Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

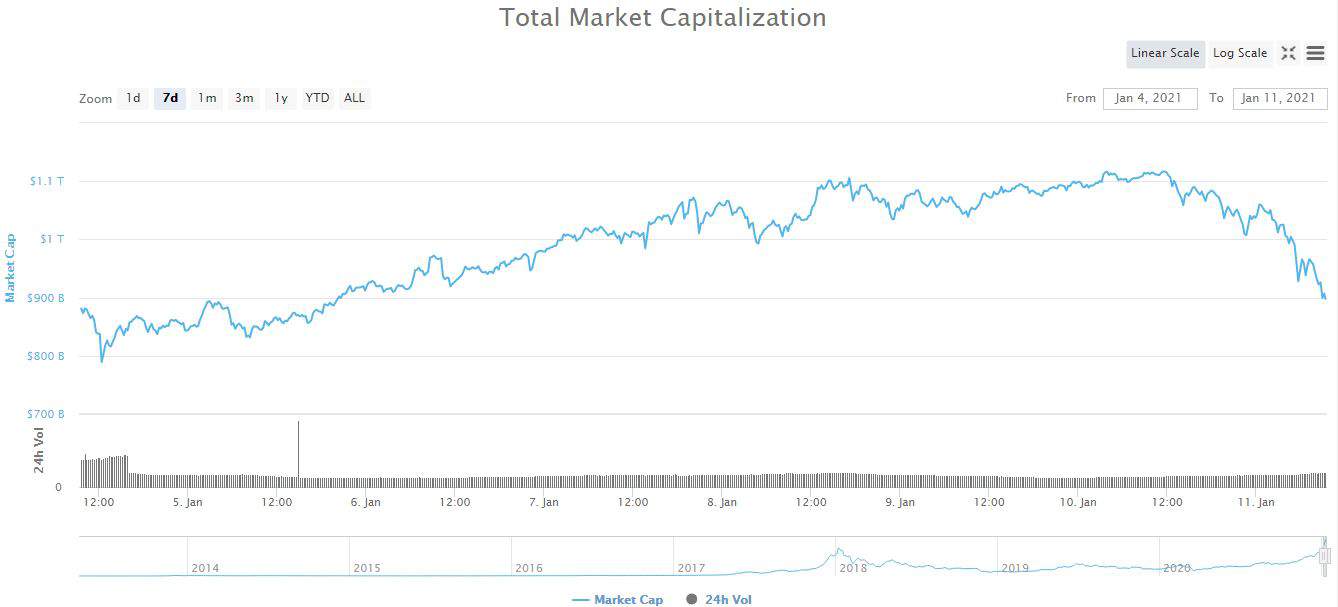

It seems that the long-anticipated cryptocurrency correction has finally materialized as over $200 billion vanished from the market cap. Bitcoin plummeted to below $33,000, while most alternative coins have it even worse with massive double-digit price drops.

Bitcoin Loses $9K In A Day

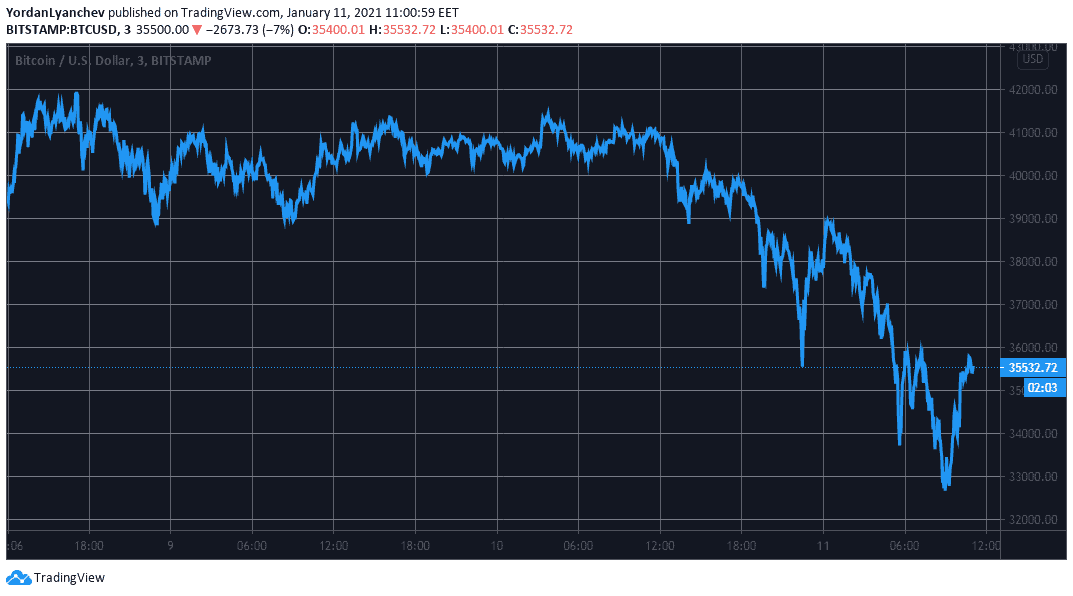

After a highly volatile and positive first ten days of the new year, in which BTC broke above $40,000 for the first time and charted an all-time high of $42,000, the cryptocurrency headed south.

During the weekend, BTC was hovering above $40,000 again and even hinting at a new breakout. However, the situation quickly changed in the past 24 hours as the bears took charge.

Bitcoin firstly dropped to about $35,000 (on Bitstamp) before it bounced off to north of $39,000 hours later. However, the price declines weren’t over – this time, BTC lost even more value.

Bitcoin’s intraday low came at $32,400, making it a 24-hour price drop of about $9,000 from yesterday’s high. Nevertheless, the asset has recovered some of the losses and currently trades at $35,500.

One possible reason behind these developments could be that the giant banking institution HSBC had reportedly blocked transactions from crypto exchanges for UK investors.

Altcoin Bloodbath

As it typically happens during a massive correction, the altcoins have it just as bad if not worse than BTC. After yesterday’s significant gains, most alternative coins have dumped by double-digits today.

Ethereum was just inches away from painting a new all-time high yesterday, but it has dropped by 17% to $1,100 today. Ripple was on its way to recover some of the substantial losses following the SEC charges, but another 20% decline has taken XRP to $0.28.

Bitcoin Cash (-20%), Binance Coin (-10%), Chainlink (-17%), Polkadot (-17%), Cardano (-17%), Litecoin (-21%), and Stellar (-20%) are also deep in the red.

EOS is down by more than 30% after Dan Larimer resigned as CTO from the company behind the blockchain project – Block.one.

Cryptocurrency Market Overview. Source: Quantify Crypto

Cryptocurrency Market Overview. Source: Quantify Crypto

Further declines are evident from Maker (-35%), Bitcoin SV (-33%), Nano (-30%), Status (-28%), Verge (-27%), NXM (-27%), Loopring (-25%), Band Protocol (-25%), Crypto.com Coin (-25%), and more.

Ultimately, the cumulative market capitalization of all cryptocurrency assets has plummeted by more than $200 billion to below $900 billion.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.