Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

Decentralized exposure on the realized volatility of any asset

As a follow up to the UMAxYAM collaboration, uLABS introduces a simple token named uVOL to track the volatility of any asset. YAM Finance will take this idea to mainnet and launch uVOL-BTC, a token that speculates on the realized volatility of Bitcoin for a particular month. This token will be added to YAM’s portfolio of products on their Degenerative platform. The uVOL design can be easily applied to other assets as well and we anticipate launching uVOL-ETH in the near future.

Bitcoin Volatility

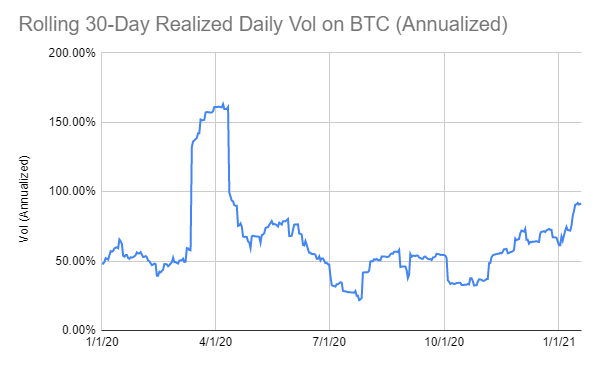

The volatility of Bitcoin continues to be a major focus in the crypto and traditional finance world. Currently, Bitcoin’s impressive rally, and equally scary fast corrections, have driven near term implied volatility, as derived from the options market, to almost 200% annualized. An over simplified interpretation of this would be the market believes a 200% move in the price of Bitcoin over a year is within a one standard deviation probability. Is that expectation too high? Will the volatility in Bitcoin continue throughout this year? Is Bitcoin too volatile to be considered a viable currency or safe haven asset? Whether volatility is considered high or low or where it will be in the future is always a debate.

Trading Volatility

In traditional finance there are several ways to express your view on the volatility of an asset. Most options traders would reflect this opinion on an asset by buying or selling options and delta hedging. This effectively neutralizes the price movement of the asset and isolates the value of the option. However, for an average trader this may be complex, costly and requires a lot of maintenance of the position. An easier way to reflect this view is through a futures contract on a volatility index. The most popular index is the VIX which is a volatility index on the S&P 500 that derives its value from a basket of index options. The centralized exchanges in the crypto world are borrowing this concept to create similar ways for users to trade the volatility of Bitcoin. For example, FTX designed BVOL tokens which use a basket of their MOVE contracts to effectively create a volatility index in a similar way. This requires a consistently deep and liquid options market which proves to be a challenge in crypto especially in the DeFi space. uVOL uses a much simpler approach that has some limitations, but should effectively provide the same exposure that users want.

uVOL-BTC

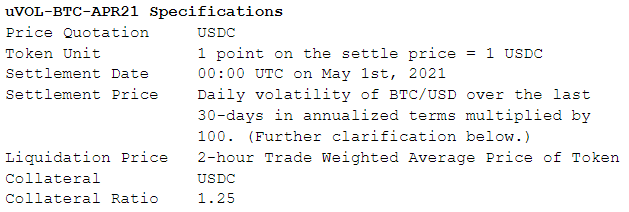

The uVOL token is an expiring token created with UMA’s expiring synthetic token contract. The uVOL-BTC token settles at the end of a month with the prior 30-day realized daily volatility in annualized terms. This is different from traditional volatility indices mentioned above that use implied volatility of options and prices of other options like securities to derive an index of expected volatility. The use of realized volatility in this design is very similar to a volatility swap in traditional finance. We believe this will be a simple and transparent way for crypto users to trade the volatility of an asset like Bitcoin. UMA token holders can easily calculate or verify the settlement price by using just their browser and a spreadsheet. uVOL-BTC-APR21 will be the first token and its specifications are listed below.

The calculation of the settlement price and the price used for monitoring collateral ratios warrants some further clarification. The daily volatility number detailed above is calculated by taking the previous 31 closes at 00:00 UTC on BTC/USD and computing the daily percentage change. This will result in a set of 30 daily percentage change observations which we then take the standard deviation of to find a daily volatility number. To annualize this number we multiply it by the square root of 365. A sample calculation of a hypothetical uVOL-BTC-DEC20 settlement can be found on this link. The price feed for monitoring collateral ratios differs from this. Instead, we use the 2-hour TWAP of the token price to determine whether a position is well collateralized or needs to be liquidated. This method and the reasons for using it are similar to the design of the uGAS token. In general, using realized volatility to monitor collateral ratios of a forward looking token could expose uVOL to under collateralization or exploitation. The price of the uVOL-BTC token acts as the best forward expectation of the final settlement of the future realized volatility of BTC/USD and a 2-hour TWAP was chosen to protect against manipulation.

All of these calculations are detailed in the draft UMIP which has been submitted for UMA community review.

(Source: Coingecko, Google Sheets with data here)

Uses of uVOL-BTC

uVOL-BTC can be a simple decentralized way to express one’s view on the volatility of Bitcoin. In addition to speculation, uVOL-BTC can be used to hedge a crypto portfolio. In times of panic, like Black Thursday of last year, volatility increases significantly as investors scramble to liquidate positions and reduce exposure. In that scenario, uVOL-BTC would increase in value to offset losses in one’s portfolio. Alternatively, one can use uVOL-BTC as a yield enhancement instrument. Traders can sell uVOL-BTC if volatility expectations are high or if users are buying uVOL-BTC as a hedge and creating a premium in its price. Whatever the use, we believe over time as multiple users adopt the product and liquidity increases, uVOL-BTC will be an index that gauges the sentiment of the entire crypto market — similar to how the VIX is used in the US equity market.

Help Wanted! Will pay Cash, UMA and YAM tokens!

We want the DeFi community to help us develop and market the uVOL-BTC token. YAM Finance needs more developers to help them build out their collection of products on their Degenerative platform. UMA wants more developers to understand and build on their protocol and DVM oracle. We, at uLABS, believe introducing a pre-packaged idea and offering our communities a chance to work with us directly would be a great way to access talent in the DeFi space. Active members of our community who are updated with our developments have already reached out to us to offer their help. We continue to welcome others to contact us if you are interested in this idea and have skills to offer.

Similar to all our partners building on UMA, YAM Treasury will be given developer mining rewards for all uVOL-BTC tokens minted. How the UMA tokens will be distributed will be similar to uGAS — 10% Management Fee to YAM Treasury, 40% dApp Mining, and 50% Liquidity Mining. Further details will be given when uVOL-BTC is officially launched.

uVOL’s Future

We believe uVOL-BTC is a simple to understand token that helps users speculate and trade their views on volatility. The options market can be complex and daunting to many whereas uVOL aims to provide exposure to this risk through a straight forward, transparent and decentralized way. If successful, uVOL-BTC can become a benchmark to gauge the sentiment of the entire crypto market. We anticipate creating other uVOL tokens in the future including a uVOL-ETH token. As usual, we welcome any and all feedback and hope this token adds value to many in the DeFi community.

uLABS Volatility Token (uVOL) was originally published in UMA Project on Medium, where people are continuing the conversation by highlighting and responding to this story.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.