Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

On Friday, January 29th, the XRP price is growing actively, trading at 0.2756 USD.

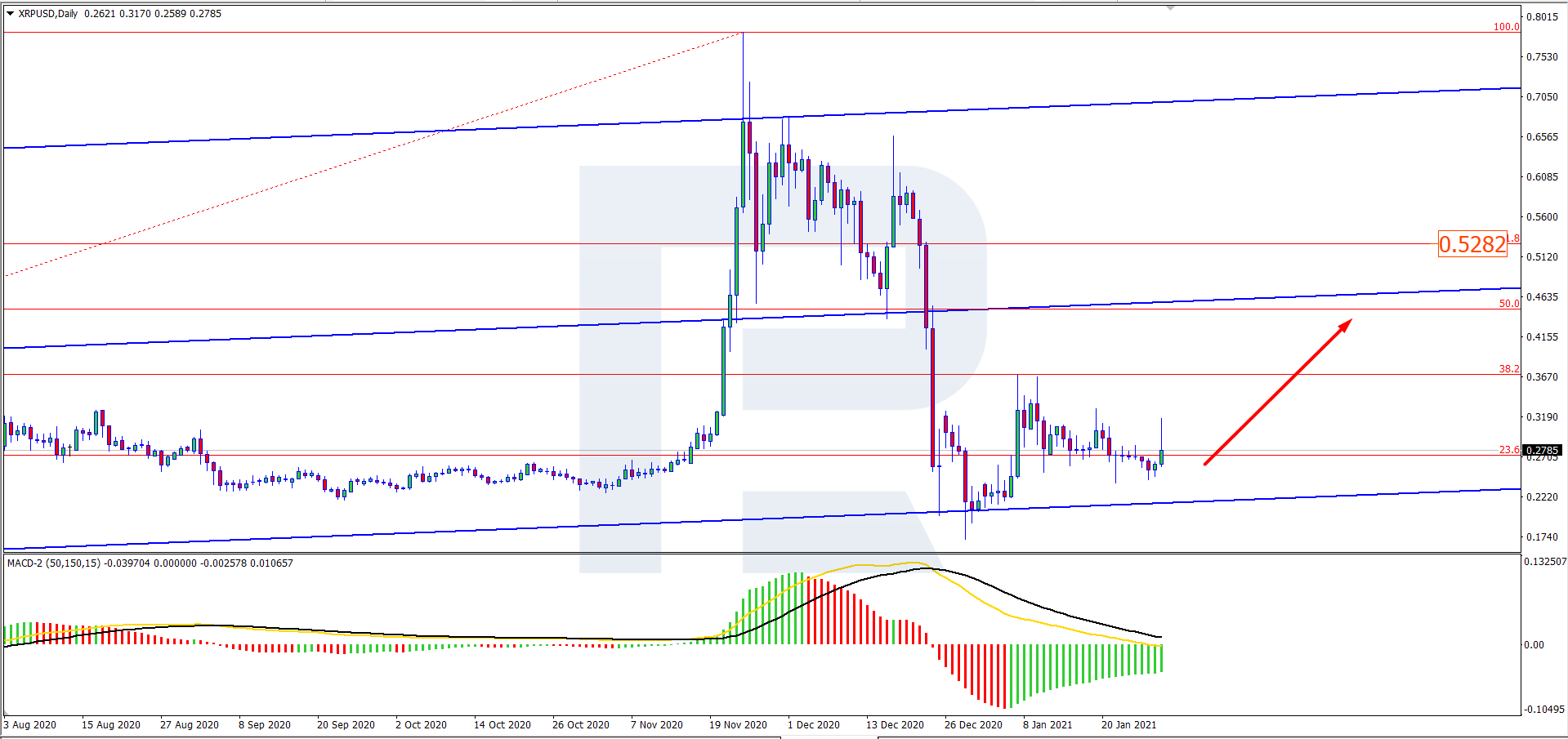

On D1, XRP/USD keeps trading near 23.6% Fibo. We can currently suppose that after the sideways movement is over, the quotations will go on upwards. The aim of the growth is 38.2%, then – 61.8% Fibo. The MACD histogram keeps growing, while its signal lines are heading for zero, which is another signal for the end of the pullback. Upon winding it up, the quotations can leave for the previous goal of 0.5282 USD.

