Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

The world’s second-largest cryptocurrency Ethereum (ETH) has surged all the way to above $2000 levels hitting its new all-time high. At press time, ETH is trading 5.68% up at a price of $2030 with a market cap of $232 billion. With this, Ethereum’s year-to-date stands at over 170%.

The recent Ethereum price rally comes on the backdrop of continued institutional purchases. The Grayscale Ethereum Trust (ETHE) has been aggressively adding Ethereum (ETH) since the start of February 2021. The Trust has added nearly 230,000 ETH coins pouring more than $400 million this month.

With this, the net assets under management of the Grayscale Ethereum Trust (ETHE) have crossed $6 billion for the very first time. Thus, ETHE alone contributes to over 14% of Grayscale’s total $42 billion worth of assets under management.

02/19/21 UPDATE: Net Assets Under Management, Holdings per Share, and Market Price per Share for our Investment Products.

Total AUM: $42.4 billion$BTC $BCH $ETH $ETC $ZEN $LTC $XLM $ZEC pic.twitter.com/hcUJAjjSXg

— Grayscale (@Grayscale) February 19, 2021

Besides, ever since going live on February 8, the CME Ether Futures has added more fuel to the price rally. In the first complete week of trading, CME recorded more than $168 million in total trading volume. It shows that Ethereum (ETH) continues to drive interest among big investors.

Also, the data from Santiment shows that Ethereum (ETH) whale addresses with over 10K ETH coins have grown over 1200 in numbers.

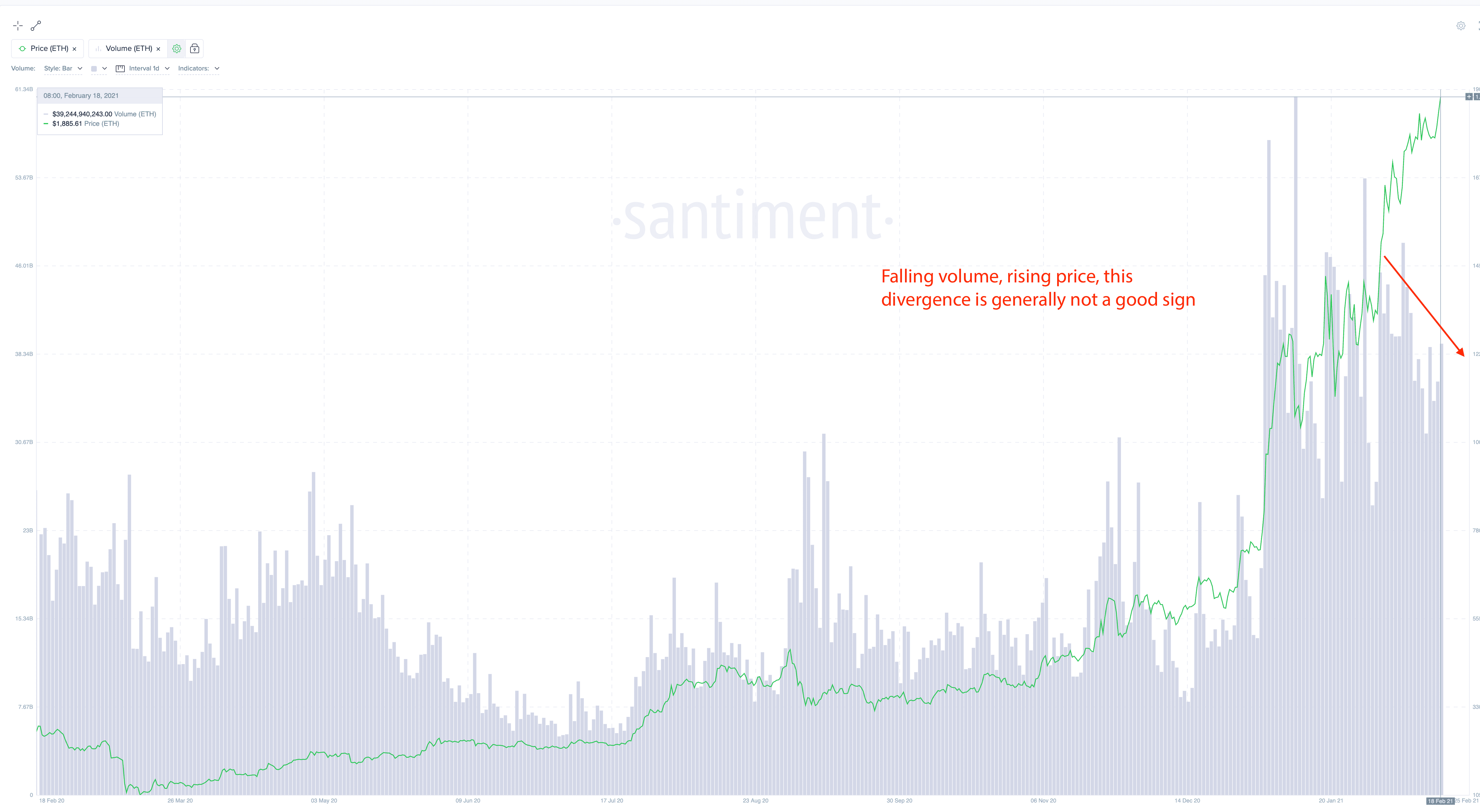

ETH Price Surges Despite Drop In Trading Volume and Social Volume

The on-chain data from Santiment shows that the Ethereum ‘trading volumes vs the price’ chart has shown some very concerning divergences. Although the ETH price has gone up, the volume has dropped suggesting a lack in buyers’ interest.

Courtesy: Santiment

Courtesy: Santiment

Also, the ETH social volume remains considerably low at this new Ethereum All-Time high in comparison to the social value levels during previous breakouts. The Santiment report mentions:

“Perhaps the crowd is just not that excited about ETH any more. This lack of interest is generally good as the crowd tends to come in right at the local top. As long as price is able to stablize with low social volume, it’s a nice setup”.

One of the major problems that ETH investors are currently facing is the surge in Eth gas fee. With DeFi activity at its high, this has helped Ethereum-competitor Binance Smart Chain (BSC) which has ultimately helped the Binance Coin (BNB) price to surge nearly 10x year-to-date and become the third-largest cryptocurrency by market cap while hitting its all-time high above $300.

The post ETH Tops $2000 Levels As the Grayscale Ethereum Trust (ETHE) Hits $6 Billion AUM appeared first on Coingape.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.