Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

The decentralized finance sector continues to grow with an impressive all-time high of over $24 billion locked. Additionally, the Binance DeFi Composite Index, measuring the performance of numerous DeFi coins, also marked a new ATH today.

Binance DeFi Index To New Highs

Launched in August 2020, the DeFi Composite Index tracks and measures the performance of “a basket” of DeFi assets in what the company described as a “standardized way.”

“The composite price indices are combinations of different underlying instruments intended to measure the overall market (or subset) performance over time. The indices price is usually calculated as a weighted average price of the components.”

It’s worth noting that the Binance DeFi Composite Index tracks DeFi tokens listed on the leading exchange and is denominated in Tether (USDT).

Some of the coins with the largest shares in the index include LINK (14%), YFI (7.5%), MKR (7%), Uni (6.5%), AAVE (6%), SNX (6%), and COMP (4.8%). Naturally, as the prices of most DeFi tokens have exploded recently, so has the index.

Earlier today, it jumped to an all-time high of $1,261.5. Although it has retraced slightly since then to $1,230, this is still a 70% increase from the bottom last week during the Monday crash.

Binance DeFi Composite Index Price Performance. Source: Binance

Binance DeFi Composite Index Price Performance. Source: Binance

TVL Above $24B For A New Record

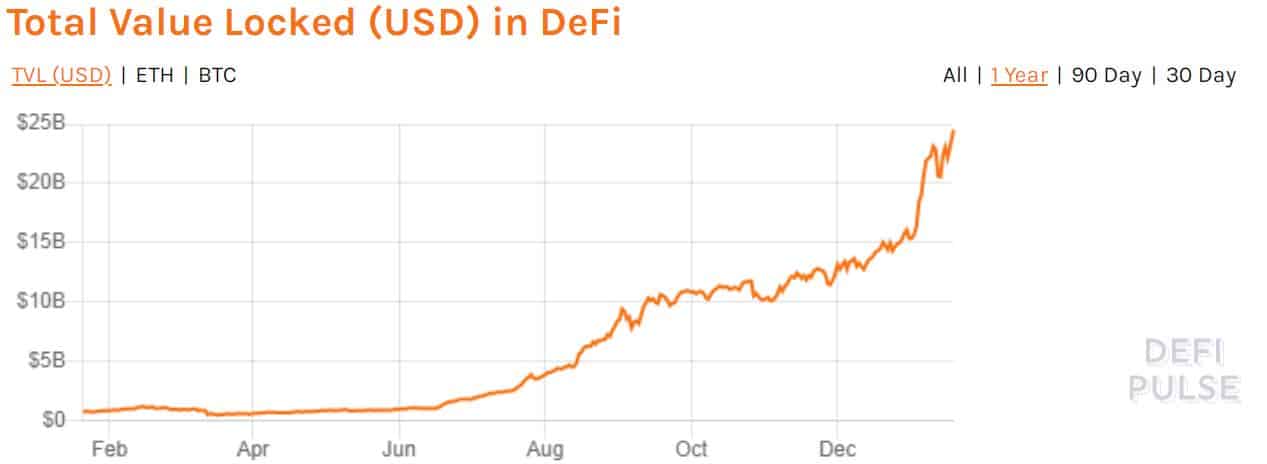

The total value locked in various DeFi projects is another indicator of the sector’s growth. As of writing these lines, it has skyrocketed to a new record of $24.57 billion.

This amount represents the dollar equivalent value of all cryptocurrency assets locked in smart contracts on decentralized lending and borrowing platforms.

Total Value Locked In DeFi Projects. Source: DeFiPulse

Total Value Locked In DeFi Projects. Source: DeFiPulse

The DeFi sector exploded in popularity last year. As the graph above illustrates, the TVL dabbled with $1 billion for several months before it finally conquered it in the summer. However, it hasn’t looked back since and has only broken above other milestones.

Interestingly, the lending platform Maker has surpassed the most widely-used decentralized exchange Uniswap and has taken the first spot with nearly $4.2 billion.

Aave takes the third spot with $3.4 billion, followed by Compound ($3 billion), Curve Finance ($2.08 billion), and SushiSwap ($2 billion).

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.