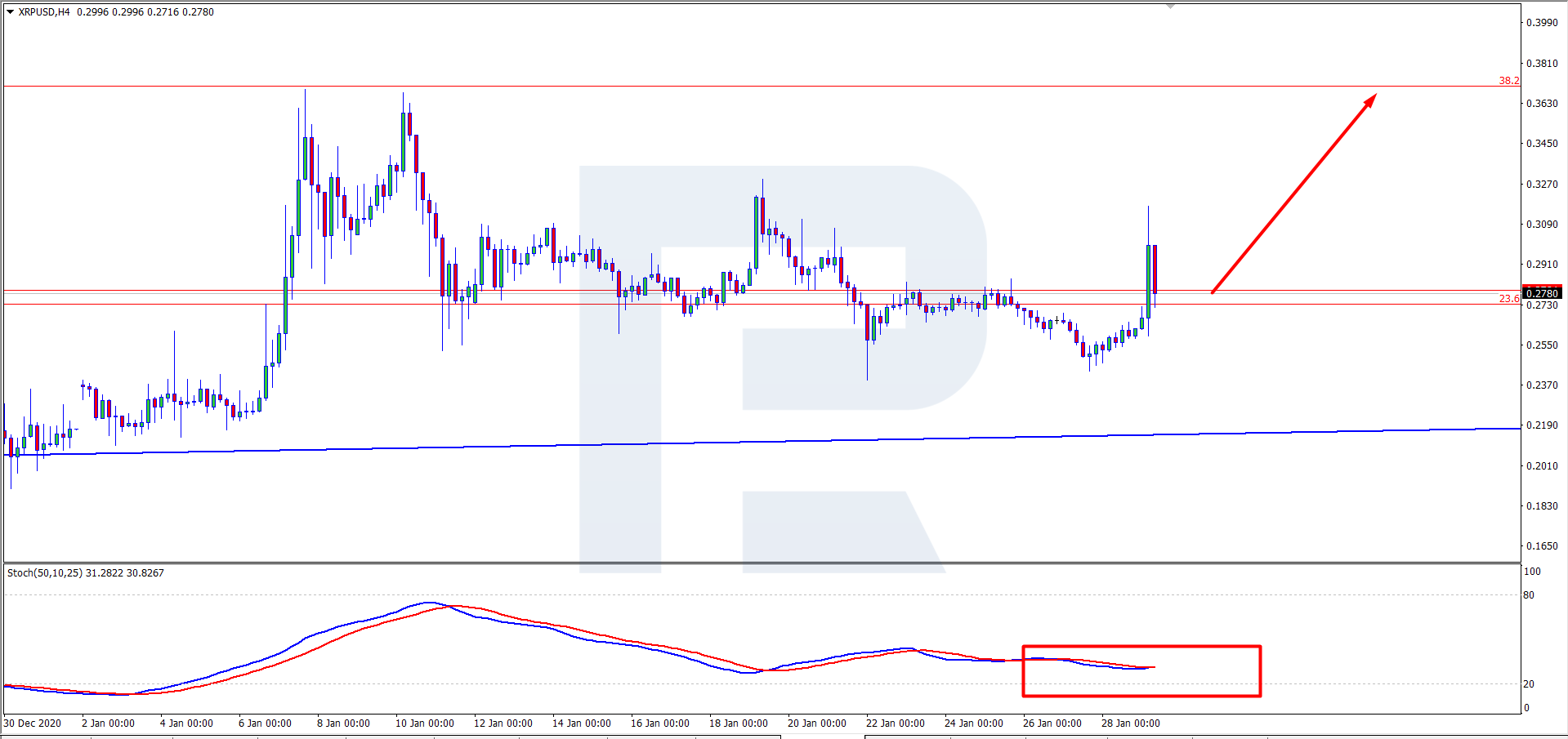

On H4, the quotations are forming another correction near the support level of 23.6% Fibo. The price might soon bounce off it and head for 38.2%, then – to 61.8% Fibo. The Stochastic has formed a Golden Cross near 20 and keeps going horizontally, giving yet another signal for the end of the correction. In the nearest future, the pair can be back with the ascending dynamics, aiming at the same point as on the larger timeframe – 0.5282 USD.

The Ripple company finally bought a share in the subsidiary of a Japanese financial giant MoneyTap; by the plan of the blockchain company, from now on, the development of services and applications will become even faster. After the merger with MoneyTap, two representatives of Ripple will join the board of directors of the Japanese counterpart. Apart from Ripple, MoneyTap has 38 more shareholders.

The MoneyTap app is based on the RippleNet and is being introduced to the Japanese banking system actively. In MoneyTap, they are now busy introducing a strict identification system (KYC) with a biometric-based log-in procedure. The launch is scheduled for spring. With time, all the members of the Japan Bank Consortium are expected to join the system by MoneyTap.

Ripple is very keen on the Japanese market, mostly because of its capacity. Moreover, Japan is special in terms of its immaculate clearness of regulative rules, which is among the key developmental issues for Ripple.

By Dmitriy Gurkovskiy, Chief Analyst at RoboForex

Disclaimer

Any predictions contained herein are based on the author's particular opinion. This analysis shall not be treated as trading advice. RoboForex shall not be held liable for the results of the trades arising from relying upon trading recommendations and reviews contained herein.

Disclaimer: This trading analysis is provided by a third party, and for informational purposes only. It does not reflect the views of Crypto Daily, nor is it intended to be used as legal, tax, investment, or financial advice.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.