Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

Bitcoin has made a solid move today surging 5% and making its way to $40,000 levels. At press time, BTC is trading 5.23% up at a price of $39,607 and a market cap of $407 billion. Over the last week, Bitcoin (BTC) has added nearly $6000 to its price in a catch-up rally with Ethereum (ETH) which hit a new ATH earlier today of $1750.

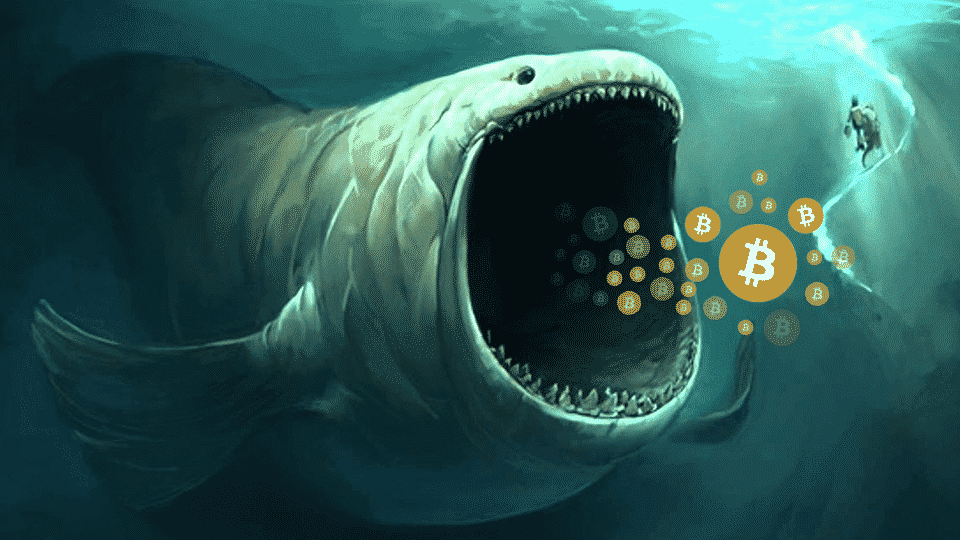

As BTC inches closer to new highs, the whales have been eating into retail investors’ holdings over the last few days. Mid-tier BTC addresses with 10-1000 BTC have resolved to profit-booking while whales with over 1000-BTC have been on an accumulation spree. Interestingly, the rally has triggered a FOMO among small players notes on-chain data provider Santiment.

🐳 The whales of #Bitcoin (1,000+ $BTC addresses) haven't stopped accumulating, while the mid-tier traders (10-1,000 $BTC) haven't stopped taking profit as its price hovers around $38,000. Meanwhile, the small addresses have been #FOMO'ing back in rapidly! https://t.co/GmBoJjByhB pic.twitter.com/hgiogTqD9y

— Santiment (@santimentfeed) February 5, 2021

As CoinGape reported earlier this week, the whale address with over 1K BTC has surpassed the mid-tier addresses for the very first time in history. On the other hand, as big players accumulate more BTC, they are moving it to cold storage as the exchange supply continues to drop.

Coinbase Pro Exchange Registers Massive Bitcoin Outflow

On Friday, February 5, the Coinbase Pro exchange saw a massive $15K BTC outflow following large OTC deals on the platform. This is for the second time in 2020 that over 15K Bitcoins have been moved out of Coinbase in a single transfer.

15k Coinbase outflow at 37,413.

It seems like lots of OTC deals are on-going lately.$BTC pic.twitter.com/rAZlEtzO4t

— Ki Young Ju 주기영 (@ki_young_ju) February 5, 2021

On the other hand, data from Glassnode shows that the liquid supply of Bitcoin floating in the network is drying up faster than ever before. Glassnode founder ‘Yann and Jan’ report that 78% of the BTC supply is either HODLed or lost. They add that that there are now only 4M to be shared among future market entrants and with institutional players like PayPal and Square coming in, the supply can reduce faster going ahead.

Float in the network is drying up faster than ever.

Currently about 78% of issued $bitcoin’s are either lost or being hodled, leaving less than 4M bitcoins to be shared amongst future market entrants (incl. Paypal, Square, SP500 Companies, ETF’s, etc). pic.twitter.com/hCtEqQOEEl

— Yann & Jan (@Negentropic_) February 5, 2021

Another interesting development on Friday was that Twitter CEO Jack Dorsey announced that he now owns a complete Bitcoin node. Meaning he can now process transactions and add new blocks to the network. It’s good to see tech industry giants joining the Bitcoin (BTC) bandwagon.

Running #bitcoin pic.twitter.com/W51ga3yrKb

— jack (@jack) February 5, 2021

The post Bitcoin (BTC) Approaches $40,000, Retail Investors Lose Their Holdings to Whales appeared first on Coingape.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.