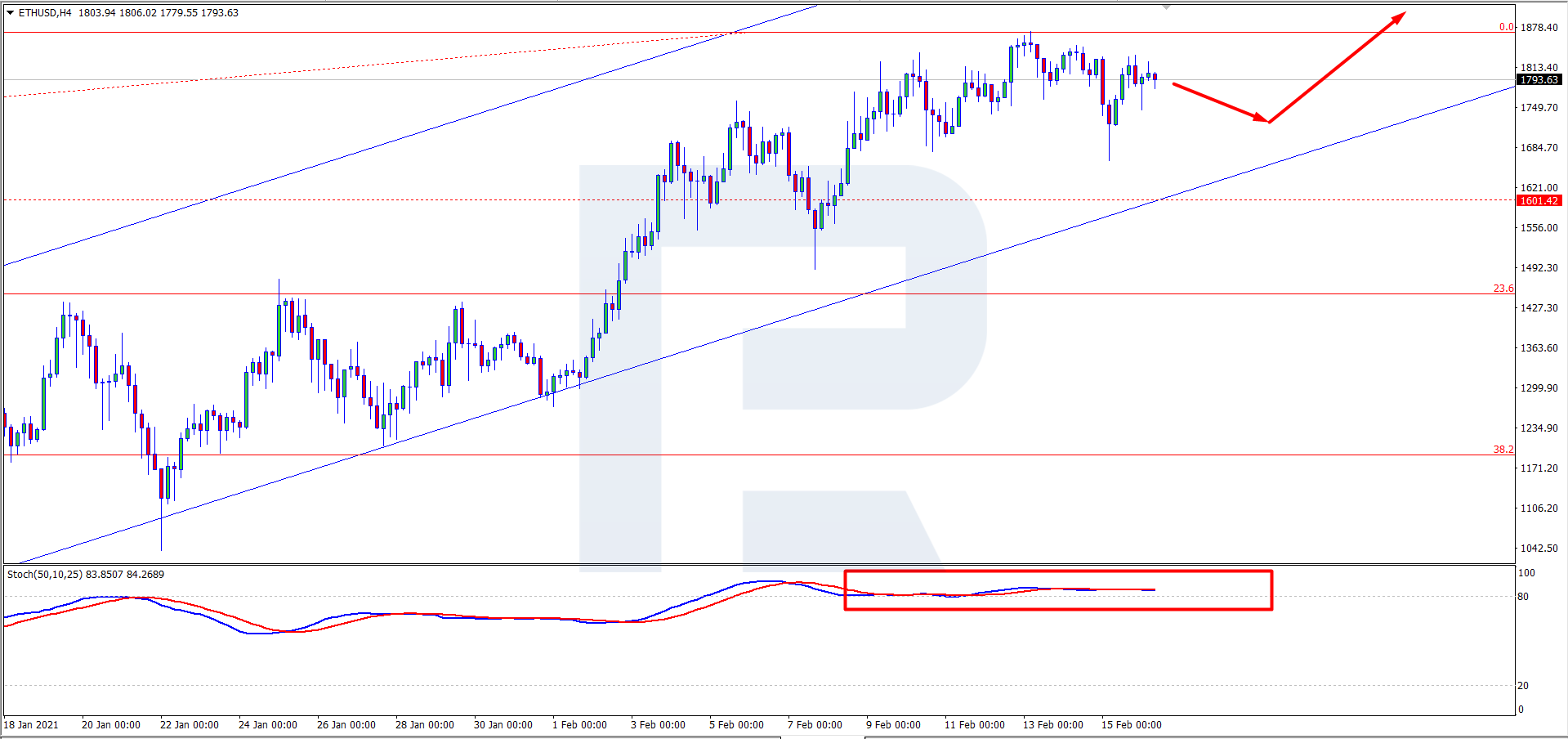

On H4, the picture is similar to that on D1: the quotations are correcting inside an ascending channel under a horizontal resistance level. Upon forming another pullback, the coin has all the chances for further development of the uptrend. The Stochastic remains in the overbought area and has formed a Black Cross, which is another signal for a correction before further growth with the same aim as on the larger timeframe — 2,030 USD.

An American actress Lindsay Lohan put on an auction an NFT. It will be sold on the Rarible platform. The starting price is known to be 33 ETH (about 59,400 USD). The money from the sale will be given for charity to organizations that are ready to work with crypto (Ethereum, in this case). As Lohan says, the world is already decentralized financially, and we need to adapt to the revolution we are witnessing.

An NFT is a most curious object. It is not meant for splitting and is unique. Practically, it exists in one version, it cannot be replaced other than by the owner. There are many ways of using it, but most often, it is used to confirm one’s rights for some object.

This is quite a new and important phenomenon — attracting money via selling unique tokens in auctions. This way crypto gets in our daily lives and attracts more and more attention.

Disclaimer

Any predictions contained herein are based on the author’s particular opinion. This analysis shall not be treated as trading advice. RoboForex shall not be held liable for the results of the trades arising from relying upon trading recommendations and reviews contained herein.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.