Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

24/7, Unrestricted Trading of WSB STONKS

UMA stands for universal market access. At uLABS we believe financial markets should be universally accessible — unrestrained by censorship, pre-existing financial and social capital, or nationality. The recent events in the financial markets have broken the status quo. We recognize this moment in history as an opportunity to change the future. We are launching uSTONKS as a show of support for the little guy and fight against the powers that would limit universal market access. We welcome anybody to trade uSTONKS — a new synthetic token we have designed and hope to bring live soon with our partners at YAM Finance.

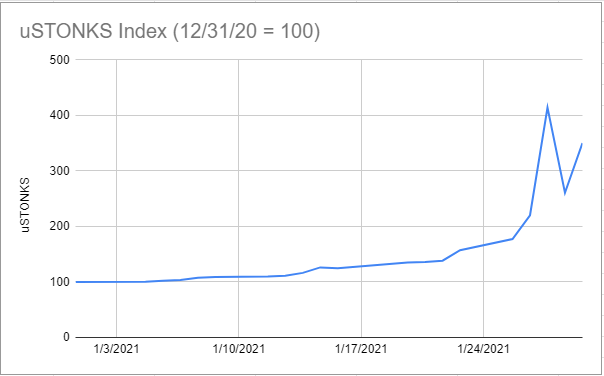

The uSTONKS token is a synthetic that tracks an index consisting of ten stocks that are most commented on r/wallstreetbets. We found assistance in extracting this data and selecting these names with swaggystocks.com. The ten tickers are chosen ahead of the token launch and are equally weighted in the uSTONKS index. A base date is set where the index is 100 and each stock represents 10 points on the index. The first token to launch will be uSTONKS-MAR21 and will consist of the ten tickers below. This token will base its index off of the December 31, 2020 exchange closes. You can see the construction of the index in the table and also how the index has performed over the last month in the chart. We created a simple Google Sheet to illustrate the calculations. As well, the GOOGLEFINANCE functions in the sheet can be copied for one’s personal use in monitoring this index value.

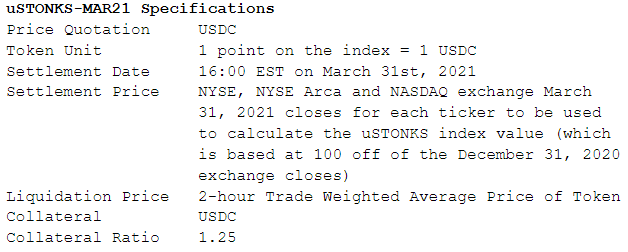

The uSTONK-MAR21 token will expire at 4:00PM EST on March 31st, 2021. The exact closing prices on the NYSE, NYSE Arca and NASDAQ exchanges for each stock will be used to calculate the final settlement of the uSTONKS index.

Similar to uGAS and uVOL, uSTONKS will use the 2-hour TWAP of its own token price to determine whether a position is collateralized or needs to be liquidated. This self-referential logic is needed because uSTONKS is a decentralized synthetic that trades continuously 24/7 whereas the underlying stocks in the uSTONKS index trade during exchange hours which leaves gaps in prices between the 4:00PM EST close and 9:30AM EST open the next day and on weekends and market holidays. Using price feeds from the exchanges to monitor collateral ratios of token sponsors could be problematic outside of market hours especially if there is significant news released on a stock or meaningful macro market forces. Though some stocks are traded after hours, the ability to extract this price data is difficult and the frequency may not be consistent across all ten stocks. Therefore, using the uSTONKS token price itself to monitor collateral ratios is a better alternative as it should reflect the actual price movements during exchange hours and also reflect expectations of price movements after market hours.

One technical detail to discuss is how to treat corporate action that may alter the price of an individual stock such as dividends and stock splits. The uSTONKS index will not adjust for dividends. Tickers in the current index have little to no dividends being paid and most stocks pay dividends in a predictable manner so there should not be a major impact on the index value from this source. However, we have decided to account for stock splits in the index. If a stock does split we will simply adjust the base price accordingly and the final settlement would have no distorted impact and would only reflect the change in the market capitalization of the company. As with all price identifiers, if there are any unexpected events, UMA token holders will discuss and use their judgement to come to a fair conclusion.

The UMA community will review this price identifier described in detail in this UMIP while the YAM community independently reviews this token as well. If the vote is successful and both communities agree, then YAM and UMA will work to make this token live on the Degenerative platform as soon as possible. Similar to previous collaborations, YAM Treasury would receive developer mining rewards for all uSTONKS tokens minted. How the UMA tokens will be distributed will be similar to uGAS — 10% Management Fee to YAM Treasury, 40% dApp Mining, and 50% Liquidity Mining. Details will be confirmed when uSTONKS-MAR21 is officially launched and token contract specifications could be subject to change given how quickly this space moves.

Conclusion

In light of the recent events, decentralized finance has gained even greater importance. All individuals should have the same access and freedom to obtain the risk exposure they desire regardless of their financial means or nationality. This statement expands beyond certain brokers offering access to specific stocks; indeed, it’s a question of worldwide access. This is a pivotal moment in time for the financial markets, and actions taken today will ripple into the future. The teams at uLABS and YAM are dedicated to doing our part to setting the industry on a new trajectory.

uLABS and uSTONKS was originally published in UMA Project on Medium, where people are continuing the conversation by highlighting and responding to this story.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.