Latest news about Bitcoin and all cryptocurrencies. Your daily crypto news habit.

Perhaps you’re fed up with hearing the phrase “Ethereum killer.” After all, any project that labels itself as such has a real fight on its hands. But Zilliqa, as a third-generation blockchain, is in with a shout.

The Singapore-based platform launched at the end of 2017, initially as an ERC-20 token running on the Ethereum blockchain. However, since February 2020, the platform has transitioned to its own blockchain.

When designing Zilliqa, Co-founder Prateek Saxena, along with Xinshu Dong and Amrit Kumar, focused on tackling crypto’s most pressing problem, scalability.

Zilliqa is the first public blockchain to implement sharding, meaning it can scale to meet a burgeoning ecosystem’s demands.

Sharding refers to dividing the Zilliqa network into groups of nodes called shards. Each shard comprises 600 nodes, which operate like mini-blockchain networks processing transactions separately rather than as a group.

As the network grows, so too does the number of shards. Based on the current capacity of six shards, or 3,600 nodes, Zilliqa’s can reach 2,828 transactions per second.

Add into the mix staking, smart contracts, and a decentralized exchange in Zilswap, and it’s easy to see why Zilliqa is within touching distance of breaking the top 20.

In fact, 2020 has proven to be a special year for the project. Since January, investors are up 1,700%, while last week saw the price hit a year-to-date high of $0.10.

Source: ZILUSDT on TradingView.com

Zilliqa End of Year Report Shows Amazing Growth

The firm posted their end of year report on Boxing Day, which details the amazing growth experienced over the last twelve months.

“Zilliqa has shown a spectacular rate of progress, which has culminated in some record-breaking milestones in 2020. This is entirely a testament to our accomplished team, our dedicated community and the burgeoning and brilliant businesses which cement our ecosystem.”

📢We've DONE IT AGAIN, demonstrating staggering growth across ALL FRONTS in 2020.📢

🔖Details in our ecosystem report! https://t.co/GZ3cXDaKdY

📈Growth =Multiplied🔄Ecosystem =Enriched💻Tech =Tremendous

The numbers speak for themselves & YOU are a big part of this! – AN pic.twitter.com/27M6Za1X84

— Zilliqa (@zilliqa) December 26, 2020

In particular, social media marketing efforts, including SocialPay, have paid dividends in building a strong userbase. SocialPay pays out Zilliqa as a reward for participating in social media, such as posting retweets.

The report shows wallet addresses had reached over a million in December. That’s a seven-fold increase compared to a year ago.

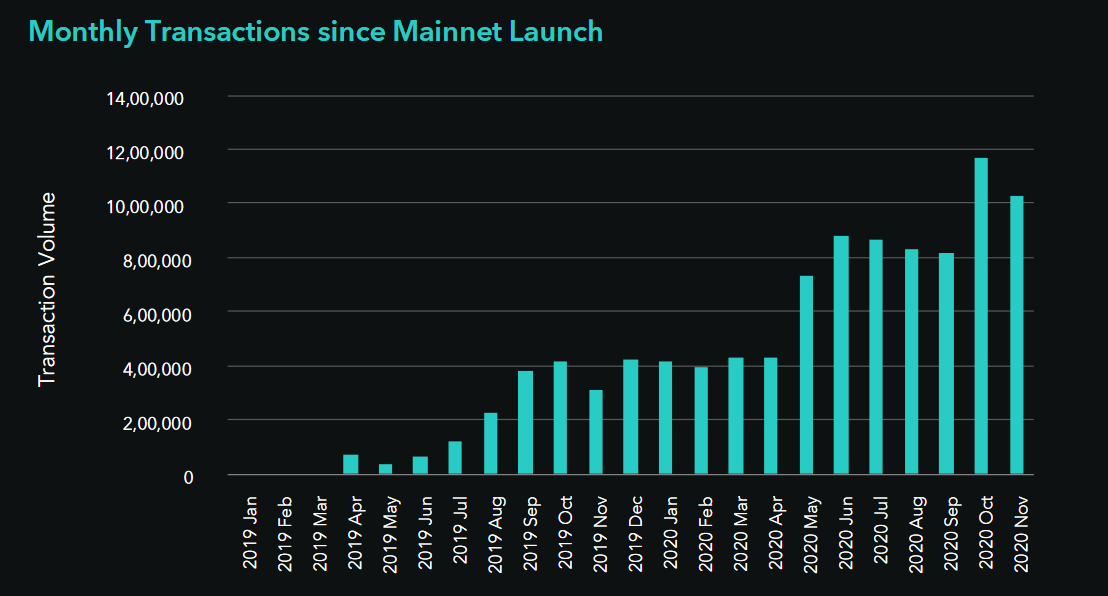

With that, monthly transactions are also on the rise. The latest figures show the number of monthly transactions hit an all-time high in October, with a monthly volume of just under 12 million. A 300% increase compared to October 2019.

“These statistics prove that it’s an extremely active chain and that real world applications are leveraging the Zilliqa blockchain at scale, which as the market knows is a leading indicator of a chain becoming established in the market.”

Source: zilliqa.com

And while Ethereum eventually managed to launch staking, Zilliqa investors had the option to stake since October, with far lower barriers to entry to boot. Namely a minimum staking requirement of 10 ZIL, or $0.80 in today’s money.

Plus, stakers also get to earn one gZIL governance token for every 1,000 ZIL paid out as a staking reward.

Currently, 4.2 billion ZIL is staked, which accounts for 30% of the circulating supply.

Ethereum faces the monumental task of implementing sharding on a live blockchain. With that in mind, it’s worth knowing that other projects, including Zilliqa, are scalable and cheap to use right now.

Based on Zilliqa’s growth this year, this is a fact that hasn’t escaped the attention of investors.

Disclaimer

The views and opinions expressed in this article are solely those of the authors and do not reflect the views of Bitcoin Insider. Every investment and trading move involves risk - this is especially true for cryptocurrencies given their volatility. We strongly advise our readers to conduct their own research when making a decision.